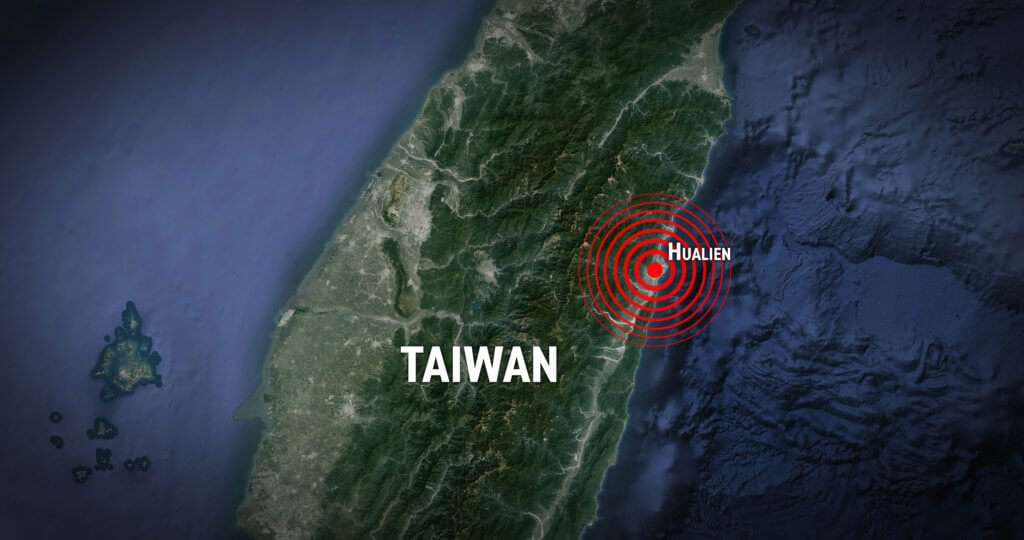

Tragedy struck Taiwan in April when a 7.4 magnitude earthquake hit Hualien, the strongest in decades. In addition to the devastating loss of life, impacts were felt throughout the region with billions of dollars’ worth of damage to property and businesses. The Sedgwick Asia team handled many of the catastrophic event loss (CAT) claims and once again saw the critical role experience plays in preparing partners and policyholders to respond to major loss.

CAT events like the Taiwan earthquake are a significant test for insurers and reinsurers, which can receive up to tens of thousands of claims for a single event. When lives, businesses and communities are at stake, their ability to quickly manage claims, expedite restoration, and reach a settlement is essential.

With decades of experience handling CAT losses, Sedgwick advises that those with a protocol in place before these events occur are more likely to succeed. This efficiency benefits stakeholders, both partners and policyholders, and translates into enhanced brand protection for businesses affected by a loss event.

To prepare for success, it’s helpful to view CAT response strategies in three phases: continuous preparation before an event happens, expediting the plan when an event occurs and finally, learning from the event and refining processes afterwards.

Pre-CAT phase: Before loss occurs

It’s critical to use the time during the pre-CAT phase to establish processes for a surge in claims administration as well as engage and educate partners and policyholders to enhance their ability to prepare their claims.

Internally, insurers and reinsurers need to put in place clear, global-ready strategies for mobilizing CAT adjusters. That may include establishing contingency plans that leverage freelance support when there is a surge in need. Years of experience coordinating CAT response teams around the world have taught us that having ready-to-deploy teams with approved documentation and credentials makes a difference for victims of catastrophic events. Advance preparation gets expert help into the field sooner.

The Major & Complex Loss (MCL) team at Sedgwick leverages a pre-CAT planning framework as its guide for planning during this period. At its core, the framework encourages collaboration with insurers and reinsurance teams to plan exactly what they’re going to do when a CAT event happens.

Finally, it’s critical to establish ways for policyholders to easily submit claims. From real-time updates about anticipated CAT events to proactive notifications to policyholders about how to quickly and easily notify damage and losses, technology tools make the process of notifying claims more seamless for policyholders. Sedgwick is exploring new ways to help policyholders prepare, including streamlined QR code notifications that connect directly to Sedgwick’s claim intake platform, Smart.ly.

As an industry, a greater focus is needed on pre-loss preparation – all too often, policyholders are caught off-guard during a CAT event. Insurers’ strong support through the unexpected starts with dedicated pre-loss steps.

The loss phase: When a CAT event occurs

When a CAT event hits and losses occur, providing care to claimants, processing and settling claims quickly, and restoring property to pre-loss conditions is the ultimate goal for insurers. Adjusters have to work around multiple variables – dangerous conditions, widespread damage, the need for specialist insurance services such as forensic accounting – which extend the duration of a claim.

With the breadth of technology tools available to adjusters today, claimants can get support faster, claims are managed more smoothly, and insurers can settle the claims more quickly.

At Sedgwick, our ecosystem of digital tools makes quick assistance more accessible for every stakeholder involved in CAT claims. During the loss phase, it may be dangerous for adjusters to physically access or safely review the damaged property in-person. This is where Sedgwick leverages Clarity Connect, a tool that facilitates remote site visits and assesses loss damage, to capture valuable claim data safely and begin the adjusting process sooner.

Insurers and reinsurers keep a close eye on the total claims reserve for the event. Both groups benefit immensely from real-time updates about the status of claims in-progress. This is where technology such as ViaOne helps to provide more transparency by offering near real-time updates about the claims. With this information, it’s easier for them to align their cash flow requirements with their obligations.

The post-loss phase: Putting data to work

After an event, when all claims have been processed and settled, insurers and reinsurers have a valuable opportunity to use the newly received claims data to refine their existing risk models. This allows them to price their premiums more accurately and improve their ability to foresee future CAT events and how they can improve their response.

In addition to making use of data, the post-loss phase gives insurers and reinsurers a chance to reset and engage their processes. Sedgwick encourages organizations to make the most of the moments before major events to once again evaluate and refine their protocols and tools across the three phases of a CAT event.

This ongoing process of preparation, response and evaluation is part of a broader effort insurers need to continue improving as an industry. This involves educating stakeholders, as well as policyholders, so no party gets caught unprepared. Because in the end, as with any risk, it’s not a matter of “if” but a matter of “when” a catastrophic loss – the next typhoon, earthquake, or flood event – will happen.

|

Irwin Wei

Data & Digital Solutions Manager for Asia, Sedgwick |

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital