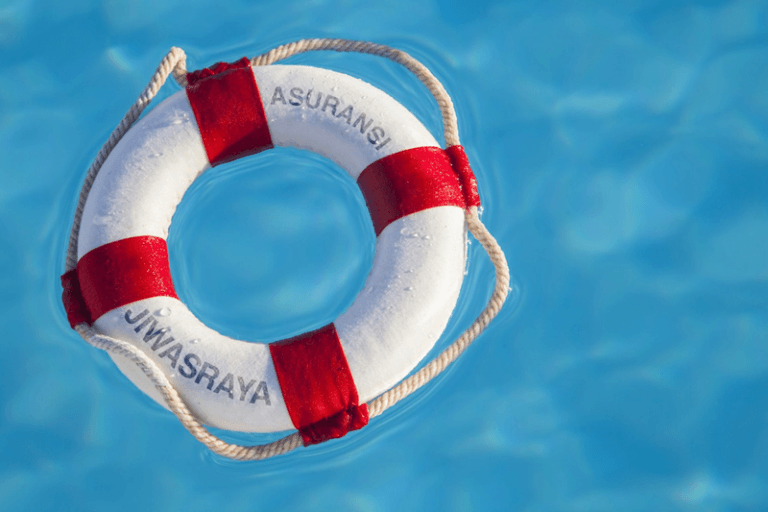

Rescuing Jiwasraya

January 31 2020 by Nick Ferguson-

Reinsurance market grapples with geopolitical risks amid renewals shift

- July 9

There is an acceleration in reinsurance rate reductions across the globe, but the question it raises is whether the softening will cool off, according to panellists at the reinsurance webinar co-hosted by IAN and Fitch Ratings last week.

-

Financial lines rate reduction should bottom out as potential large losses loom: Frontier Global’s Joel Pridmore

- July 8

Sector faces significant challenges, including major litigation such as class actions, regulatory scrutiny of Australian superannuation funds, cyber events, greenwashing, and the risk of under-reserving.

-

Qantas cyber breach to create turbulence for insureds and insurers, but losses could fly under the radar

- July 4

AIG-led cyber program placed by Marsh is unlikely to be significantly hit, industry sources told InsuranceAsia News.

-

Regional risk concerns for ‘fourth utility’ as data centres seek answers to perils threat

- July 3

Threat of cyber attack or system failure has been a focus for risk management systems, but physical risks, such as natural disasters, power failures and physical security risks, are often less understood.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.