-

Howden, Price Forbes, HDI Global, Lockton, Sompo: 17 APAC insurance people moves of the week

Liberty Specialty Markets, Labuan Re, Marsh McLennan, QBE, Marsh, Talbot Underwriting, Alliance Insurance Brokers, Specialist Risk Group, Swiss Re CorSo, Cowbell, AIG, Canopius, Pinnacle Underwriting, Ryan Transactional Risk, Resolution Life and XS Global also made personnel changes over the last week.

-

-

Lockton boosts cargo, marine team in Singapore with double move

Broker appoints Li Lin Kea as head of cargo and logistics, regional transportation for Asia, and promotes Cindy Khoo to head of marine and offshore, regional transportation for Asia.

Lockton boosts cargo, marine team in Singapore with double move

Broker appoints Li Lin Kea as head of cargo and logistics, regional transportation for Asia, and promotes Cindy Khoo to head of marine and offshore, regional transportation for Asia.

Broker appoints Li Lin Kea as head of cargo and logistics, regional transportation for Asia, and promotes Cindy Khoo to head of marine and offshore, regional transportation for Asia.

-

Liberty Specialty Markets promotes Sara de Sampaio Soares to APAC head of energy, power and mining

Singapore-based Soares has been with the insurer for almost 11 years, most recently based in Sydney as assistant vice president and national manager for energy and power across ANZ.

Liberty Specialty Markets promotes Sara de Sampaio Soares to APAC head of energy, power and mining

Singapore-based Soares has been with the insurer for almost 11 years, most recently based in Sydney as assistant vice president and national manager for energy and power across ANZ.

Singapore-based Soares has been with the insurer for almost 11 years, most recently based in Sydney as assistant vice president and national manager for energy and power across ANZ.

-

Veteran Jason Mandera becomes CEO of Marsh McLennan Indonesia

He has been with Marsh in Jakarta for over 16 years.

Veteran Jason Mandera becomes CEO of Marsh McLennan Indonesia

He has been with Marsh in Jakarta for over 16 years.

He has been with Marsh in Jakarta for over 16 years.

-

Allianz nets US$2.45bn from sale of 23% of Bajaj JVs

German insurer says India remains a 'high strategic priority'.

Allianz nets US$2.45bn from sale of 23% of Bajaj JVs

German insurer says India remains a 'high strategic priority'.

German insurer says India remains a 'high strategic priority'.

-

Opinion: I, Underwriter? An evitable conflict, or will 2026 see the first AI underwriter?

Artificial intelligence is already encroaching on the underwriting sector, with the industry working to understand the implications on insured exposures and the regulatory landscape.

Opinion: I, Underwriter? An evitable conflict, or will 2026 see the first AI underwriter?

Artificial intelligence is already encroaching on the underwriting sector, with the industry working to understand the implications on insured exposures and the regulatory landscape.

Artificial intelligence is already encroaching on the underwriting sector, with the industry working to understand the implications on insured exposures and the regulatory landscape.

-

Price Forbes taps Gallagher’s Dick Heath as head of reinsurance and wholesale for Singapore

He brings more than 40 years of broking and underwriting experience, and joins from Gallagher, where he was CEO for Asia.

Price Forbes taps Gallagher’s Dick Heath as head of reinsurance and wholesale for Singapore

He brings more than 40 years of broking and underwriting experience, and joins from Gallagher, where he was CEO for Asia.

He brings more than 40 years of broking and underwriting experience, and joins from Gallagher, where he was CEO for Asia.

-

Australia braced for ‘catastrophic’ fire dangers, temperatures could hit 47 degrees Celsius

Total fire ban in place across the entire state of Victoria, most of South Australia, and four districts of New South Wales on Friday.

Australia braced for ‘catastrophic’ fire dangers, temperatures could hit 47 degrees Celsius

Total fire ban in place across the entire state of Victoria, most of South Australia, and four districts of New South Wales on Friday.

Total fire ban in place across the entire state of Victoria, most of South Australia, and four districts of New South Wales on Friday.

-

QBE promotes Dean O’Connell to head of trade finance solutions

Sydney-based O'Connell has been with QBE for almost seven years.

QBE promotes Dean O’Connell to head of trade finance solutions

Sydney-based O'Connell has been with QBE for almost seven years.

Sydney-based O'Connell has been with QBE for almost seven years.

-

ARPC declares end of Tropical Cyclone Jenna

It is the fourth cyclone of Australia’s storm season after tropical cyclones Fina, Grant, and Hayley.

ARPC declares end of Tropical Cyclone Jenna

It is the fourth cyclone of Australia’s storm season after tropical cyclones Fina, Grant, and Hayley.

It is the fourth cyclone of Australia’s storm season after tropical cyclones Fina, Grant, and Hayley.

-

Late‑November storms to cost Australian insurers US$1.78bn: Perils

Figure covers property and motor hull losses for the severe convective storms in Queensland and New South Wales between November 21 and 27.

Late‑November storms to cost Australian insurers US$1.78bn: Perils

Figure covers property and motor hull losses for the severe convective storms in Queensland and New South Wales between November 21 and 27.

Figure covers property and motor hull losses for the severe convective storms in Queensland and New South Wales between November 21 and 27.

-

Yew Kong Kok rejoins Labuan Re as CFO

Kok previously spent nearly three years at Labuan Re between December 2018 and August 2021 as chief financial officer.

Yew Kong Kok rejoins Labuan Re as CFO

Kok previously spent nearly three years at Labuan Re between December 2018 and August 2021 as chief financial officer.

Kok previously spent nearly three years at Labuan Re between December 2018 and August 2021 as chief financial officer.

-

McLarens names dual heads for Australian forensic accounting amid leadership succession

Jane Amling and Paul Sheehy will take up joint leadership roles as heads of forensic accounting for financial lines and business interruption, respectively, coinciding with the planned retirement of Martin Miller.

McLarens names dual heads for Australian forensic accounting amid leadership succession

Jane Amling and Paul Sheehy will take up joint leadership roles as heads of forensic accounting for financial lines and business interruption, respectively, coinciding with the planned retirement of Martin Miller.

Jane Amling and Paul Sheehy will take up joint leadership roles as heads of forensic accounting for financial lines and business interruption, respectively, coinciding with the planned retirement of Martin Miller.

Popular posts:

-

Indonesia eager for ‘continuous cooperation’ with London to open the door for Islamic insurance growth

Delegation from Indonesia’s Ministry of Finance and its financial regulator, the Indonesian Financial Services Authority (OJK), was in London last month for a meeting headed by International Underwriting Association CEO Chris Jones and Islamic insurance experts.

-

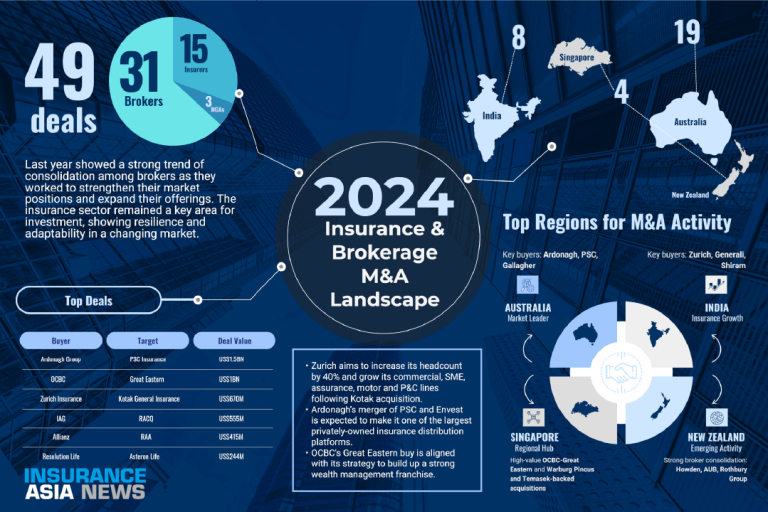

‘Exporter of capital’ Japan here to stay, set to ignite APAC M&A in 2026

Japanese dry powder, FDI liberalisation and tougher capital requirements will be the key drivers of APAC insurance M&A in 2026, according to dealmakers.

-

What’s on the horizon for APAC’s rating environment in 2026?

AM Best, Fitch, S&P Global Ratings, and Moody’s Ratings have optimistic views of the Asia-Pacific insurers for the coming year, but there are a range of factors which will make it a dynamic 12 months.

-

Cedents still ‘exploring’ options after 1.1 renewals under softening market

Guy Carpenter expects dedicated reinsurance capital to grow by around 9% in 2025, reaching approximately US$660bn, with Asia Pacific CEO Tony Gallagher telling InsuranceAsia News that the market remains highly competitive, with increased capacity and strong quoting activity.

Between The Lines

A fortnightly podcast that unpacks the pivotal stories and trends shaping the (re)insurance industry across Asia Pacific.

Spotlight

-

‘Asia is our playground’: Asia Reinsurance Brokers seeks winning formula to extend roots

-

Acord aims for ‘absolute sweet spot’ with Singapore roll out of digital messaging platform

-

Hong Kong to ‘anchor’ Sun Life’s APAC growth push after fantastic 2025: Manjit Singh

-

‘Enabling, not disrupting’: bolttech’s data-driven push to close the global protection gap

-

Descartes shakes things up with Japan earthquake launch, treaty parametric push to drive APAC growth

M&A

-

Allianz nets US$2.45bn from sale of 23% of Bajaj JVs

-

‘Exporter of capital’ Japan here to stay, set to ignite APAC M&A in 2026

-

Hanwha General Insurance secures controlling stake in Indonesia’s Lippo General Insurance

-

Go Digit General Insurance board approves holding company merger

-

Howden expands Australia footprint with CorpSure Cairns acquisition

ESG

-

Carbon credit specialist Oka launches in Singapore

-

‘You can’t do it as a hobby’: ESG must be a clear business model with easily measurable targets

-

Carbon specialist Kita expands into Australia

-

Maritime decarbonisation efforts need liability certainty to stay on course amid ‘pressing challenge’

-

With Donald Trump’s ESG curveball, what’s the outlook for APAC liability coverage?

-

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

Cyber insurance has a long way to go to reach next level, says WTW’s Carlos Grijalva, amid soaring demand in Asia

Carlos Grijalva, cyber leader for Hong Kong and greater China at WTW, talks to InsuranceAsia News about the development of the cyber market in Asia.

Building resilience, mitigating risk in APAC’s commercial property insurance market

Martin Au-Yeung, vice president and division underwriting manager at FM, talks to InsuranceAsia News.

Marine: "Post-pandemic machinery-related losses have become an even more significant issue. Mechanical failures can undermine vessel safety, operational integrity, regulatory compliance, reputation, and even financial stability."

Bo Yu, Markel