By Thomas Delor, head of actuarial, and Balaji Vijayakumar, head of catastrophe management,

Asia Pacific & MENA, Canopius

Early in the morning of August 26, 1883, in the Sunda Strait between the Indian Ocean and the Sea of Java, Krakatau Volcano erupted. The last and largest of four blasts was heard clearly 5,000 kilometres away. Pyroclastic flows moving at speeds of hundreds of kilometres per hour caused tsunami waves which rocked vessels as far away as South Africa. The port town Merak on the island of Java was destroyed by a wave of at least 30 metres. Tidal gauges in the English Channel recorded high waters caused by concussive air waves that had circled the globe. The sky worldwide darkened for years, as two thirds of the island of Krakatau, along with volcanic ash and poisonous gasses, shot into the atmosphere. The moon appeared blue-green.

Krakatau is not known to have been an insured loss in 1883. However, if a similar eruption were to occur today, it would undoubtedly lead to an enormous volume of claims worldwide, not least for marine and coastal property exposures. Some at least would arise from the impact of the tsunami waves, rather than from the eruption itself. This  extraordinary low-frequency, high-severity peril is as yet unmodelled, a tail risk which is only very rarely considered by reinsurance underwriters.

extraordinary low-frequency, high-severity peril is as yet unmodelled, a tail risk which is only very rarely considered by reinsurance underwriters.

In 2012, the Geological Society of London published a paper which warned Anak Krakatau could again cause a tsunami, this time through the collapse of the material which had built up on its remains. It happened in December 2018. Although this time the event was much less dramatic, the wave did cause insured damage, and about 400 deaths. The cause of the cascade – the failure of volcano walls, known as a caldera collapse – is one of three principal causes of volcanic tsunamis, alongside underwater explosions and the collapse of lava benches. For example, a small tsunami hit Rakata Island in October 1981, during an awakening of Anak Krakatau. A 1930 eruption of Stromboli, a volcanic island north of Sicily, caused a deadly tsunami, showing that the risk is not limited to the Pacific.

Insured losses may arise under a variety of coverages. Property damage and business interruption in coastal locations are probably the greatest exposures. Tourism and aviation are likely to be disrupted, with associated impacts including accident claims. The marine market could also be seriously affected by claims. Air transport would also be severely disrupted due to volcanic ash clouds.

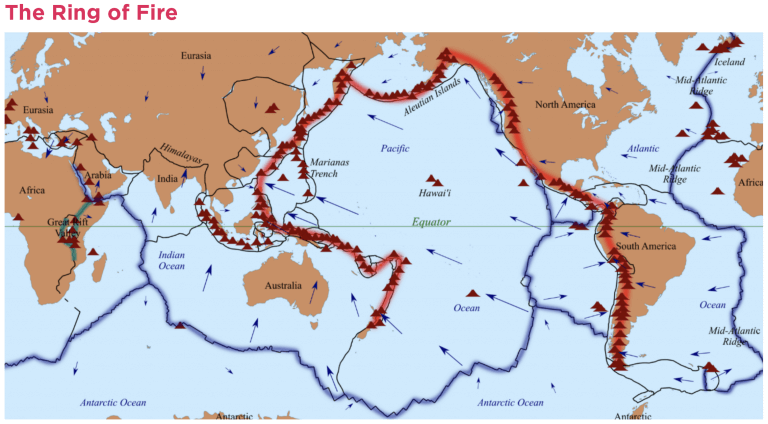

If an explosion similar to the 1883 eruption of Krakatau were to occur today in the Pacific Ring of Fire, the series of 452 volcanoes that roughly outlines the Pacific Ocean, the impact would be catastrophic, and could deliver a severe blow to the insurance market. Coastal exposures in Indonesia and other Asian countries have grown massively since the 20th century, and continue to do so as population density increases and coastal habitation extends. They have reached record-breaking levels. The vulnerable island of Java is now the most densely populated in the Indonesian archipelago, but the damage would extend much further. Many urban centres that border the Ring of Fire are vulnerable. A handful of these volcanoes are active and have genuine potential to cause a tsunami.

Losses arising from tsunamis are explicitly excluded from some standard insurance policies, but many others are silent about the risk, which presumes coverage is granted. For example, the model earthquake and Volcanic Eruption policy endorsements published by the US Insurance Services Office provide no coverage for damage caused directly or indirectly by tsunamis, even if they are attributable to a volcanic eruption, but flood- specific coverage is much more likely to include tsunami losses, which are covered under policies issued by the US National Flood Insurance Program. In contrast, the 2011 tsunami which followed the Tōhoku earthquake in Japan led to total payments by Japanese insurers of more than US$13.7 billion under residential insurance policies which covered tsunami risk, and more than US$7 billion under commercial policies, much of it related to business interruption losses, according to the General Insurance Association of Japan.

specific coverage is much more likely to include tsunami losses, which are covered under policies issued by the US National Flood Insurance Program. In contrast, the 2011 tsunami which followed the Tōhoku earthquake in Japan led to total payments by Japanese insurers of more than US$13.7 billion under residential insurance policies which covered tsunami risk, and more than US$7 billion under commercial policies, much of it related to business interruption losses, according to the General Insurance Association of Japan.

With various exposures across large international portfolios of risk, one might assume that regulators demand that carriers allocate capital to support potential volcanic tsunami losses. However, they do not do so explicitly for this kind of tail risk. We know of no capital requirements for volcanic tsunami risks imposed by any of the world’s insurance regulators, nor is a volcanic tsunami stress-test or realistic disaster scenario incorporated into the EU’s Solvency II regime or any solvency regulation in the APAC region. Further, to our knowledge no vendor model is available to assess the risk.

Re/insurers must therefore adopt their own approach to managing the risk of volcanic tsunamis and other unmodelled low-frequency, high severity events. Canopius has prepared for possible events by ensuring a focus is maintained on tail-value risks in general, considering such events during portfolio analysis, and adopting a scenario approach, against which high-risk areas identified within our risk portfolio are tested. Given the significant loss potential arising from volcanic tsunamis, it is a risk we should all consider.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The carrier proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.