Underwriting performance of P&I clubs likely to fall in FY25: AM Best

February 20 2025 by InsuranceAsia News-

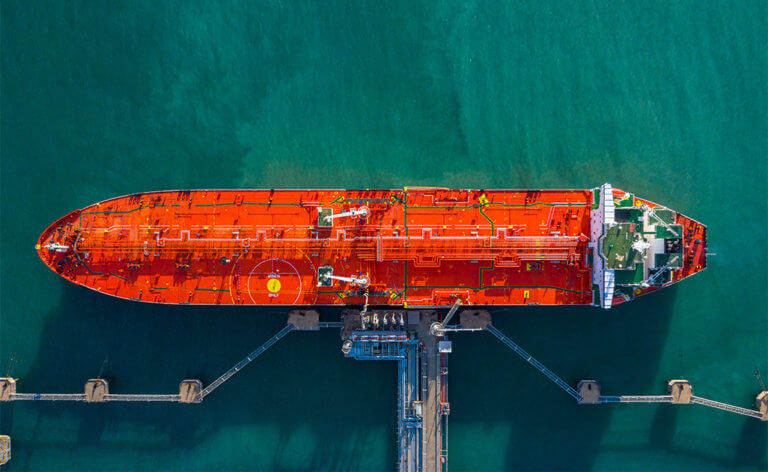

‘Positive and progressing well’: P&I renewals slow and steady amid moderate increases, member loyalty

- February 12

Skuld, Shipowners' Club, Steamship Mutual, Britannia P&I Club and West P&I speak to InsuranceAsia News ahead of the 2026 renewals.

-

Hannover Re grows APAC premiums 2% at 1.1 despite broadening market terms, pockets of weak pricing

- February 6

While 1.4 renewals will likely similar momentum, market will be mindful of last year's acceleration in rate reduction, executive board member for P&C Sven Althoff tells InsuranceAsia News.

-

Scor reports 7.4% growth in P&C premiums at 1.1 renewals, driven by APAC, North America

- February 5

Total traditional reinsurance estimated gross premium income increased by 4.7% to US$5.3bn during the recent renewals.

-

Cyber aggregate XoL rates slump 32% at 1.1 renewals: Gallagher Re

- February 2

Buyers have benefited from improvements in structural terms as well as pricing due to an oversupply of capacity.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital