Swiss Re: Why sustainability and health should be shared priorities for (re)insurers

November 15 2021

Swiss Re CEO Reinsurance Asia Russell Higginbotham explores the impact of climate disruptions and sustainability on human life and health and why they should be priorities for (re)insurers in the years ahead.

Coming as it does in the wake of the COP26 summit and amid warnings that much of Asia should brace for an unusually harsh winter,1 the theme of this year’s Pacific Insurance Conference (PIC) — ‘Driving sustainability in Asia, together’ — seems particularly timely. Contributing to sustainability and the fight against climate change has rightly become a priority for our industry as for so many others, and I’m sure thi s is a cause we can all rally behind.

s is a cause we can all rally behind.

When it comes to sustainability, we all understand the basic principles. But let’s be honest — perhaps because it’s such a huge, complex and at times almost overwhelming issue, the connections between sustainability and (re)insurance and health are not always obvious. It can be difficult to assess what specific steps we can take, right now, to effect positive change on a practical level. We can’t claim to have all the answers. But I would like to share some lessons learned from Swiss Re’s experience that can hopefully be applied to the strategies of others — and contribute to a productive and dynamic series of discussions during this year’s PIC.

This is by no means a new concern for Swiss Re. Climate change was on our emerging risk agenda in 1989 — even before the term ‘emerging risk’ was coined. Since then, we’ve developed an ambitious Group Sustainability Strategy that’s squarely focused on mitigating climate risk and advancing societal resilience, not least by developing affordable and accessible protection through digitalisation. Last year alone we advised 130 sovereigns or sub-sovereigns on climate risk management strategies, offering nearly USD11 billion in related protection, while also making progress towards our own net-zero greenhouse gas emissions targets.

Climate’s connection to health crises

Knowledge and awareness around climate change have risen exponentially since it appeared on our radar 30 years ago. Yet for all the progress, the impact of climate change on human life and health remains an area that’s not been widely investigated.

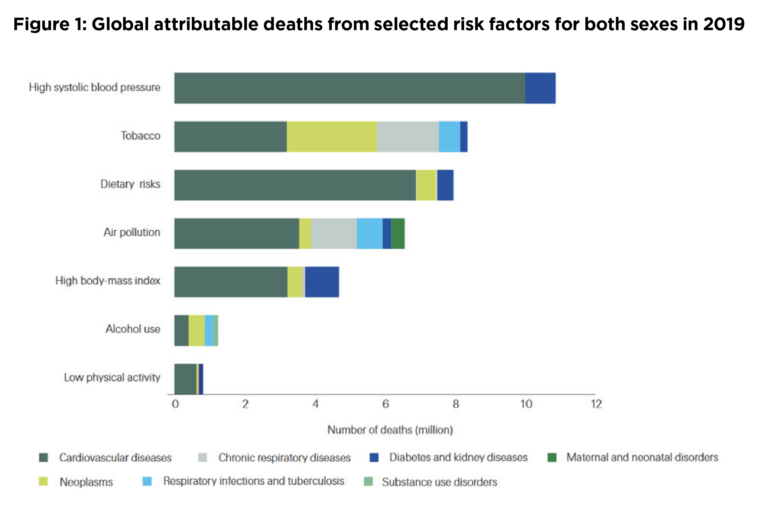

I hope together we can begin to rectify that because the links between changes in our environment and human health are direct and fundamental. Climactic shifts influence some of the most basic determinants of health — air, water, growing conditions for staple foods — and can profoundly alter the transmission patterns of various diseases. To put this in context, in 2019, environmental risk factors such as air and water pollution, heat and cold waves, and occupational risk accounted for around 20% of deaths globally2 (refer

to figure 1).

In the face of this destructive potential, what can we as (re)insurers do? I’d argue that first and foremost we should concentrate on our core strength, which is our ability to accurately assess changes in the risk landscape, often well before they hit the mainstream. The practices and data capabilities we’ve developed allow us to model the impacts of various climate change scenarios with a depth and precision few other organisations can match. By applying that knowledge and expertise and sharing it with the right partners, we can help mitigate the impact of climate on health and contribute to better outcomes.

This isn’t just a nice idea; it’s an approach that’s already driving results. We’ve teamed up with Lancet Countdown, an expert network dedicated to researching the connections between health and climate change on a project to estimate the healthcare and economic impacts of exposure to outdoor air pollution in urban areas in Chile. We’re also analysing and modelling the potential effects of climate change on the prevalence of dengue fever in Brazil, with the ultimate intention of designing solutions that we can offer governments there and elsewhere to create opportunities for risk transfer and mitigation.

Here in Singapore, our Corporate Solutions practice has launched HazeShield, a standalone insurance solution designed to help businesses minimise the health and financial fallout from the severe haze outbreaks that regularly strike the region due to the ongoing destruction of peat swamp forests. We’re also extending our partnerships with various cities to better protect those particularly vulnerable to temperature fluctuations — the overwhelming majority of which are right here in Asia Pacific.3

Keeping the future on target

It’s been gratifying to see these initiatives begin to bear fruit, and we hope to achieve even more in the years ahead by continuing to focus on our three 2030 Sustainability Ambitions. One is mitigating climate risk and advancing the global energy transition, which we’re working toward s by developing new protection solutions for emerging, and rising, natural catastrophe threats. Building societal resilience is another key target and health is a major part of that.

s by developing new protection solutions for emerging, and rising, natural catastrophe threats. Building societal resilience is another key target and health is a major part of that.

We are striving to close the mortality and health protection gaps that remain across this region and elsewhere by providing comprehensive health and longevity protection to customers and encouraging well-being across all age groups. This is reflected in our emphasis on the ‘Big Six’ lifestyle factors (refer to figure 2) — including environment nutrition and physical activity — which we now view as essential to health and consequently risk assessment. We believe by incorporating these into underwriting, we can encourage and even incentivise customers to better manage their health and enhance overall engagement.

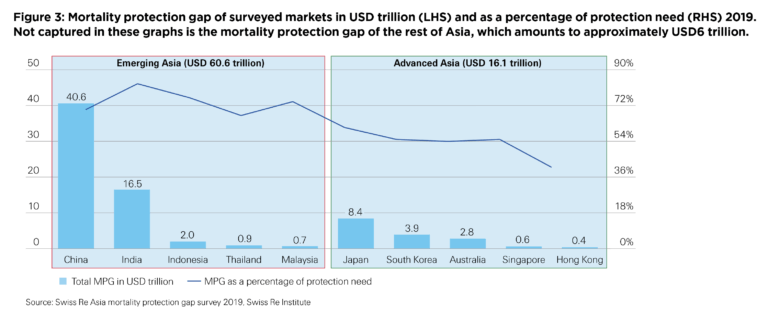

To advance health further, it’s also absolutely critical that we make L&H insurance affordable and accessible to groups for whom it’s traditionally been out of reach. The pandemic has starkly underlined the high cost of inadequate protection against sickness, unemployment or death for many families and communities. Though last year we paid out USD10.8 billion in claims and protected 3.1 million additional lives, that’s a drop in the bucket relative to the estimated USD83 trillion mortality gap we still see across the region (refer to figure 3). We need to do more, and we’re aiming by 2026 to cover another 1.5 million lives from previously unreached socioeconomic groups.

Our work has demonstrated conclusively that when it comes to making substantive progress on massive issues like health and climate change, there are two essential ingredients — partnerships and digitalisation.

Digitalisation plays a huge role in advancing both accessibility and affordability. Through innovations like Magnum Go, our L&H insurance platform, we’re automating processes like underwriting and substantially reducing operating costs and making it far easier for clients and brokers to disseminate products and insights to their customers. We’ve seen a massive uptake of these offerings over the past few years and are working con stantly to improve and extend them.

stantly to improve and extend them.

I’m excited by the potential of fields like data analytics and artificial intelligence to enhance our knowledge of, and our ability to prevent and mitigate, risks and to manage future crises. Better data will also improve our ability to integrate ethical considerations, an important and often overlooked aspect of sustainability, into our product development and decision-making.

So, I hope as we prepare to discuss the issues facing our industry, I’ve helped demonstrate how climate change presents serious L&H implications — but also that there are good reasons for optimism, and many opportunities we can seize that will contribute to better, more resilient societies as well as commercial goals. I look forward to our conversations on how we can act on these opportunities, together.

3 https://www.cnbc.com/2021/05/14/asian-cities-face-the-biggest-environmental-risks-study.html

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.