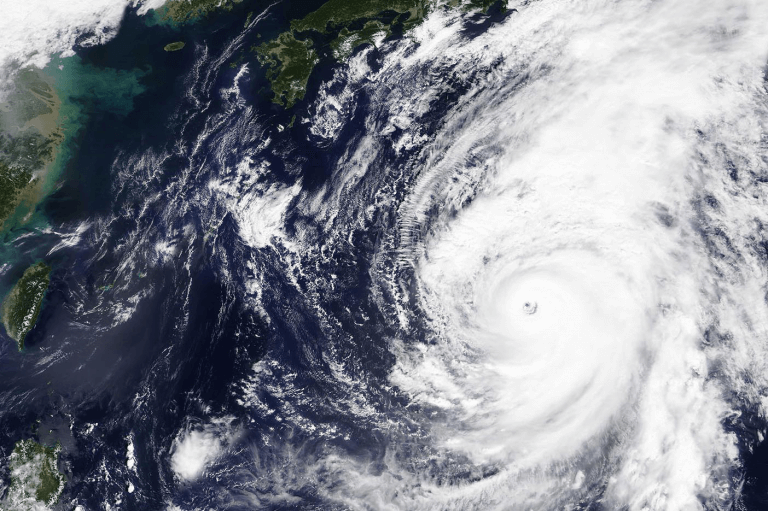

Typhoon Hagibis’ losses at US$8bn to US$16bn: AIR

October 23 2019 by Yvonne Lau-

Sompo profits boosted by reduced natural catastrophe losses

- February 13

Sompo is on track to achieve a record profit in FY25.

-

Tokio Marine upgrades FY25 forecasts after better-than-expected Q3 results

- February 13

Tokio Marine said that its adjusted net income in the first nine months of FY25 was JPY984.5 billion (US$6.42 billion).

-

MS&AD reports 7.5% increase net premiums written to US$24.8bn in Q3 FY25

- February 13

Japanese conglomerate also announces it has reached a final agreement to merge Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance.

-

Markel names John Bang as head of South Korea and Japan

- February 12

Markel says the the newly created role reflects its commitment to expand in the key markets.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital