-

‘It’s your battle. It’s your career’: regional leaders ponder incomplete progress as International Women’s Day shines light on equality, diversity

Zurich's Tulsi Naidu, Axa XL's Sylvie Gleise, WTW's Chiaki Tanaka, Coface's Grishma Kewada, Asia Insurance's Winnie Wong, and Howden's Shweta Swaroop spoke to InsuranceAsia News to mark International Women's Day.

-

-

Lotte Non-Life faces capital plan review as JKL accelerates sale

Financial Services Commission directs South Korean carrier to submit a new capital improvement plan within two months, having rejected an earlier proposal.

Lotte Non-Life faces capital plan review as JKL accelerates sale

Financial Services Commission directs South Korean carrier to submit a new capital improvement plan within two months, having rejected an earlier proposal.

Financial Services Commission directs South Korean carrier to submit a new capital improvement plan within two months, having rejected an earlier proposal.

-

Lockton taps Aon veteran Livy Dai as China CEO

He is based in Shanghai and will oversee Lockton's growth in mainland China.

Lockton taps Aon veteran Livy Dai as China CEO

He is based in Shanghai and will oversee Lockton's growth in mainland China.

He is based in Shanghai and will oversee Lockton's growth in mainland China.

-

Stephen Ward to lead Steadfast’s newly formed Miramar Group

Steadfast has brought together seven MGAs under one entity led by CEO Ward.

Stephen Ward to lead Steadfast’s newly formed Miramar Group

Steadfast has brought together seven MGAs under one entity led by CEO Ward.

Steadfast has brought together seven MGAs under one entity led by CEO Ward.

-

Generali appoints Sun Lei as Asia deputy regional officer

Hong Kong-based Sun joins the Italian insurance group after more than 21 years at Allianz in Europe and Asia.

Generali appoints Sun Lei as Asia deputy regional officer

Hong Kong-based Sun joins the Italian insurance group after more than 21 years at Allianz in Europe and Asia.

Hong Kong-based Sun joins the Italian insurance group after more than 21 years at Allianz in Europe and Asia.

-

US DFC unveils US$20bn maritime reinsurance facility for Gulf trade

US International Development Finance Corporation, along with American insurers, will offer revolving cover with a focus on hull and machinery and cargo to start.

US DFC unveils US$20bn maritime reinsurance facility for Gulf trade

US International Development Finance Corporation, along with American insurers, will offer revolving cover with a focus on hull and machinery and cargo to start.

US International Development Finance Corporation, along with American insurers, will offer revolving cover with a focus on hull and machinery and cargo to start.

-

Fitch downgrades Marein Re on weakened capital position, financial strain

Indonesian reinsurer's capital ratio sank to 163% and combined ratio climbed to 102% in 2025 on reserve top-ups.

Fitch downgrades Marein Re on weakened capital position, financial strain

Indonesian reinsurer's capital ratio sank to 163% and combined ratio climbed to 102% in 2025 on reserve top-ups.

Indonesian reinsurer's capital ratio sank to 163% and combined ratio climbed to 102% in 2025 on reserve top-ups.

-

Full Capacity: Steering through escalating Middle East conflict

This week's newsletter discusses an BHSI's leadership change, QBE's takeover in India, Hong Kong's new captive, Zurich sealing the Beazley deal and insurance during Middle East escalations.

Full Capacity: Steering through escalating Middle East conflict

This week's newsletter discusses an BHSI's leadership change, QBE's takeover in India, Hong Kong's new captive, Zurich sealing the Beazley deal and insurance during Middle East escalations.

This week's newsletter discusses an BHSI's leadership change, QBE's takeover in India, Hong Kong's new captive, Zurich sealing the Beazley deal and insurance during Middle East escalations.

-

BHSI, Howden, Lockton, Starr, Marsh: 16 APAC insurance people moves of the week

Ergo Insurance, Aon, Beazley, Markel Insurance, QBE, Swiss Re CorSo, Raheja QBE, Market Lane, Swiss Re, CFC, Chubb, Liberty and Sompo also made personnel changes over the last week.

BHSI, Howden, Lockton, Starr, Marsh: 16 APAC insurance people moves of the week

Ergo Insurance, Aon, Beazley, Markel Insurance, QBE, Swiss Re CorSo, Raheja QBE, Market Lane, Swiss Re, CFC, Chubb, Liberty and Sompo also made personnel changes over the last week.

Ergo Insurance, Aon, Beazley, Markel Insurance, QBE, Swiss Re CorSo, Raheja QBE, Market Lane, Swiss Re, CFC, Chubb, Liberty and Sompo also made personnel changes over the last week.

-

Ardonagh-backed Cornerstone Risk acquires Australia’s Cav Insure

Cav Insure was founded in 2015 in Stanthorpe, Queensland by Josh and Cara Cavallaro.

Ardonagh-backed Cornerstone Risk acquires Australia’s Cav Insure

Cav Insure was founded in 2015 in Stanthorpe, Queensland by Josh and Cara Cavallaro.

Cav Insure was founded in 2015 in Stanthorpe, Queensland by Josh and Cara Cavallaro.

-

Aon appoints Markus Poh as director of transaction solutions for Asia

He joins from Singaporean law firm Rajah & Tann, where he had been a corporate lawyer since May 2022.

Aon appoints Markus Poh as director of transaction solutions for Asia

He joins from Singaporean law firm Rajah & Tann, where he had been a corporate lawyer since May 2022.

He joins from Singaporean law firm Rajah & Tann, where he had been a corporate lawyer since May 2022.

-

Marsh names Tim Atkins head of Insurance Consulting Group for Pacific region

Sydney-based Atkins has led the Marsh McLennan Agency over the last six years.

Marsh names Tim Atkins head of Insurance Consulting Group for Pacific region

Sydney-based Atkins has led the Marsh McLennan Agency over the last six years.

Sydney-based Atkins has led the Marsh McLennan Agency over the last six years.

-

Jio Financial pumps US$16m into Allianz Jio Reinsurance

Jio Financial’s total aggregate investment in the previously announced joint venture with Allianz now stands at US$16.3m.

Jio Financial pumps US$16m into Allianz Jio Reinsurance

Jio Financial’s total aggregate investment in the previously announced joint venture with Allianz now stands at US$16.3m.

Jio Financial’s total aggregate investment in the previously announced joint venture with Allianz now stands at US$16.3m.

Popular posts:

- Warning of 50% spike in marine war risk premiums as Iran conflict intensifies

- ‘It’s your battle. It’s your career’: regional leaders ponder incomplete progress as International Women’s Day shines light on equality, diversity

- QBE hires Zurich’s Chai Guan Lim as head of distribution in Malaysia

- Donald Trump pledges insurance for vessels in Strait of Hormuz

-

Legal precedent raises stakes for aviation war insurers as Iran conflict grounds fleets

Aviation war market faces a flurry of policy cancellations and reinstatements this week, with rates expected to surge by triple digits.

-

Warning of 50% spike in marine war risk premiums as Iran conflict intensifies

With US$500bn in energy trade at a standstill, proportionality and caution are the watchwords for the marine market as it braces for a prolonged crisis.

-

Cat’s well and truly out of the bag: Asia’s ILS market set for ‘active’ 2026

Other jurisdictions may follow Hong Kong and Singapore in establishing their own ILS regimes after a record-breaking year for catastrophe bond issuance globally last year.

-

P&I clubs drop anchor on rate increases amid strong retentions

Gard, West P&I, The Swedish Club, NorthStandard, and Skuld reflect on the 2026 protection and indemnity (P&I) renewals season.

Between The Lines

A fortnightly podcast that unpacks the pivotal stories and trends shaping the (re)insurance industry across Asia Pacific.

Spotlight

-

‘No longer optional’: parametric climate cover gains urgency as Asia Pacific faces accelerating volatility

-

‘Big expectations’ as Gift City branch gives Mapfre Re vehicle to drive India, APAC growth: Javier Sánchez Cea

-

‘Exciting and new’: Specialist Risk Group aims to put itself on the map in Australia, Southeast Asia

-

Cyber on the mind for ‘next few years’ as Asian ransomware attacks more than double as digitalisation outpaces defences

-

Chubb’s Evan Greenberg ‘bullish on long-term opportunity’ for Asia

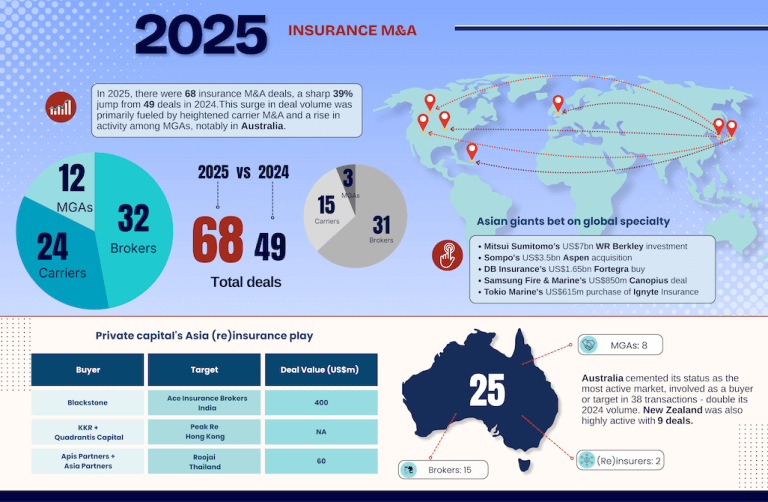

M&A

-

Ardonagh-backed Cornerstone Risk acquires Australia’s Cav Insure

-

Jio Financial pumps US$16m into Allianz Jio Reinsurance

-

Mitsui Sumitomo completes acquisition of 15% stake in WR Berkley

-

Australia’s competition watchdog reopens review of IAG-RAC deal

-

Zurich, Beazley finalise terms on US$11bn deal to build specialty powerhouse

ESG

-

Carbon credit specialist Oka launches in Singapore

-

‘You can’t do it as a hobby’: ESG must be a clear business model with easily measurable targets

-

Carbon specialist Kita expands into Australia

-

Maritime decarbonisation efforts need liability certainty to stay on course amid ‘pressing challenge’

-

With Donald Trump’s ESG curveball, what’s the outlook for APAC liability coverage?

1.1 renewals takeaways and 2026 market outlook with Gallagher Re’s Mark O’Brien

Mark O'Brien, head of Asia Pacific at Gallagher Re, talks to InsuranceAsia News about the 1.1 renewals and the outlook for the market in 2026.

Cyber insurance has a long way to go amid soaring demand in Asia: WTW’s Carlos Grijalva

Carlos Grijalva, cyber leader for Hong Kong and greater China at WTW, talks to InsuranceAsia News about the development of the cyber market in Asia.

Insurtech: "As the [AI] hype continues, so does the imperative for insurers, insurtechs and distributors to look beyond the noise to the underlying forces at play."

David Lynch, bolttech