Floods are one of the most complex natural perils with highly localised impacts, making them challenging to insure and data is key to the effective design of an affordable product to protect the vulnerable.

Asia, home to many rapidly growing economies, has made significant strides in reducing poverty, improving health and education, and raising living standards for millions of people. Advances in forecasting, early warning systems, and flood defence have drastically lowered deaths from floods and typhoons compared to a century ago.

However, significant disparities and vulnerabilities remain, especially concerning natural catastrophes, particularly floods.

According to the Intergovernmental Panel on Climate Change, the UN’s climate body, human-induced climate change is expected to cause heavy rainfall events to become more frequent and intense across most regions globally. This trend is anticipated to persist with continued warming.

Acts of God or man?

In his 1942 dissertation, an American hydrologist and geographer, Gilbert F. White, said “Floods are acts of God, but flood losses are largely acts of man”.

Scientists assess the impact of climate change on extreme weather by examining natural and human factors. Hydrometeorological (e.g., floods and storms) and climatological disasters (e.g., droughts) have been trending upwards in recent decades, unlike geophysical disasters (e.g., earthquakes and volcanic eruptions). Prolonged periods of increased rainfall primarily result in fluvial (river) flooding, while short, intense cloudbursts can lead to pluvial flood or localised flooding without any large water bodies overflowing.

In addition to climate change, the impact of increased flood frequency is compounded by rising population exposure, increased personal wealth and greater population vulnerability. According to a report by a reinsurance broker, economic losses in the Asia Pacific region due to natural disasters soared to US$65 billion in 2023, primarily driven by floods in China and droughts in India. Of these total losses, only 9%, or US$6 billion were covered by insurance.

The report highlights that floods have been the costliest threat in Asia Pacific for the fourth consecutive year, accounting for over 64% of total losses in 2023. Annual flood losses have exceeded US$30 billion since 2010. This situation underscores the “climate injustice” where the largest greenhouse gas-emitting countries and the world’s most vulnerable economies are not the same, leading to significant global costs.

Source: Aon’s report on climate-and-catastrophe-insights-report.pdf (aon.com)

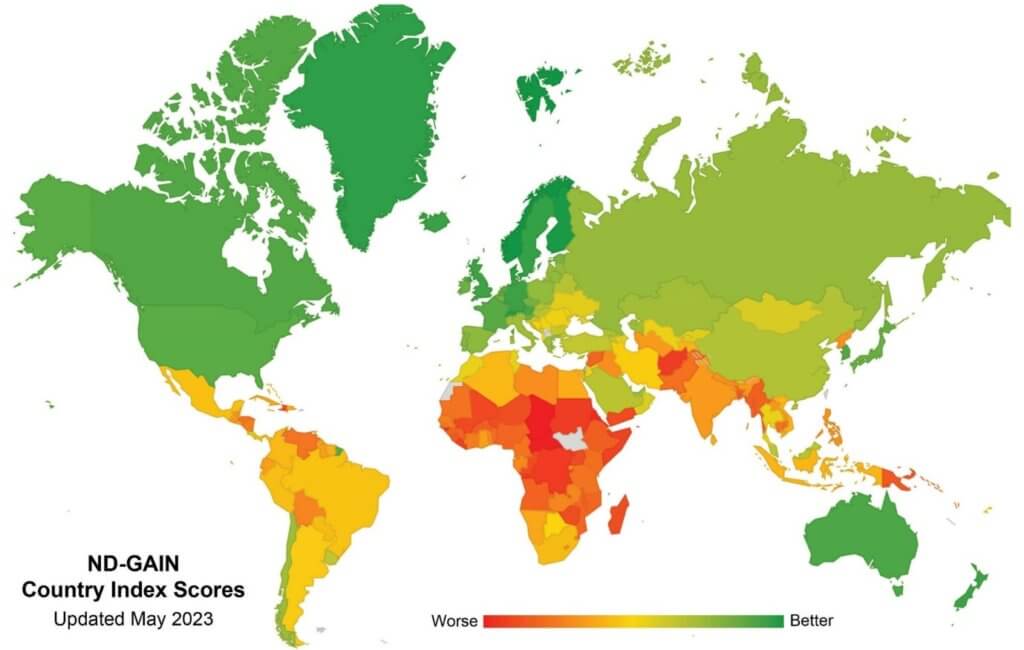

Exhibit A highlights the countries that are most vulnerable to climate change. The Notre Dame Global Adaptation Initiative index gauges countries’ vulnerability based on their exposure, sensitivity and ability to adapt to the negative impacts of climate change.

Source : Country Index // Notre Dame Global Adaptation Initiative // University of Notre Dame

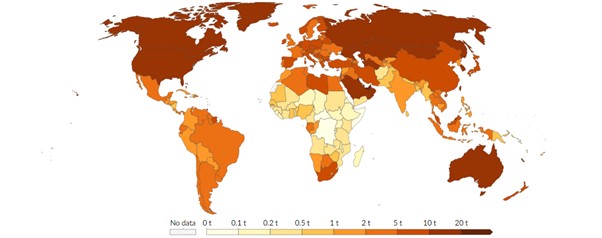

Exhibit B: Annual carbon dioxide emissions per capita

Source: Per capita CO₂ emissions, 2022 (ourworldindata.org)

The blame game – is climate change really at fault?

Across Asia and the Pacific, millions of people face multiple threats to their security, including economic, social, political and environmental. While it is common to blame climate change for these issues, the reality is that any of these dangers are self-inflicted, with climate change being more of a consequence than the cause.

Flooding, a natural part of ecosystems, is worsened by human activities. Jakarta, Indonesia, with 10 million residents, is one of the fastest-sinking megacities with 40% already below sea level. Its flooding issues are exacerbated by rapid, unplanned urbanisation, land use changes, and population growth. The narrowing of river channels and canals, combined with periodic clogging from sediment and trash, intensifies the problem. Blaming climate change alone overlooks significant sociopolitical factors.

Similar situations are seen in emerging cities like Bangkok, Thailand; Ho Chi Minh City, Vietnam; and Manila, the Philippines. A recent study revealed that 37 of 82 major cities in China are experiencing subsidence, which means the land is gradually sinking, affecting 70 million people with rate of 10mm a year or more. Though seemingly minor, this cumulative effect damages infrastructure and worsens flooding.

Mitigating subsidence is complex, as it is often caused by groundwater extraction for drinking water. Simply stopping extraction is not viable without finding an alternative water source first.

Urban planning often overlooks poverty, despite clear evidence that migration to cities is driven more by the need for employment and survival than by the allure of urban amenities. To reduce the impact of floods on impoverished populations, informal settlements should be strategically planned and encouraged to develop outside of floodplains or wetlands.

A fractured governance system can exacerbate urban problems. Cities often focus on creating new infrastructure but may lack the funding or public interest to maintain or upgrade existing facilities. Over time, this neglect leads to infrastructure deterioration, turning assets into liabilities and endangering lives. To minimise damage and protect human life, it is crucial that urban local bodies have integrated functions.

During a crisis, disjointed management – where water, transport, fire services and planning are handled by separate departments – can create significant challenges.

Asia is not alone

Paris shined this summer showcasing its best during the 2024 Summer Olympic Games. However, more than a century ago, the city was devastated by the Great Flood of 1910. Large parts of Paris were submerged for two months, including the famed metro subway system and over 20,000 buildings. Although Paris now has a chief resilience officer to mitigate the impact of future floods, it is estimated that rebuilding the infrastructure after a similar flood today would cost over EUR30 billion.

Europe is dotted with historical flood markers on its buildings, serving as a reminder. Both the public and politicians should heed these warnings from the past and prepare for the next flood.

3Ds: damage, disruption, disease

Floods have economic, social and environmental impacts. Economically, they cause damage and disruption to property, manufacturing, businesses and the daily activities of residents.

For instance, the 2011 Thai floods severely impacted the manufacturing sector forcing over 14,000 businesses to close nationwide. Approximately 1,300 factories in central Thailand were affected, disrupting both local and global supply chains.

Production of cars, electronics and other goods was halted for months as factories were submerged. This disruption had a ripple effect on global manufacturing, with Japanese car manufacturers suspending production for several weeks.

Social impacts include health risks from exposure to contaminated floodwaters, increased waterborne diseases and mental health issues stemming from loss and displacement. Long-term effects such financial strain, loss of education and damage to cultural heritage are challenging to quantify.

Environmentally, floods cause soil and bank erosion, bed erosion, siltation and landslides. They damage vegetation, and pollutants carried by floodwater can degrade water quality, habitats and flora and fauna.

Playing catch-up

Mitigating and adapting to urban flooding requires a comprehensive approach that combines structural solutions such as storm surge barriers and retention areas along with non-structural solutions, which are urban planning adjustments, response capabilities and aligning institutional frameworks.

Outlined below are key strategies to address urban flooding – integrating immediate actions with long term nature-based solutions to mitigate disaster:

Urban planning. Adapting urban planning and zoning practices to consider flood risk can help guide development away from flood-prone areas and ensure that new construction incorporates flood-resilient design principles. Integrating floodplain management regulations into urban planning and zoning can reduce exposure to flood risk. Additionally, improving capacity and ensuring regular maintenance of drainage and sewer systems can better manage stormwater and reduce overflow during heavy precipitation events.

Improving resilience at the community level. Educating the public about flood risk and tailoring solutions on each community’s risk and flood profile are essential. This may include encouraging the use of traditional construction techniques that ensure all floors are raised above typical flood heights.

Sponge cities. Following the model adopted in China, the concept of sponge cities involves maximising open land and green spaces to absorb and manage rainfall. By integrating parks and green infrastructure, these cities can significantly reduce the risk of flooding. This can also use rainwater harvesting techniques to recharge groundwater.

Using modernised flood protection. Structural elements such as dams, levees, and retention basins can significantly reduce flood risk for communities. In addition to traditional methods like manually filled sandbags, there are now more innovative flood protection systems available for individual homeowners or businesses.

Conserving water bodies and mangroves: Preserving and restoring natural water bodies such as lakes and wetlands, play a crucial role in flood management by acting as reservoirs for excess rainwater, preventing its accumulation in urban areas. Strict regulations are necessary to prevent encroachments and pollution of these vital ecosystems.

These solutions are not new, and many countries have attempted to implement them in various ways. Thailand’s 2011 floods were devasting but led to significant improvements in flood management. Since then, the country has invested heavily in flood mitigation, introducing a strategic water management plan and funding flood risk reduction infrastructure in vulnerable areas.

Similarly in India, the 2024 amendment to the Disaster Management Act of 2005 proposes establishing an Urban Disaster Management Authority (UDMA) in each state capital and all cities with municipal corporations. The bill also mandates the creation of a disaster database at both state and national levels.

The role of (re)insurance

Floods are one of the most complex natural perils, with highly localised impacts, making them more challenging to insure compared to other perils. The varying risk characteristics of different types of floods – river, flash, storm surge – add to this complexity. Affordable insurance is often unavailable for poor communities.

A fundamental principle of insurability is “assess ability”. Risk exposures, variation in vulnerability, and local geographic complexities make it difficult for insurers to design an ideal product. Another crucial principle is mutuality or diversification. If only the high-risk customers, such as those who have previously experienced a flood claim, seek flood coverage, it becomes prohibitively expensive without sufficient diversification.

Effective product design starts with data. However, detailed, accurate information on flooding hazards is often hard to obtain at national and local levels due to the lack of high-quality, high-resolution topography, complicating risk assessment and modelling.

For over a decade, Allianz Re has utilised flood maps from a major external provider. These flood hazard maps, combined with internal and external portfolios, help build a comprehensive risk picture. The availability of flood catastrophe models in Asia has gradually expanded, aiding in estimating capital requirements and reinsurance costs.

Geocoding of insured assets is vital for flood risk assessment because flood events are so geographically specific. For instance, a property located at the bottom of a hill is at greater risk than one slightly elevated nearby. Geocoding enhances pricing accuracy, risk knowledge, and portfolio diversification, avoiding risk accumulation in hotspots.

However, geocoding assets in Asia can be challenging due to imprecise addresses. Street names and numbers are not as strictly defined in some regions, often leaving models with only a postal code. Additionally, information such as construction year, building materials and design can also be difficult to obtain, reducing the effectiveness of flood risk mitigation tools.

(Re)insurers have improved their understanding of supply chain vulnerabilities and their ability to accurately price flood risk. Governmental efforts to boost insurance penetration are crucial to closing the flood protection gap. At Allianz, we leverage our global expertise to assists our clients in developing solutions for their local markets.

|

Sonia Rawal P&C and Agriculture Client Manager, Allianz Re |

|

Katherine Wenigmann Flood Expert, Allianz Re |

-

Cybersecurity: The false promise of flawed certifications

- April 23

There is little correlation between certifications and avoiding breaches as the cybersecurity landscape evolves too quickly for annual checkups to be sufficient.

-

Trade credit: Amid trade war, APAC firms must stay agile and ensure adequate protection

- April 2

The US has implemented a new tariff regime across industries and countries, with import duties being a central aspect of US economic and foreign policy. These measures aim to protect domestic industries from what the US government perceives as unfair trade practices, global excess capacity, and imbalanced trading relationships. The policy includes mainland China, delayed […]

-

Insurtech: Tech predictions for the insurance sector in 2025

- January 27

2024 was the year we saw signs that the insurance industry is rapidly transitioning from experimenting with generative AI (GenAI) to deploying scaled production use cases. Fuelled by new data streams and advancements in IOT, and wearables, predictive capabilities are reaching new heights. However, prediction alone is insufficient to reduce loss ratios systemically; meaningful impact […]

-

2004 tsunami: Loss, and lessons: reckoning with the Indian Ocean tsunami 20 years on

- December 20

Though two decades have passed, the 2004 Indian Ocean tsunami is still fresh in my memory. I was in Australia at the time. It was a warm summer’s day, with many people starting to watch the Boxing Day test cricket match between Australia and Pakistan in Melbourne, when the news first hit. Like all of […]

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.

Sonia Rawal, Allianz Re

Flood resilience: Water, water everywhere…

Sonia Rawal, Allianz Re