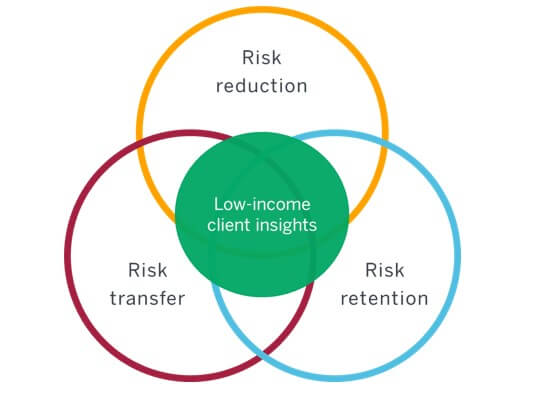

At the MicroInsurance Centre at Milliman (MIC@M), we believe insurance is one component of a broader risk management approach that is necessary for low-income populations to successfully manage their financial risks. We call our approach Risk Management 360 (RM360). This approach to individual-level risk management provides a holistic solution to risks faced by low-income customers. In practice, RM360 requires that a broad lens be used to explore potential solutions (financial and non-financial) to design a risk management blanket that helps low-income customers reduce risk (through prevention, preparation and adaptation) while preparing them to better retain risk (through financial and non-financial means) and transfer risk (through insurance) as the last recourse.

While insurance is core to managing risks, we recognise that our low-income customers, like the rest of us, would rather avoid a risk event from happening in the first place (e.g., a cow dying or a daughter contracting dengue fever) than just relying on a good insurance cover to pay after the event. Insurers also benefit from this approach because fewer risk events mean fewer claims. This, in turn, could translate into further benefits for customers in the form of lower premiums—that’s a win-win situation. Let’s look at an example of a livestock insurance cover, which in its basic form would offer the dairy farmer a fixed amount of money if her cow died. While that’s great, the farmer would prefer her cow staying alive and healthy over receiving a limited sum of money. If an insurer wanted to design a solution based on the RM360 approach, they could offer the insurance product (risk transfer) along with a “Call-a-vet” service (risk reduction) to offer immediate medical assistance in case of emergencies and/or better feed (risk reduction) to keep the cows healthy and provide more milk. They could also offer an emergency loan service (risk retention) to help in exigencies. This holistic approach would help and encourage the farmer to keep her cows healthy and get immediate medical help, which would reduce incidence of deaths. This, in turn, would be beneficial to both the dairy farmer and the insurance company.

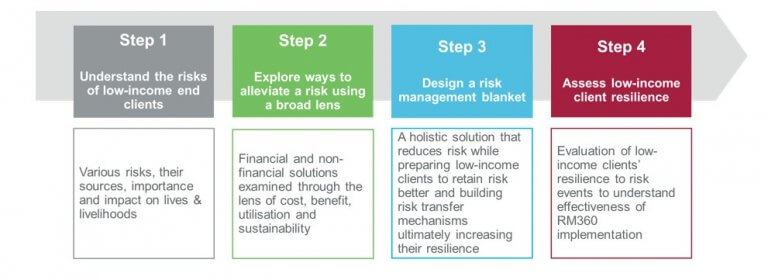

The first step of putting RM360 into practice is to understand the needs of customers, the risks they face, the impact on their lives of these risk events, the coping mechanisms they employ and their experience and perceptions of the effectiveness and additional burdens resulting from those efforts, including from insurance. Nothing can replace talking to customers and yet so few solutions are designed taking into account comprehensive client insights.

The second step in applying an RM360 framework would be to explore a wide variety of solutions, financial and non-financial, to alleviate the risk faced by a client. Thinking broadly and outside of financial solutions alone is critical at this stage because the client may not be aware or interested in the fact that an insurer can or will provide an effective formal risk transfer solution, for example. She is looking for the best possible solution or bouquet of solutions that meet her family’s needs. She will examine the various solutions by asking:

- Can I afford this?

- Is it worth my money?

- Will we actually use it?

- Will it sustain or benefit us in the long run?

- Do I trust it?

The third step, based again on client feedback, would be to design a risk management blanket, consisting of the financial and non-financial solutions that the client found valuable based on the above five criteria. A holistic solution is one that helps the client reduce her family’s risk while preparing her to better retain risk and build risk transfer mechanisms, ultimately increasing resilience to risk events.

The last step of the RM360 framework is to evaluate the effectiveness of solutions implemented in order to understand their long-term impact on low-income clients, i.e., did they contribute to making them resilient to the risk events they were tailored for?

Let’s see examples of insurers applying the RM360 framework. When the incidence of dengue increased drastically in the Philippines some years ago, Pioneer Insurance Company saw a need to cover their clients against the disease, which often led to long periods of hospitalisation and absence from work. Based on client insights, they designed a SUAVE[1] product that covered dengue fever and had a very easy claims process. The customer needed only to send their medical certificate and lab results on Viber or WhatsApp and their claim would be paid. In order to make the intangible offering more relevant to their clients, they partnered with a skin care company and offered a can of mosquito repellent with every dengue insurance policy. Conversely, customers who bought at least four mosquito repellent spray bottles from the skin care company received a free dengue insurance cover. The mosquito repellent reduced the risk of contracting dengue and the insurance cover was a back-up in case prevention did not work.

Another notable RM360 example is the Nibedita product from Green Delta Insurance in Bangladesh. What makes Nibedita unique is that besides coverage against accidents, the product provides a trauma allowance in case of rape, road bullying incidents, robbery and acid attacks. Additionally, women with Nibedita policy can also avail themselves of various services in the field of health, legal service, capacity building, lifestyle, counselling, financial service, travel service, etc. The main idea behind Nibedita is that women’s empowerment is a prerequisite for socioeconomic development of a country. Bangladesh, a lower middle-income country with a consistently growing economy, has seen a sharp rise in women participating in all spheres of public life. As a result, issues such as gender equality and women’s empowerment, amongst others, are widely discussed. This was the driver behind Nibedita’s aim to cater to the needs of women and to make them more independent and able to manage the unique risks that they and their families face.

This article was written by Indira Gopalakrishna, a microinsurance specialist, Asia Pacific at Milliman.

Watch the upcoming three-part vodcast series ‘360 Degree Perspectives’ on InsuranceAsia News, where Michael J. McCord, principal and managing director of the MicroInsurance Centre at Milliman, will be speaking about RM360 in practise and sharing thoughts with Bert Opdebeeck, the founder of the Microinsurance Master, Lorenzo Chan, president and CEO of Pioneer Life and the Retail Organization & Digital Transformation Head of the Pioneer Group, and Farzanah Chowdhury, managing director and CEO of Green Delta Insurance.

[1]SUAVE stands for Simple, Understood, Accessible, Valuable and Efficient. It is a concept of the MicroInsurance Centre at Milliman.

-

AI: Complexity mismatch amid the case for augmenting the investment office

- January 21

With prudent oversight and strong guardrails, an augmented investment office can allow insurers to confidently ride the private credit boom without being undermined by the complexity they have embraced.

-

Marine: Amid backlogs and breakdowns, Covid-19 maintenance delays put vessel safety at risk

- December 9

Asia is at the sharp end of a hidden maritime risk, with post-pandemic machinery-related losses becoming an even more significant issue.

-

W&I: Balancing growth, commerciality and sustainability in Asia Pacific’s W&I market

- November 6

Warranty and indemnity (W&I) insurance is now being utilised with increasing frequency across a far broader range of deal sizes and geographies in the region.

-

Nuclear: Insurance sector’s role in the region’s nuclear renaissance

- October 21

The biggest driver of nuclear expansion in Asia is the massive increase in power demand from data centres, while the real transformation will be driven by small modular reactor technology.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital

Indira Gopalakrishna, Milliman

Risk Management 360: A holistic approach to help low-income customers manage risks

Indira Gopalakrishna, Milliman