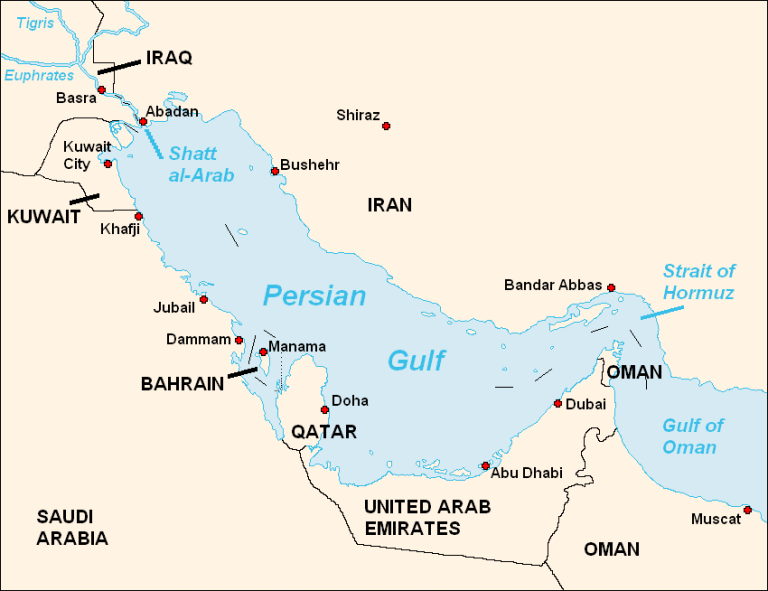

Persian Gulf marine war risk premiums soar

June 17 2019 by InsuranceAsia News-

Strait of Hormuz in spotlight as Middle East war risks rise

- October 23

With a huge amount of oil and gas passing through the strait everyday, Asia's marine (re)insurance market on high alert as regional tensions escalate and premiums rise.

-

Asian Re’s loss ratio deteriorates as cat losses bite: AM Best

- May 10

Underwriting results remain volatile with Asian Re's five-year average COR exceeding 125%.

-

Political risk rises as US imposes more sanctions on Iran

- December 12

Tensions are rising in the Middle East again.

-

Claimed attack on Iranian tanker to raise war risk rates

- October 16

The latest incident in the Middle East will drive rates up further.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.