Analysis Page 21 / 77

-

- October 27 2023

Australian carriers brace for claims as deadly bushfires rage across New South Wales, Queensland

With over 100 fires burning, several dead, homes burned down and thousands of hectares of land destroyed, it is being described as the worst fire season since the 2019-20 black summer.

-

- October 26 2023

Hong Kong speeds up US$1bn of drainage improvements in climate resilience move

John Lee, the SAR's chief executive, said the city will step up disaster preparedness, including a review of transport and drainage works.

-

- October 25 2023

Accidents and increased heat put pressure on Hong Kong’s construction market

With one construction firm being put on a building blacklist and a summer of record heat, some market players are calling for stronger regulations.

-

- October 20 2023

Record heat in 2023 spurs myriad APAC nat cat losses

15% of insured nat cat losses so far this year have been in Asia, with yet another US$100bn-plus loss year in the making, says Gallagher Re.

-

- October 19 2023

India dam collapse claims’ burden on carriers may be lower due to glacial lake outburst rider

Early reports by the National Disaster Management Agency say the event was likely a GLOF, for which claims payable are capped at US$60m per any one accident.

-

- October 13 2023

Asian aviation, marine markets react to war risk peril as Israel conflict breaks out

A senior market source tells IAN that airlines are unlikely to be able to gain cover as Israeli government steps in with US$6bn to support home carriers.

-

- October 12 2023

IAG’s Hunter Hailstorm loss creep to squeeze H1 margins

Reinstatement costs of US$45m also to hit performance, as IAG's CEO laments a "substantial and sustained reduction" in reinsurance global capacity.

-

- October 11 2023

Parametric expansion to help cover niche APAC risks

Insurers need to quickly adapt index-based products to climate change using data analytics and technology to support client needs.

-

- October 10 2023

Hong Kong’s record rainstorms put focus on ‘overlooked’ water damage risks

Property and construction firms should prioritise protection from water, which causes more than half of all damage in the SAR, say leaders from Zurich and Lockton.

-

- October 9 2023

Exclusive: (Re)insurers staring at US$2bn+ losses from India’s Himalayan dam collapse, flood damage

An IFFCO Tokio-led panel of eight insurers have a US$1.37bn property damage and BI policy for the 1,200MW Teesta-III project that was completely damaged in a flash flood, show documents reviewed by IAN.

-

- October 6 2023

Asian EV insurance market revving for expansion beyond China

As electric vehicle manufacturing, ownership and charging infrastructure grow rapidly around the region, carriers are rolling out tailored products.

-

- October 5 2023

Asia fossil fuel risks grow in reliance on captives, smaller players and MGAs

With larger players shying away from coal cover, miners are turning to self-insurance and specialists, while oil and gas is still supported.

-

- October 4 2023

Lack of aggregate cover brings earnings volatility to APAC carriers

As rates soar, insurers are retaining more nat cat risk on their books, with the situation set to continue into the 2024 renewals.

-

- October 2 2023

Australia’s GI brokers saw 11.4% increase in H1 GWP

The broking sector, which continues its consolidation trend, controlled US$11.9bn of premiums, according to APRA data.

-

- September 27 2023

Mega cargo vessels present growing claims issues for Asia ports

Cargo from larger ships is exposed to potentially higher risks by staying in ports longer, increasing the prospect of claims in relation to theft, delays in delivery, flooding, defrosting and container damage.

-

- September 26 2023

APAC carriers’ coal jitters sees excess capacity shift to renewables, gas

Regional (re)insurers are replacing ESG-hit premiums by increasing business from greener energy projects, potentially driving down rates.

-

- September 25 2023

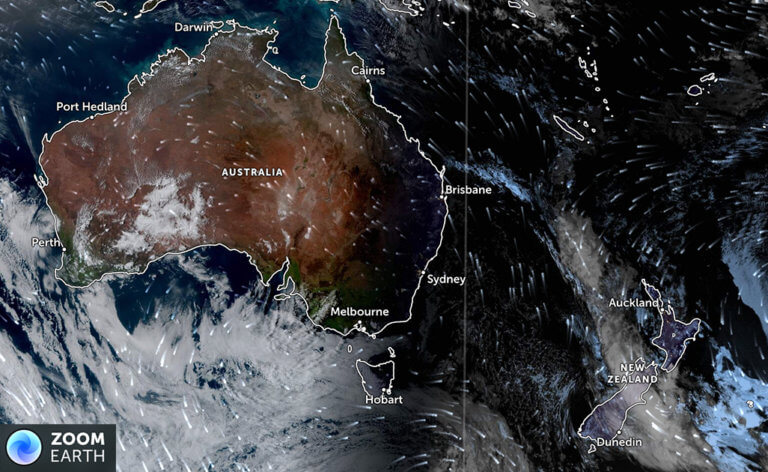

Ominous start to spring weather in Australia, New Zealand puts (re)insurers on high alert

Bushfires, an El Niño declaration, record rain, landslides, heavy snow and an earthquake in the last few days point to busy six months ahead for claims' handlers.

-

- September 21 2023

China-Taiwan woes put pressure on marine (re)insurance market

Lack of data for accumulation risks and unavailability of a maximum loss scenario are real concerns for the shipping sector, says IUMI president Frédéric Denèfle.

-

- September 20 2023

CIB’s chairman Alex Yip eyes GBA opportunities for Hong Kong’s specialty market

Since transitioning away from being a self-regulatory body, the Confederation of Insurance Brokers is focusing on redeveloping the city as a ‘key hub’ for the Asian (re)insurance sector.

-

- September 19 2023

What explains Singapore’s quiet broker M&A market?

While there has been some activity around the fringes over the last 12 months, organic growth appears more attractive.