Swiss Re: Balance – and the best of both worlds: How insurers can make the most of digitalisation

October 29 2021

A survey of consumers across South and Southeast Asia found that no less than 40% are now open to purchasing personal lines insurance online. Russell Higginbotham, CEO Reinsurance Asia and Regional President Asia, Swiss Re

As we look forward to the Singapore International Reinsurance Conference (SIRC), digitalisation will clearly be a major topic of discussion – for good reason. Research we’ve just released confirms something I’m sure many of us have come to realise: that particularly in the wake of the pandemic, technology is moving beyond serving mainly as an addon, but is becoming core to how we do business.

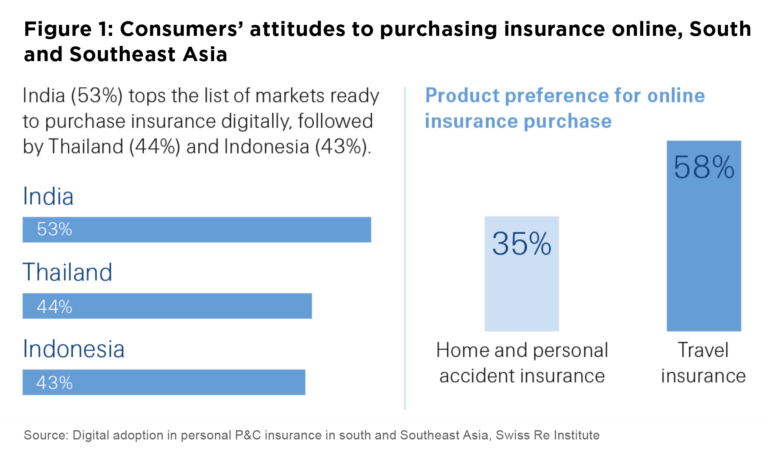

This is partly a result of the pace of technological change and the opportunities we’ve explored as an industry. But make no mistake, it’s driven primarily by our customers. A survey we conducted of consumers across South and Southeast Asia, a region that’s traditionally trailed others in terms of digital adoption, found that no less than 40% are now open to purchasing personal lines insurance online. Appetite for online engagement is even higher in specific markets such as India (53%) and when it comes to certain products, notably travel insurance (58%).

This is partly a result of the pace of technological change and the opportunities we’ve explored as an industry. But make no mistake, it’s driven primarily by our customers. A survey we conducted of consumers across South and Southeast Asia, a region that’s traditionally trailed others in terms of digital adoption, found that no less than 40% are now open to purchasing personal lines insurance online. Appetite for online engagement is even higher in specific markets such as India (53%) and when it comes to certain products, notably travel insurance (58%).

The other trend evident in the research is the pandemic reshaping consumer perceptions of risk, and consequently protection needs. Confidence in financial stability has clearly been shaken, with over half the respondents worried about future salary cuts. Despite progress with vaccinations, the threat posed by emerging variants remains front of mind as the region reopens, with just under a third of respondents citing catching the virus on their commute as their top concern.

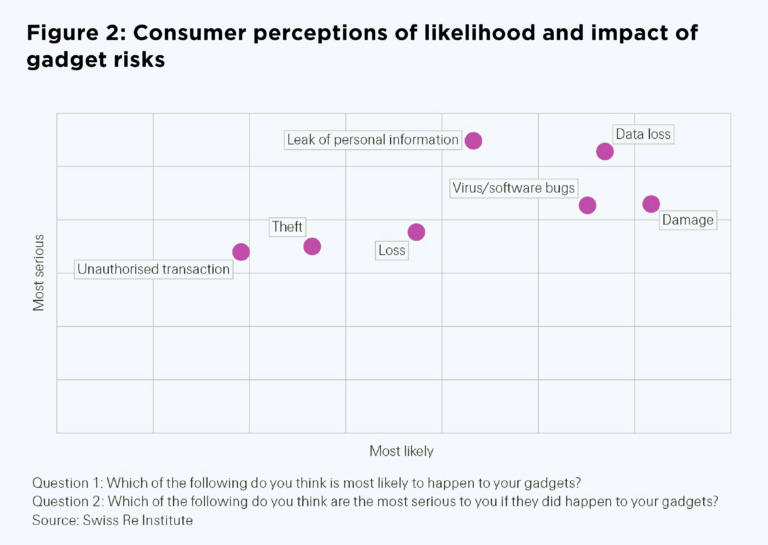

The shift online has also heightened awareness of technology-related threats, with more consumers seeking protection from cyber-attacks and misuse of digital payments, and insurance against the theft, loss or damage of digital gadgets.

