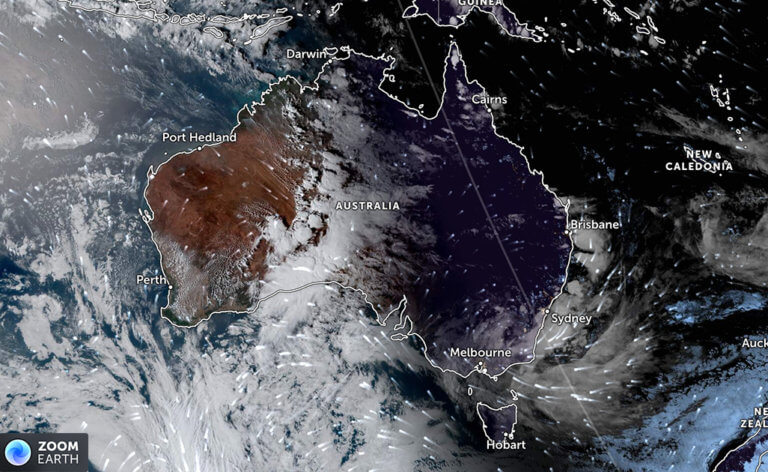

Wild weather hits eastern Australia; further storms, hail and heavy rainfall expected

November 29 2023 by InsuranceAsia News-

Markel appoints Joanna Quigan as senior underwriter for professional and financial risks

- July 3

She will be based in Melbourne and report to Kym Beazleigh, head of professional and financial risks.

-

As ‘bomb cyclone’ hits Australia’s NSW, 2025 losses top US$1.2bn

- July 2

Coastal low weather system has led to damaging wind and heavy rainfall since Tuesday.

-

‘Reinsurers have been quite clear that they’re still looking to grow’: Gallagher Re’s Heather Bone

- July 2

At the July 1 renewals, while supply was abundant, demand is falling given increasing consolidation in Australia’s insurance industry.

-

IAG lifts profit outlook as nat cat bill comes in below forecast

- July 1

Australian insurer revealed that natural peril costs for FY2025 had come in roughly US$132m below expectations.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.