Zurich | Economic pressures, impacts of inflation and energy supply shortages top the risk list for APAC leaders

January 2 2024

Slowing economies and the ongoing impacts of the inflationary environment create a complex risk environment in the Asia-Pacific, according to the World Economic Forum’s latest Executive Opinion Survey.

The Asia-Pacific (APAC) region has remained a key driver of the global economy in 2023. But forecasts for the region suggest that growth will dip from 4.6% this year to 4.2% in 2024 and 3.9% in the medium-term as China’s economic slowdown dampens the region’s performance. That sober outlook is reflected in the World Economic Forum’s Executive Opinion Survey (EOS), as economic pressures emerge as the top risk for APAC leaders.

From inflation and labour shortages to weather-related disasters, leaders across APAC share some common concerns, according to this year’s EOS. The survey, which gathers data from 11,000 respondents across 110 economies, paints a picture of the top concerns.

Financial concerns pose the biggest risk

It’s a difficult time for business leaders, who face multiple economic, energy and environmental challenges. Financial risks, energy supply pressures and labour shortages all feature in the top five risks for APAC leaders. While forecasts predict APAC inflation will be lower than in other regions, it could remain at a higher baseline for longer.

Amid slowing growth forecasts in China, APAC’s biggest economy, leaders cited the risk of economic downturn is the greatest perceived risk in four out of five APAC sub-regions. The growing focus on economic risks is a marked contrast to 2020, when no economic risks made the top five in East Asia and the Pacific, and two of the top five were technological risks.

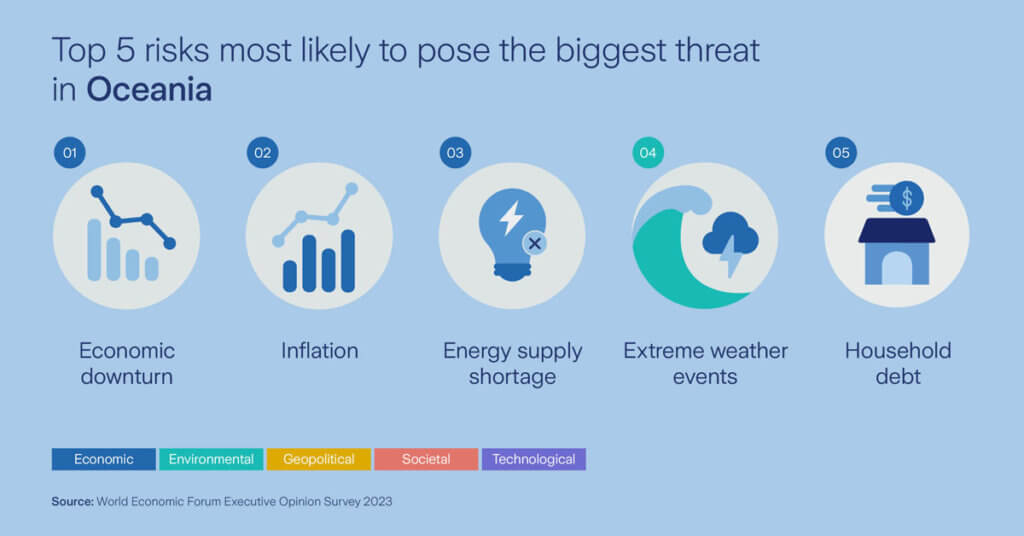

In 2023, inflation comes third on the list for every region except Oceania, where it is in second place. Labour shortage comes in at fourth for South and South-Eastern leaders, and second in East Asia, but it’s absent from the top five in Oceania.

Meanwhile, energy supply shortage consistently ranks between second and fourth place across the five sub-regions surveyed. But these perceptions of risk should be contextualised by the fact that APAC is still home to some of the fastest growing economies in the world: the GDPs of China, Indonesia, Cambodia and the Philippines are all forecast to grow by over 5% in 2023 , while India’s growth could reach 6.3%.

APAC leaders eyeing climate and biodiversity risks

At the same time, risks related to climate change are also top of mind for many APAC leaders. That reflects the fact that APAC is the most disaster-prone region in the world, where the increasing impacts of climate change pose a rapidly growing threat. A total of 140 weather-related disasters struck the region in 2022, impacting 64 million people and causing damage estimated at US$57 billion.

Oceanian respondents rank extreme weather events at number four, the highest environmental risk of any sub-region, and environmental concerns are evident across the APAC. South-East Asian leaders scored extreme weather events sixth and were more concerned than the global average about biodiversity loss and pollution. Non-weather-related natural disasters were number 15 for East Asian leaders, above the global rank of 30. And Central Asian respondents ranked water shortages at number 10, far above the global rank of 24.

Pollution risks are also viewed differently across the different regions. APAC leaders ranked pollution risks (air, water, soil) at number nine in South-east Asia. In Oceania and Eastern Asia, pollution risks were less of a concern at 24.

The 2023 survey suggests that the pressure of dealing with the volume and intensity of short-term crises are weighing on leaders’ abilities to manage the looming threat from climate change. As such, failure to adapt to climate change did not receive the expected rankings in this survey.

How risks are evolving in the region

In general, economic concerns are trending away from unemployment and underemployment and toward labour shortages and inflation.

In last year’s EOS, debt crises in large economies featured in the top five for all regions in Asia. In 2023, leaders were slightly less concerned about the prospect of debt crises, although there were exceptions at a country level. In Australia, Indonesia, South Korea, Malaysia, New Zealand, the Philippines and Thailand, debt crises continued to appear in the top five risks.

In Central Asia, geo-economic confrontation, severe commodity supply crises, severe commodity price shocks or volatility and debt crises all dropped out of the top five risks between 2022 and 2023. New entrants to the top five risks this year include wealth and income inequality in South Asia and infectious diseases, which arrived in the top five in South-East Asia. Notably, cybercrime and cybersecurity dropped out of the top 10 risks this year, with the exception of Eastern Asia.

Geopolitics and debt divide regional leaders

Beyond economic and climate concerns, APAC leaders’ perception of risks are, perhaps unsurprisingly, quite varied. In stark contrast to their Central Asian peers, for example, Oceanian leaders ranked interstate conflict close to the bottom of their list at 31.

Meanwhile, Oceania’s high-ranking risks related to household debt are way down the risk list for South Asian businesses at 30. Leaders in South Asia instead ranked illicit economic activity high on their worry list at number eight (above the global rank of 19), but this risk is close to the bottom in all other APAC sub-regions.

Interconnectedness of risks across APAC and globally

While we identify and rate risks on a standalone basis, it is important to consider the interconnectedness of top risks. These will continue to exert varying degrees of impact across both the APAC region and globally. Accordingly, the interconnectedness of regional and global risks will always be an important consideration as we build our overall risk assessment.

Overall, economic, geopolitical and environmental risks are ranked relatively highly by APAC leaders compared to their global peers. Businesses and insurers should work closely with governments to manage these risks as a priority while also turning their attention to building resilience against long-term challenges. APAC countries must pursue sustainable growth, balancing gains in GDP and productivity with the effective management of environmental risks to secure their economic future.

|

Sid Medappa

Regional Head of Risk, APAC, Zurich Insurance Email: [email protected] |

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.