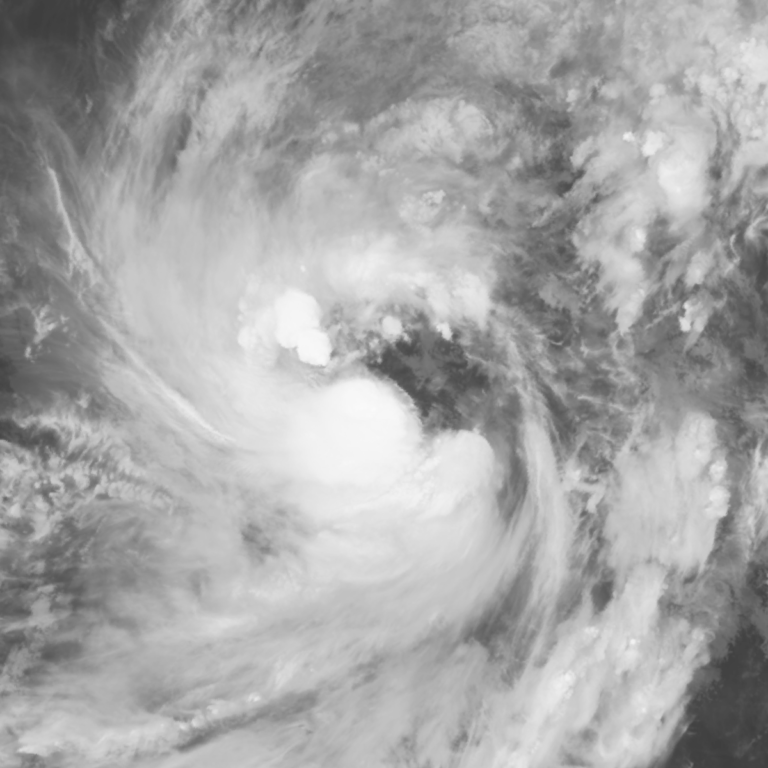

Tropical Storm Nalgae wreaks havoc in the Philippines

October 31 2022 by Andrew Tjaardstra-

Aon’s Karl Hamann returns to Philippines as country CEO

- February 3

Hamann, who replaces Darren Oliver, will relocate to Manila to take up his new role in April.

-

Filipino carriers FPG Insurance, Mercantile Insurance cleared to merge

- January 29

Philippine Competition Commission says the merger likely poses no substantial lessening of competition in the relevant markets.

-

Philippines grants PCIC record budget allocation following reinsurance mandate

- January 27

State-owned crop insurer has been allowed to engage the private sector through co-insurance, reinsurance, and risk pools since last month.

-

Philippines’ Nat Re promotes Jaime Jose Javier Jr. to COO

- January 7

Von Edward Ebron succeeds Javier as vice president and head of life reinsurance and data administration.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital