-

Generali Asia P&C operating profit drops to US$78.5m in FY25 as COR edges above 100%

The Italian insurer warned that Asia was most exposed to the Iran conflict due to Strait of Hormuz oil reliance.

-

-

Perils lowers Cyclone Alfred final insured losses estimate to US$1.34bn

Personal lines accounted for 70% of total industry losses, commercial lines 26%, and motor lines 4%.

Perils lowers Cyclone Alfred final insured losses estimate to US$1.34bn

Personal lines accounted for 70% of total industry losses, commercial lines 26%, and motor lines 4%.

Personal lines accounted for 70% of total industry losses, commercial lines 26%, and motor lines 4%.

-

HDFC Ergo promotes Parthanil Ghosh to MD and CEO

Mumbai-based Ghosh has been an executive director with the carrier since May 2025.

HDFC Ergo promotes Parthanil Ghosh to MD and CEO

Mumbai-based Ghosh has been an executive director with the carrier since May 2025.

Mumbai-based Ghosh has been an executive director with the carrier since May 2025.

-

Iran conflict heightens specialty insurance tail risks: Moody’s

Beyond marine and aviation, PVT and SRCC coverage carries uncertainty, but insurers are enjoying strong demand and rate hikes, the rating agency said.

Iran conflict heightens specialty insurance tail risks: Moody’s

Beyond marine and aviation, PVT and SRCC coverage carries uncertainty, but insurers are enjoying strong demand and rate hikes, the rating agency said.

Beyond marine and aviation, PVT and SRCC coverage carries uncertainty, but insurers are enjoying strong demand and rate hikes, the rating agency said.

-

Warburg Pincus weighs sale of Oona Insurance after buyer interest: Bloomberg

The private equity firm has hired Citigroup to review strategic opportunities for the Southeast Asian digital general insurer.

Warburg Pincus weighs sale of Oona Insurance after buyer interest: Bloomberg

The private equity firm has hired Citigroup to review strategic opportunities for the Southeast Asian digital general insurer.

The private equity firm has hired Citigroup to review strategic opportunities for the Southeast Asian digital general insurer.

-

MS&AD elevates Clemens Philippi to chief strategy officer for international business

Norihiro Tanaka will become chairman of MSIG Asia, succeeding Tetsuya Adachi, who 'will conclude his tenure with the group'.

MS&AD elevates Clemens Philippi to chief strategy officer for international business

Norihiro Tanaka will become chairman of MSIG Asia, succeeding Tetsuya Adachi, who 'will conclude his tenure with the group'.

Norihiro Tanaka will become chairman of MSIG Asia, succeeding Tetsuya Adachi, who 'will conclude his tenure with the group'.

-

ICA declares significant event following Northern Territory, Queensland floods

Heavy rain and flash flooding has struck Queensland and the Northern Territory this week.

ICA declares significant event following Northern Territory, Queensland floods

Heavy rain and flash flooding has struck Queensland and the Northern Territory this week.

Heavy rain and flash flooding has struck Queensland and the Northern Territory this week.

-

DFC mandates Chubb to lead US$20bn reinsurance facility for Gulf trade

Resuming the flow of trade through the strait of Hormuz is vital for world energy supply.

DFC mandates Chubb to lead US$20bn reinsurance facility for Gulf trade

Resuming the flow of trade through the strait of Hormuz is vital for world energy supply.

Resuming the flow of trade through the strait of Hormuz is vital for world energy supply.

-

Aon Malaysia hires Generali’s Janice Wong as senior vice president for corporate

Wong was most recently head of broking at Generali Malaysia, where she worked for over 25 years, starting as an assistant general manager.

Aon Malaysia hires Generali’s Janice Wong as senior vice president for corporate

Wong was most recently head of broking at Generali Malaysia, where she worked for over 25 years, starting as an assistant general manager.

Wong was most recently head of broking at Generali Malaysia, where she worked for over 25 years, starting as an assistant general manager.

-

Starr appoints Vivian Xiao Wei as China head of financial lines

Shanghai-based Xiao has 17 years of underwriting experience, with a strong background in financial lines.

Starr appoints Vivian Xiao Wei as China head of financial lines

Shanghai-based Xiao has 17 years of underwriting experience, with a strong background in financial lines.

Shanghai-based Xiao has 17 years of underwriting experience, with a strong background in financial lines.

-

Malaysia’s Mandarin Re commits capacity to LIRG for property, ILW risks

Binder's scope includes traditional property cat exposures, ILW transactions designed to meet the retro and capital-management needs of cedents and reinsurers globally.

Malaysia’s Mandarin Re commits capacity to LIRG for property, ILW risks

Binder's scope includes traditional property cat exposures, ILW transactions designed to meet the retro and capital-management needs of cedents and reinsurers globally.

Binder's scope includes traditional property cat exposures, ILW transactions designed to meet the retro and capital-management needs of cedents and reinsurers globally.

-

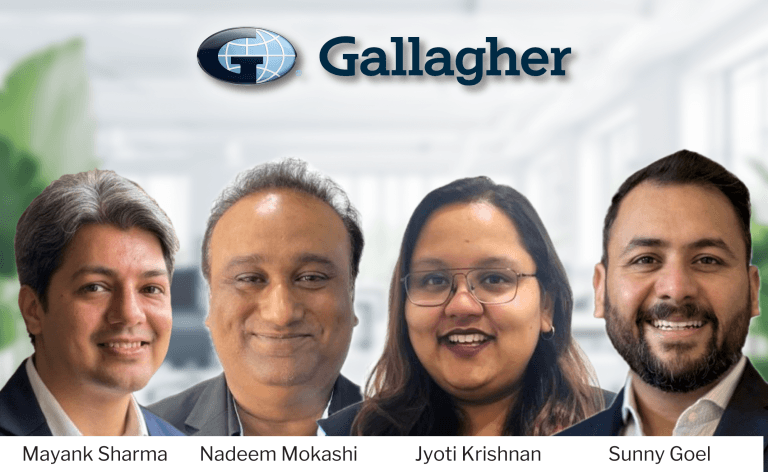

Gallagher strengthens India liability, claims teams with four senior hires

The broker has appointed Mayank Sharma as national head of liability, Sunny Goel as strategic business leader for liability and renewable energy, Jyoti Krishnan as chief legal officer and national head of liability and specialty claims, and Nadeem Mokashi as head of P&C claims.

Gallagher strengthens India liability, claims teams with four senior hires

The broker has appointed Mayank Sharma as national head of liability, Sunny Goel as strategic business leader for liability and renewable energy, Jyoti Krishnan as chief legal officer and national head of liability and specialty claims, and Nadeem Mokashi as head of P&C claims.

The broker has appointed Mayank Sharma as national head of liability, Sunny Goel as strategic business leader for liability and renewable energy, Jyoti Krishnan as chief legal officer and national head of liability and specialty claims, and Nadeem Mokashi as head of P&C claims.

-

West P&I strengthens Korean presence with new consultancy agreement

WIK Marine Consultant's director S. R. Kim has been appointed as West P&I’s representative in South Korea.

West P&I strengthens Korean presence with new consultancy agreement

WIK Marine Consultant's director S. R. Kim has been appointed as West P&I’s representative in South Korea.

WIK Marine Consultant's director S. R. Kim has been appointed as West P&I’s representative in South Korea.

Popular posts:

- ‘It’s your battle. It’s your career’: regional leaders ponder incomplete progress as International Women’s Day shines light on equality, diversity

- Aon appoints ex-APAC CEO Anne Corona to lead North America

- Willis’ Kelsie Makepeace takes up new role in Dubai

- Stephen Ward to lead Steadfast’s newly formed Miramar Group

-

Questions mount over Trump’s touted US$20bn war facility for Gulf shipping

The extent of involvement from the international marine (re)insurance market is also unclear, given that the US agency said it will work ‘with preferred American insurance partners’.

-

Captive momentum accelerates in Asia as firms look to close insurability gap

Despite a softening market, a growing number of companies are turning to captives to manage emerging exposures and fill gaps left by the traditional insurance market.

-

P&I renewals on an even keel as lower claims, higher returns soften stance

Despite early fears of hardening conditions following a surge in pool claims, the 2026-27 renewals closed on a notably pragmatic tone prior to the outbreak of the war in Iran.

-

‘It’s your battle. It’s your career’: regional leaders ponder incomplete progress as International Women’s Day shines light on equality, diversity

Zurich's Tulsi Naidu, Axa XL's Sylvie Gleise, WTW's Chiaki Tanaka, Coface's Grishma Kewada, Asia Insurance's Winnie Wong, and Howden's Shweta Swaroop spoke to InsuranceAsia News to mark International Women's Day.

Between The Lines

A fortnightly podcast that unpacks the pivotal stories and trends shaping the (re)insurance industry across Asia Pacific.

Spotlight

-

‘No longer optional’: parametric climate cover gains urgency as Asia Pacific faces accelerating volatility

-

‘Big expectations’ as Gift City branch gives Mapfre Re vehicle to drive India, APAC growth: Javier Sánchez Cea

-

‘Exciting and new’: Specialist Risk Group aims to put itself on the map in Australia, Southeast Asia

-

Cyber on the mind for ‘next few years’ as Asian ransomware attacks more than double as digitalisation outpaces defences

-

Chubb’s Evan Greenberg ‘bullish on long-term opportunity’ for Asia

M&A

-

Warburg Pincus weighs sale of Oona Insurance after buyer interest: Bloomberg

-

Steadfast acquires food and beverage specialist broker Victual

-

IRDAI clears Allianz Jio Re, Kiwi General to begin operations

-

Ardonagh-backed Cornerstone Risk acquires Australia’s Cav Insure

-

Jio Financial pumps US$16m into Allianz Jio Reinsurance

ESG

-

Carbon credit specialist Oka launches in Singapore

-

‘You can’t do it as a hobby’: ESG must be a clear business model with easily measurable targets

-

Carbon specialist Kita expands into Australia

-

Maritime decarbonisation efforts need liability certainty to stay on course amid ‘pressing challenge’

-

With Donald Trump’s ESG curveball, what’s the outlook for APAC liability coverage?

Development of Asia’s ILS market with Peak Re’s Iain Reynolds

Iain Reynolds, head of third party capital at Peak Re, talks to InsuranceAsia News about the development of Asia's ILS market

1.1 renewals takeaways and 2026 market outlook with Gallagher Re’s Mark O’Brien

Mark O'Brien, head of Asia Pacific at Gallagher Re, talks to InsuranceAsia News about the 1.1 renewals and the outlook for the market in 2026.

Reinsurance: The real test is what happens in the tail. That means looking beyond expected losses and asking harder questions: how much capital is exposed in a truly severe scenario?

Pavel Huerta, Swiss Re