All told, we estimate the digital P&C personal lines market in South and Southeast Asia will reach a cumulative US$7.5 billion in premiums over the next five years. And when it comes to the digitalisation of our industry, this is just the tip of the iceberg. Technology is underpinning growth and product innovation across the board, whether in property and casualty, where we’ve developed CatNet® toprovide swift overviews and assessments of natural hazard exposures; or life and health insurance, where with data from wearable devices, we can construct an accurate picture of a customer’s ‘biological’ age and personalise premiums to match.

Dangers in the rush to digital

No doubt there’s much progress to celebrate, and much more to look forward to. Yet I’m also cautious that in all the excitement around innovation and digital possibilities, we can’t lose sight of what’s really important – which is not technology, but the customer.

There’s a massive focus now on building a pure digital proposition that allows for all customer interactions to take place virtually, which would have clear benefits in terms of economies of scale and extending insurers’ reach. In one recent global poll of insurance CEOs by KPMG, 85% said the pandemic had accelerated the digitalisation of their operations and operating models, while 78% said that it had “turbocharged” progress on the creation of a seamless digital customer experience.

This is a remarkable transformation. But as (re)insurers kick their digital strategies into high gear, I’m also cautious about how digitalisation is sometimes presented as a standalone – or the only – option. The kind of advice and guidance needed by someone who’s considering health insurance for the first time; a couple who have just had their first child; or even a business trying to assess the vulnerability of its supply chain to natural disasters, can’t be adequately provided by an AI system or a digital avatar, no matter how sophisticated. Situations like these call for human expertise and reassurance. And in the business of financial protection, they arise all the time.

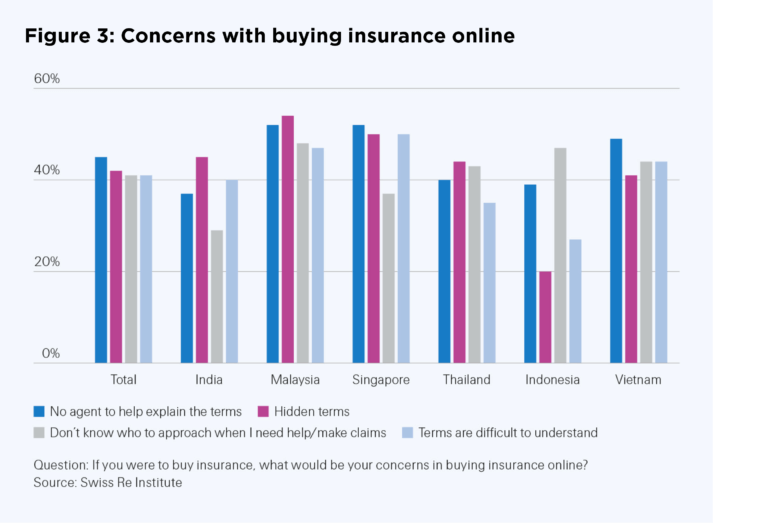

Our research indicates customers feel the same way, with just over 40% of respondents to our survey suggesting a lack of human contact to help explain products or terms would deter them from switching to digital insurance platforms. I’d argue then that what we really need to encourage insurance adoption, and address this region’s still vast protection gap, is a different kind of ‘killer app.’

Making the right investments

The answer is a hybrid, human/digital approach that leverages the speed, efficiency and data-derived intelligence made possible by technology, while leaving room for the empathy, good judgement and exceptional service experience that only human professionals can create.

Rather than having technology take over all aspects of the customer journey, we should apply technology to identify the best times for a human agent to step in. Examples would be when a new insurance need is identified or a complex query received. We should match investments in technology with investments in our human workforce, ensuring our people are carefully and continuously educated, and that we’re fostering stable, sustainable teams that are more than capable of supporting long-term customer relationships.

It’s encouraging to see some companies already taking steps in this direction. For our part, we’ll continue to invest in technology that automates or accelerates optimal parts of the customer journey, such as solutions for underwriting, which too often is still an onerous and time-consuming process. We will also redouble efforts to provide comprehensive technical training to our clients, their trainers and salesforces.

As Swiss Re’s Asia CEO, I will also advocate this ‘best of both worlds’ approach in our dialogues with regulators and customers, and I look forward to further exploring the hybrid model through active conversations with my industry peers in important forums like the SIRC. My hope is to see us advance not just as individual organisations, but as an industry, leaving us better equipped to meet the protection needs of a rapidly developing region at a critical juncture.

Russell Higginbotham

CEO Reinsurance Asia and

Regional President Asia, Swiss Re

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital