Next Jebi scale wind loss likely 20 years away: PartnerRe

February 17 2020 by Andrew Tjaardstra-

Australia’s East Coast hailstorm losses rise to US$1bn: Perils

- February 2

Updated estimate reflects higher claims after severe convective storms brought destructive hail and winds to the Australian states of Queensland, New South Wales and Victoria.

-

‘Hopeless’: observation-based models fall short as insurers comprehend modern flood risks

- January 28

Speaking on InsuranceAsia News’ Between the Lines podcast, Fathom COO and co-founder Andrew Smith says the arrival of next-generation global flood models could not be more timely amid climate change.

-

Bridging Asia’s protection gap key focus for Verisk, but data issue remains

- January 15

US-based data analytics and risk assessment firm has inland flood models for Japan, and has recently released flood models for Malaysia and Indonesia, with plans to introduce a hail model for Japan and flood models for New Zealand and Australia.

-

Late‑November storms to cost Australian insurers US$1.78bn: Perils

- January 8

Figure covers property and motor hull losses for the severe convective storms in Queensland and New South Wales between November 21 and 27.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

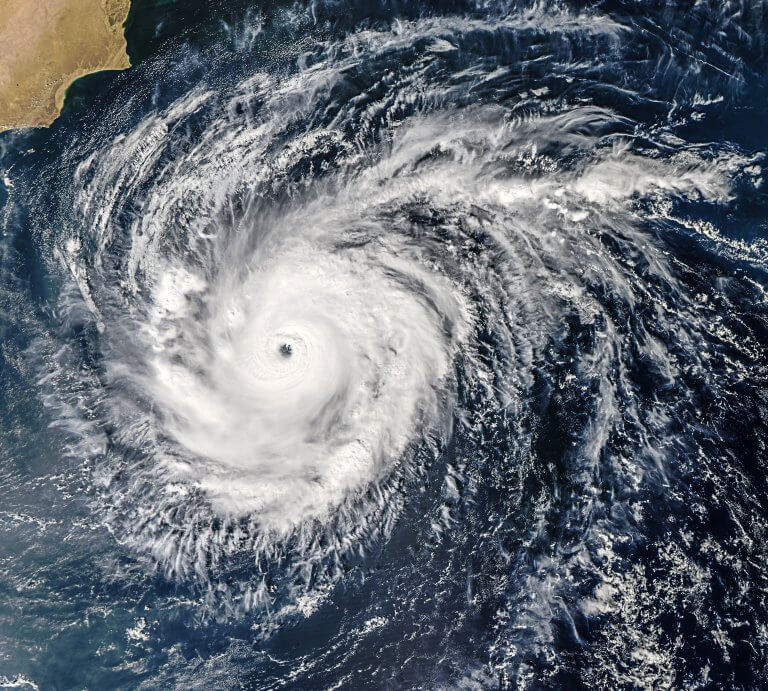

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital