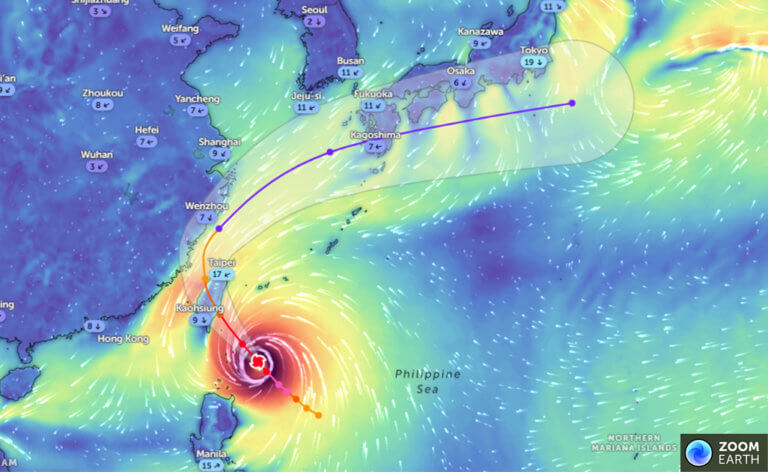

Taiwan braces for heavy rains, strong wind with super typhoon Kong-rey set to make landfall

October 30 2024 by Mithun Varkey-

‘A global problem’: Nicolas Maduro capture creates new dynamic for Asian geopolitical risks

- January 12

Insurers have little real exposure to Venezuelan risks following the actions by the US, but it is not the case in other regions of the world, with Southeast Asia now a particular focus.

-

Sompo Hong Kong taps Will Wang as head of casualty

- December 29

He relocates to Hong Kong for the role that also covers Macau and Taiwan.

-

Crawford snaps up Tony Tung Yu Lin to join Taiwan engineering team

- December 29

He joins from WSP in Asia, where he had served as a civil structural engineer since March.

-

APAC non-life insurers to remain stable in 2026 as capital strength offsets regulatory, catastrophe pressures: Fitch

- December 4

Stable margins and strong solvency expected, Fitch says, with disciplined pricing and steady reinsurance support underpinning a neutral outlook.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital