HK regulator’s big plans for Belt and Road Exchange

June 29 2020 by Yvonne Lau

It had been a quiet couple of years since the launch of Hong Kong Insurance Authority’s (IA) Belt and Road Insurance Exchange Facilitation (BRIEF) in December 2018.

But last month brought renewed traction to BRIEF, despite a year of political unrest in Hong Kong and uncertainties from the Covid-19 outbreak.

In mid-May, the IA signed a Memorandum of Understanding (MoU) with Chengdu’s Municipal Financial Regulatory Bureau (CMFRB) – another step forward in financial integration with the mainland. Bai Jindong, CMFRB’s deputy director general, hailed it as “an important step in the cooperation of the insurance sectors of Chengdu and Hong Kong.”

There are now 42 members signed up to BRIEF.

By late May, the IA announced that it signed up its first industry association to BRIEF – the International Union of Marine Insurance’s (IUMI) Asia hub.

While Covid-19 put certain initiatives and plans on hold, market players have used the time to make better preparations for BRI initiatives ahead — “fine-tuning existing strategies to align with global conditions,” said the Hong Kong Federation of Insurers (HKFI) to InsuranceAsia News (IAN).

What can we expect from BRIEF moving forward, as the Insurance Authority and the market resumes operations post-pandemic?

BRIEF moves

There are now 42 members signed up to BRIEF. This includes insurers, reinsurers, captive players, brokers, law firms and industry association(s). At the time of inception in 2018, they had 29 members.

Specialty risks along the BRI mean greater demand for risk services and insurance coverage. And Hong Kong is “well-positioned and equipped to provide [these] services to meet growing demand,” emphasised the HKFI.

But inevitably, the pandemic brought disruptions. The “scope and pace” of BRI activities are undergoing adjustment. Indeed, just last week, the IA announced that the ‘temporary facilitative measures’ (TFM) had been extended until (at least) September 30.

“The BRIEF is a [great] starting point to unite and converge resources, expertise and interests in the territory towards the [larger] picture of the BRI. [It] highlights Hong Kong’s fundamental value [as a services hub and connector].” Hong Kong Federation of Insurers

Despite the disruptions, the Hong Kong Insurance Authority told IAN that they are working on three priority areas. Clement Cheung, the IA’s chief executive notes that reinsurance, captives domiciling and tax reliefs for specialty risks insurance are at the top of the agenda.

In July, it is expected that the Legislative Council (LegCo) will pass an amendment bill to “expand the scope of insurable risks for captives,” affirmed Cheung. Previously, a reduced corporate tax rate of 8.25% had already been extended to on-shore risks underwritten by captives set up in the SAR since 2018/2019. The IA hopes to leverage upon Hong Kong’s “unique position” as an offshore financial centre.

In order to build up competitiveness, the regulator has introduced legislative changes that will halve the profits tax rate for insurers underwriting marine and specialty risks — for instance, catastrophe, political, war and trade risks.

Cheung explains: “The tax concession is also applicable to insurance broker companies placing such risks to (re)insurers in Hong Kong, thus creating incentives along the value chain – i.e. for captive managers, risk managers, specialist insurers, professional reinsurers, insurance brokers and loss adjusters – to step up their presence in [the SAR].”

The regulator also highlighted that they have secured preferential treatment from the China Banking and Insurance Regulatory Commission (CBIRC) since 2018. This means that “when an insurer in the mainland cedes risks to a qualified reinsurer in Hong Kong, its capital requirements will be reduced.”

The IA says that the foundations had been set for their strategic role in BRI initiatives back in 2017. In December of that year, the Hong Kong government signed an agreement with China’s National Development and Reform Commission (NDRC) — the ‘Arrangement for Advancing Hong Kong’s Full Participation in and Contribution to BRI.’

Cheung said that the above initiatives… “underpins and reinforces the [government] arrangement with the NDRC.”

Full integration ahead?

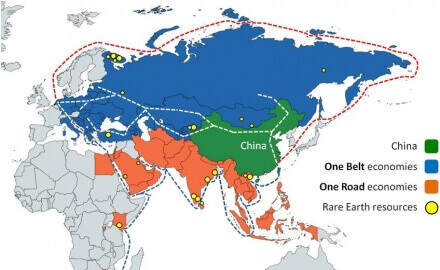

The IA states that BRIEF was set up to bring together key stakeholders to capture the “unprecedented opportunities” brought on by China’s launching of the Belt and Road Initiative.

“The BRIEF is a [great] starting point to unite and converge resources, expertise and interests in the territory towards the [larger] picture of the BRI. [It] highlights Hong Kong’s fundamental value [as a services hub and connector],” noted the HKFI to IAN.

Indeed, mainland firms and other project owners will be exposed to a myriad of specialty risks in their overseas investments along the Belt and Road. And Hong Kong is seen as the conduit to facilitate professional services in the realm of risk and insurance.

Both public and private sector stakeholders are hopeful — but cautiously so — regarding the potential opportunities arising from BRI programmes. It remains to be seen whether recent geopolitical tensions, particularly between the China and US, coupled with China’s pandemic fallout, will affect international players’ enthusiasm for BRI projects.

And the Hong Kong Federation of Insurers added with a caveat that BRIEF movements should ultimately “be facilitated with the private sector.”

Regulatory measures ahead must weave together private and public sector interests — and take into account events playing out on the global stage — to optimise the chances of success.

-

China Taiping opens representative office in Dubai

- December 6

The establishment of the office, located in DIFC, will help the carrier support Belt and Road initiative.

-

Captives pivotal to development of Belt & Road green energy projects: HKIA panel

- September 12

The SAR seeks to be the preferred captive domicile to manage risks from overseas renewable energy projects, participants at a Belt & Road summit moderated by the city's Insurance Authority heard.

-

China Re extends US$85.4bn cover to Belt & Road projects via reinsurance pool: report

- June 21

Through China Belt & Road (B&R) Reinsurance Pool, the reinsurer has been providing risk protection to over 1,000 Chinese corporates' offshore projects over the past three years, president Zhuang Qianzhi says.

-

Chinese state-owned insurers extend US$427bn in Belt & Road cover: report

- June 14

PICC, China Life, China Pacific Insurance, China Taiping Insurance and China Re have extended risk protection to back up the government's global infrastructure development strategy.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital