Technological advances are providing the ability to deliver flexible, real-time analytics that are a game-changer for the way businesses understand and respond to risk.

Vivek Bajaj joined RMS in September 2019. Having spent more than 20 years facilitating technological transformation in the financial services sector working at both IBM and Microsoft, the risk modelling sector was an environment he saw as charged with transformational potential. One year on, he talks about a market in transition driven by necessity.

What motivated you to enter the risk modelling arena and take up the role at RMS?

It’s an interesting question. I have been attracted to this intersection between technology and financial institutions, and in my career I have been fortunate to work with several major financial sector players to help drive their technological transformation. Every business is different, but my experience has focused on areas such as advanced analytics, AI and data transformation.

The opportunity to work at RMS was exciting. The transformation of the risk management sector is already well underway and, again, how does technology, capital and modelling science, among other factors, mix together to lead to better outcomes? As RMS has stated, we are, or seem to be, living in a world of constant catastrophes, which need to be understood, managed and protected against. It was clear to me that the relevance of risk modelling is only going to increase — look at the frequency and intensity of natural perils, huge systemic risks posed by events such as the Covid-19 pandemic, the growing threat of cyber and terrorism, and the rapid emergence of new exposures. RMS helps businesses not only address but accommodate these risks and move forward, rather than being overcome by them. That role will only become more business critical as we push ahead.

With your career focus on technological transformation, where would you say the (re)insurance industry is on this journey?

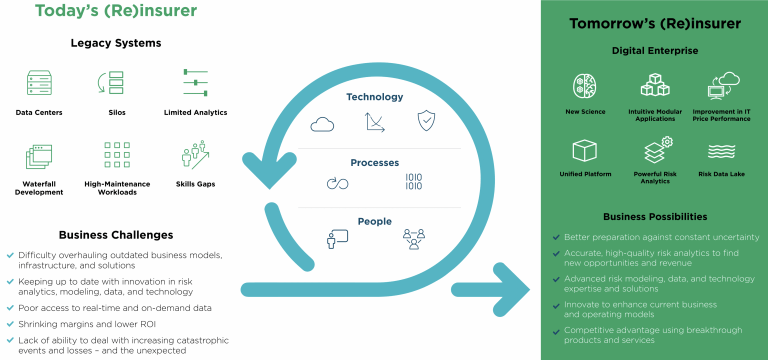

Transformation is necessary. Risk is dynamic and the industry recognises that how you address risk must also be dynamic. For some time, the standard approach has been to use models for certain risks which are modelled periodically to establish frequency and loss potential, and based on that adjust business plans accordingly.

That cannot be the standard moving forward. The industry needs, and is increasingly demanding, the ability to analyse an ever-changing risk environment.

Simultaneously, there has been a market-wide shift in how technology is viewed. This is not only in terms of the analytics, capacity and workflow efficiency potential it offers, but also in that the days of maintaining a large in-house data and IT infrastructure are becoming numbered. Software-as-a-service capabilities and cloud-based computing provide the scale and agility to approach risk analysis in a much more dynamic way, and the industry sees this.

What has your experience shown in terms of the risks associated with technological transformation?

As the industry transitions to a more agile, technology-based approach, there is the risk that businesses will become dazzled and distracted by these shiny new technologies. In the banking industry, for example, there was a period when many large institutions were building their own AI labs before they had really established the business rationale. It was very much a case of building a solution and then trying to find a problem.

Any approach to technological transformation must begin with a clear understanding of the business objective. The technology is the facilitator and enabler, not the driver. Establish your business goals and then address the combination and balance of these systems and capabilities required to achieve them.

At RMS, we are delivering an open-standard platform environment that offers next-generation functionality, such as the ability to dynamically analyse risks at much greater data granularity, but it is fully flexible to allow businesses to adopt new technology and applications when appropriate to the scale of the business challenge that they are addressing.

For example, RMS Risk Intelligence provides an open, modular, unified and highly reliable cloud platform that supports advanced modelling, deeper risk insights and analytics. It delivers both higher performance and scale, with no hardware or software to maintain, so helping to reduce cost of ownership. Risk Modeler 2.0, which sits on the platform, enables real-time risk analytics while also offering in-built flexibility.

To what extent are model and platform advances facilitating a more responsive marketplace?

If you look at recent renewals in the Asia market, you have seen how the rate environment has responded quickly to significant market losses. Japan has experienced four major typhoon events in the space of two years, with Trami, Jebi, Faxai and Hagibis significantly impacting the market.

There have been multiple lessons learned from these events, such as new insights on post-event loss amplification and the impact of fluvial flooding across the region. RMS responded quickly and we have recently made available our latest Japan Typhoon and Flood HD Model that incorporates new insights from these recent events.

What the industry response has shown here is essentially the ability to adjust to new data and learning from events, and address market dynamics quickly to reflect that. That responsiveness is only really possible where you have higher levels of data granularity and the ability to analyse data at a speed much closer to real time.

At a broader level, our industry is looking to position itself to integrate new or evolving exposure categories into its view of risk in a much more agile way. If you look at cyber, it is evolving to become a mainstream peril and companies are leveraging model capabilities to address critical issues such as silent cyber and risk accumulation. And the more that models are used, the more enriched the data environment becomes and, in turn, our ability to respond.

How important is that greater industry collaboration in how we evolve our approach to risk?

Sharing, collaborating and integrating different perspectives and views of risk will have to become the order of the day for our industry. But we have to recognise the dynamics of a competitive marketplace and the barriers that that creates in terms of the willingness to exchanging information and approaches.

At RMS, we are increasingly seeing our role as being a facilitator for industry interaction. For example, through RMS Risk Intelligence, we have created an open standard platform that can support models other than our own and enables our clients to process those multiple perspectives to reach a better understanding of risk.

Our approach to standards and the development and launch of the Risk Data Open Standard also reflects that facilitating role. Our goal and that of the many global participants in this standard is to support the efficient exchange of exposure information at the industry level — effectively creating a standard that enables the communication of multiple risk perspectives. In many ways, RDOS is the language while Risk Intelligence is the forum that facilitates the discussion.

As we look to emerge from the Covid-19 pandemic, we all recognise that another potential issue of similar global scale could be on the horizon — from cyber, terrorism or another peril. Whatever the root cause, we must be prepared to respond — and key to that preparation will be our willingness and ability to communicate effectively as an industry across all categories of risk.

Vivek Bajaj

Managing Director, Continental Europe & Asia-Pacific

[email protected]

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital