Peak Re | Unlock the potential of South-East Asia insurance markets

September 6 2023

South-East Asia is a land of vibrant growth but also comprises a mix of economies at different stages of development. Collectively, the region has managed an impressive growth of 4.4% per annum since 2010, well above advanced markets’ trend growth of 1.8%.

South-East Asia is home to 600 million people with an annual output of US$2.3 trillion, roughly 8-9% of the world’s total. Yet, significant divergence exists. For instance, per capita GDP was high in Singapore at over US$80,000, but only around US$2,000 in Laos, Cambodia or Myanmar.

The region is under-represented in insurance terms. Total gross written premiums of Asean (as a close proxy of South-East Asia) amounted to an estimated US$92 billion in 2022, equivalent to just 1.7% of the global total.

Un-insurance and under-insurance are manifested in many regional markets’ low insurance penetration and density. Nonetheless, strong economic growth over the past decades has supported a rapid expansion of the region’s insurance sector, albeit from a low base. Since 2010, total insurance premiums have increased by an estimated annual (nominal) rate of 8.1%.

The region’s insurance market landscape is governed by a wide range of regulatory regimes with different levels of foreign participation. Yet, the markets are highly vibrant, with traditional insurance supplemented by alternative models like private-public partnerships, microinsurance and takaful insurance.

Positive growth drivers abound

Multiple positive growth drivers underpin optimism about the insurance outlook of South-East Asia:

Socioeconomic factors

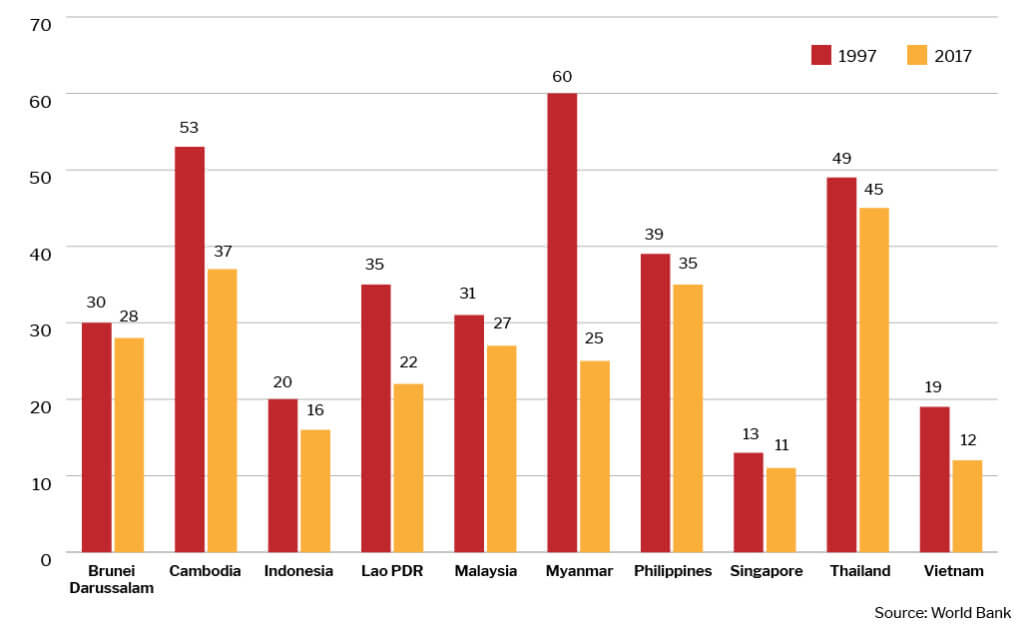

A relatively young demographic with a large emerging middle class, rapid urbanisation creates more insurance opportunities and increasing insurability of SMEs partly due to the formalisation of the informal economy (see figure 1).

Policies and regulations

Increasingly sophisticated regulations including solvency and capital regimes, convergence towards principle-based and international best practices, and other favourable regulatory treatments (such as simplified business registration, increasing foreign access and insurance incentives).

Development policies

Participation in free-trade agreements (FTA, e.g. Asean Economic Community, RCEP) that increasingly take into scope trade in services.

Technology

Accelerating digitalisation and the rise of ecosystems opening up many new insurance opportunities (both in terms of products and distribution), and open insurance is getting more attention.

Sustainability. Product innovation to align with ESG principles and expectations of the region’s young population.

Figure 1: Estimates of informal output (% of official GDP)

Source: World Bank, https://www.worldbank.org/en/research/brief/informal-economy-database

Among the various positive factors, it is worthwhile to highlight the following three trends.

Distribution innovation

A number of factors are converging to facilitate the rise of new and innovative ways to distribute insurance in South-East Asia. First is the increasing digitalisation of the region and a higher propensity for emerging consumers to shop online. Second is the proliferation of digital ecosystems, which are increasingly tailored to the needs of consumers. Last but not least, reducing regulatory barriers that make it more viable to bundle insurance with ecosystems through digital channels.

There are many offshoots to this phenomenon. For example, embedded insurance has seen rapid development in many regional markets. Embedded insurance integrates complementary insurance products into the digital journey of consumers. It could be an add-on proposition or a bundled offer with the core product. Some estimates suggest that embedded insurance in Asia could grow to become a US$270 billion market by 2030.[1]

There is no doubt that traditional channels will remain relevant. Still, opportunities relating to digitalisation, the proliferation of ecosystems, and focusing on the needs of consumers will take on an increasingly significant role in helping to deepen insurance penetration in the region.

Middle class

According to the Asia Development Bank, the size of the middle class in Asean was around 190 million in 2020.[2]This rising segment of society is bullish about its future, though it also features significant protection gaps, particularly with a large population being informally employed.

The International Labour Organization estimates that over 240 million people in Asean are in informal employment (which includes own-account workers and family workers). This represents over 70% of the region’s workforce aged 15 and older.[3] These informally employed persons may not have access to social insurance, including healthcare, maternity benefits, assistance in cases of unemployment, work-related injury, disability and sickness, as well as pensions.

Tapping into the potential of this rising middle class requires an in-depth understanding of regional differences. For example, a study by Peak Re shows that while around one-third of the middle class in Malaysia, Thailand, and Vietnam expect themselves to move upwards within the socioeconomic hierarchy over the next five years, the ratio was significantly higher at two-thirds in Indonesia.[4]

Around half of the middle-class respondents in the Philippines aspired to become an entrepreneur or own a business. The ratio was closer to 20% in Malaysia and Vietnam.

Frontier markets

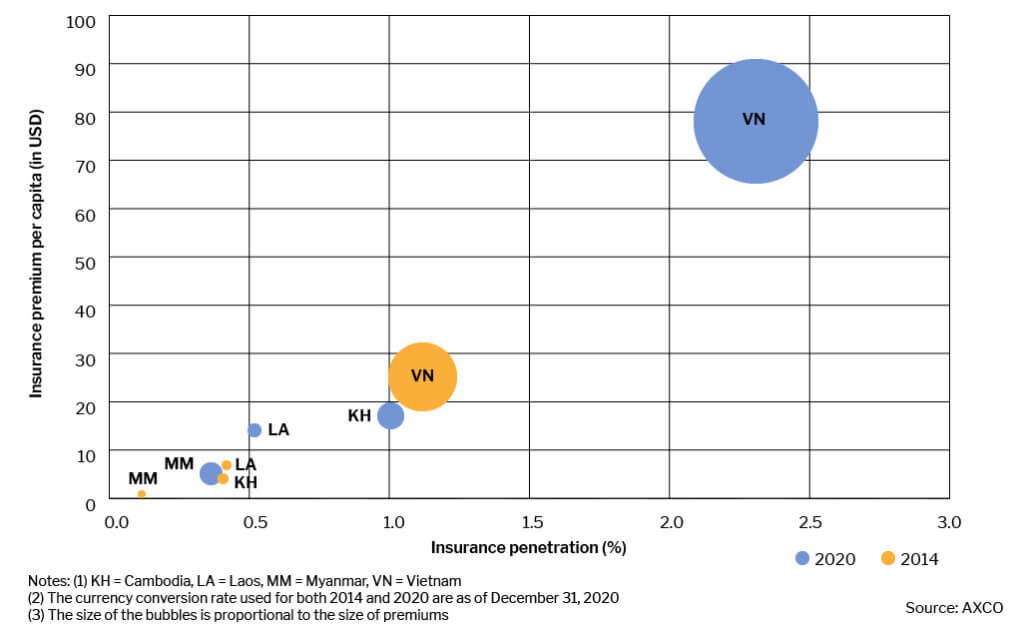

Within the scope of South-East Asia or ASEAN, much of the attention has been focused on the larger insurance markets of Indonesia, Malaysia, Thailand and the Philippines. Beyond these traditional emerging markets, the less-established insurance markets in smaller emerging economies are also showing promising growth (see figure 2).

The countries commonly referred to as CLMV – Cambodia, Laos, Myanmar and Vietnam – could be meaningful sources of future insurance growth. Some of them have shown persistent solid economic growth over the past years. Regulatory barriers are being dismantled, and they can easily benefit from a shorter learning curve than other emerging markets or their peers in South-East Asia.

Figure 2: Insurance premiums, penetration and density in selected South-East Asian markets

Conclusion

Beyond the large Chinese and Indian insurance markets, South-East Asia remains an attractive, fast-evolving and dynamic marketplace for insurance. Increasingly, the focus of insurance growth is shifting towards inclusive and sustainable development that encompasses the commercialisation of different operating models. The integration of technologies is an important feature to enable greater touchpoints with customers (mainly middle-class households) and innovations like digital claims processing.

South-East Asia is a vast region with a diverse socioeconomic landscape. Tapping the opportunities would require perseverance as well as a deep understanding of the local market dynamics.

|

Clarence Wong

Chief Economist, Peak Re

Email: [email protected] |

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital