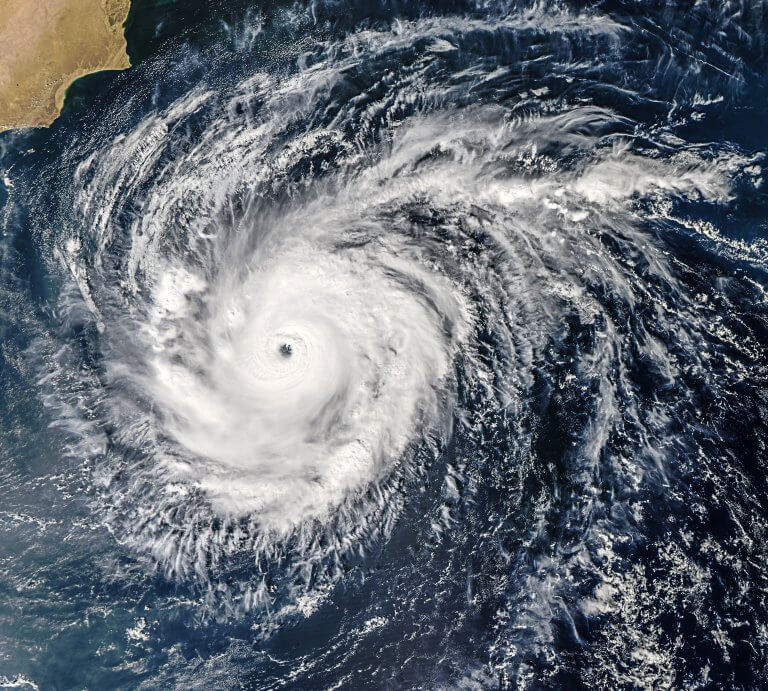

Typhoon Jebi loss could reach US$16bn

May 29 2019 by InsuranceAsia News-

Japanese non-life insurers to rely more on underwriting, global growth: Fitch

- July 3

Three major insurance groups - Tokio Marine, MS&AD, and Sompo - reported a sector-wide combined ratio of 99% in FY2025.

-

Aon names Keiko Seta as head of Japan desk

- July 3

Seta joins having spent the last five years at Miller Insurance Services.

-

Gallagher Re to assume 100% control of Japan P&C cedent fac portfolio from JV partner Miller

- July 2

Reinsurance broker has also appointed Pablo Muñoz as CEO for global facultative reinsurance business.

-

Howden acquires majority stake in Japanese retail broker Holos Holdings

- July 2

Global broker will pick up a 68.3% stake in the Kyoto-based life and non-life insurance intermediary with 20 branches in Japan.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.