Pricing critical illness (CI) insurance necessitates a view of the future, informed by trends in past disease incidence rates. One of the main CI conditions is cancer. Examples from Asia show that population incidence rates for some of the most prevalent cancers have notably improved in recent years.

Not incorporating this short- to medium-term experience in CI trend assumptions could lead to a sizeable over-estimation of future claim costs, and therefore to overpricing.

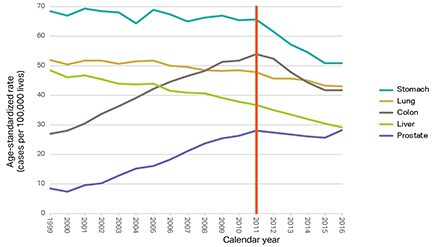

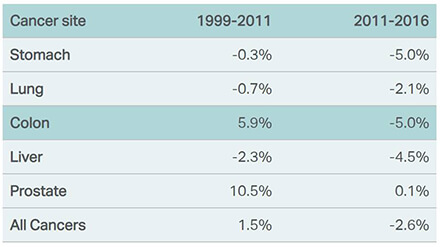

As shown in Figure One and Figure Two (see below) incidence rates for many of the most prevalent male cancers have improved, or continued to improve, after 2011 (most notably for colon and stomach cancer). A shift in incidence rates was also observed in Japan in 2011.

Colon cancer incidence deteriorated at a rate of 5.9% for more than 10 years and then improved at a trend of minus 5% since 2011. Incidence trends based on data from 1999-2011 would therefore be more pessimistic than those calculated on data from 2011-2016. For a male non-smoker aged 45, incidence trends based on 1999-2011 data would potentially overestimate the present value of future claims by 37% for stomach cancer and 120% for colon cancer.

This has a significant impact on CI pricing. For example, for South Korea, for all male cancers – an assumed arbitrary worsening trend of 1.5% instead of an improving trend of minus 2.6% for 10 years, which potentially overstates the current value of claims by 18%. A book of business/treaty last priced in 2011 could have been overpriced by 18%.

Figure One: Age-standardised population incidence rates for the most prevalent male cancers 1999-2016, South Korea. Trends notably improved after 2011. Data source: Korea Central Cancer Registry (KCCR) [1].

Will the trend continue?

Despite the observed improvements in stomach and colon cancer in South Korea, 2016 (the most recent year) data indicates a flattening. Although only one year, several risk factors indicate that improvement will continue in the short to medium term (next five to 10 years), but is likely to flatten in the long term. Factors include:

- The prevalence of Helicobacter pylori in Korean adults has fallen constantly by 1.5% per year since 1998. At the same rate, it would take another 20 years to reach western levels.

- Smoking rates are likely to continue to decline, suggesting a continued improvement given the lag between cause and effect, at least in the short term.

- If eligibility for screening and removal of pre-cancerous colon polyps widens, as is likely, and given lags of up to 10 years for polyps to become cancerous, improvements can be expected for years to come.

- The increasing discovery of early-stage male stomach cancers is an indication of earlier screening. However, given that over 70% of those eligible are already being screened, this risk factor is likely to cause a flattening in future incidence rates.

Figure Two: Empirically calculated incidence trends for the most prevalent male cancers, South Korea, using 1999-2011 and 2011-2016 population data. The two periods lead to distinctly different trend rates on which to price future CI business, adding complexity to deriving long-term incidence trends. Data source: KCCR.

Updating trend assumptions

The observations highlight the importance of regularly monitoring cancer incidence trends, understanding the evolving risk factors and updating trend assumptions. Of course, across all cancers, improving trends in some may offset worsening trends in others; in Singapore, for example, worsening incidence trends in females for breast cancer are offsetting improving incidence trends in colon and lung cancer.

It is recommended therefore that short- to medium-term trending for countries where data is available should be guided (but not dictated) by relevant, recent historic experience. This can then be blended into a long-term trend assumption that the pricing actuary considers reasonable given not just incidence data but all relevant risk factors including medical developments, lifestyle changes and screening programs.

This article is written by CJ Sadler who is a senior pricing actuary life and health at PartnerRe; he is based in Hong Kong.

Reference

-

Insurtech: 6 AI trends reshaping the industry

- February 25

AI has become the defining technology of our time, entering the hands of everyday consumers and employees faster than any innovation in recent history. The speed of adoption has been remarkable, mirrored by an equally intense wave of hype, but real business impacts are beginning to surface. What was once the domain of specialised data […]

-

AI: Complexity mismatch amid the case for augmenting the investment office

- January 21

With prudent oversight and strong guardrails, an augmented investment office can allow insurers to confidently ride the private credit boom without being undermined by the complexity they have embraced.

-

Marine: Amid backlogs and breakdowns, Covid-19 maintenance delays put vessel safety at risk

- December 9

Asia is at the sharp end of a hidden maritime risk, with post-pandemic machinery-related losses becoming an even more significant issue.

-

W&I: Balancing growth, commerciality and sustainability in Asia Pacific’s W&I market

- November 6

Warranty and indemnity (W&I) insurance is now being utilised with increasing frequency across a far broader range of deal sizes and geographies in the region.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital

CJ Sadler, PartnerRe

The impact of improving cancer rates on critical illness pricing

CJ Sadler, PartnerRe