Market raises concerns over Asia secondary perils pricing

January 18 2022 by Karen Lai

The failure of traditional models to properly take account of the expected losses arising from secondary perils may be putting increased pressure on underwriting results.

“In many cases [secondary perils have] resulted in losses that were higher than underwriters had anticipated. This can lead to under-pricing, especially in competitive markets where prices do not build in enough margin for error,” Mike Mitchell, head of property and specialty underwriting at Swiss Re, told InsuranceAsia News (IAN).

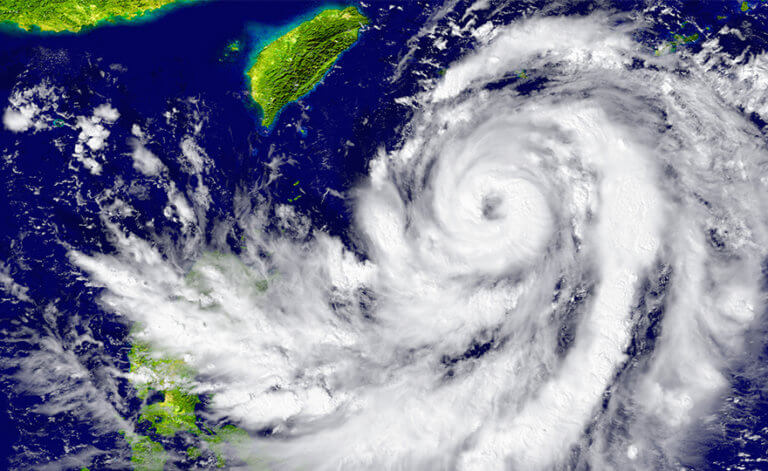

Secondary perils are those smaller events, that are caused by the impact of larger scale insurance claims. In recent years they have started to take on much greater prominence around the world — for example floods, wildfires and severe convective storms.

Mitchell explained that the three big types of catastrophes – earthquakes, tropical cyclones and winter storms – used to account for 80% of insured losses, whereas over the past decade this has shrunk to around half. In 2020, secondary perils accounted for 45% of worldwide nat cat losses, according to data from Swiss Re.

Models and data

Despite this, reinsurers say that nat cat models in Asia still focus too heavily on large-scale events.

“In the past insurance risk and pricing models haven't fully taken into consideration the probability of different secondary perils,” said a senior executive at one Asian reinsurer.

One problem with updating existing models is the lack of data availability in many Asian countries, especially in developing markets.

Insuring a building against damage, for example, often requires a high level of granular data – including the location of the building, estimated replacement value, size of the building, material that was used to build it and so forth.

“It's very difficult in many parts of [Asia] to get access to that level of data, both on the mapping and the physical landscape. That sort of data may not be publicly available or the exposure data may not be sufficient to run this sorts of analysis,” said Mitchell.

Markets with a low penetration of insurance tend to have poorer data, since there has not been the market need to improve data sets.

With rising urbanisation in many countries, and the imminent threat from climate change, things are likely to get worse. Last year's costly flooding in Henan, China is a powerful example.

“The losses that everyone is concerned about are only going to increase because the population and values at risk are increasing and the climate is changing,” said Michael Drayton, a consultant at RMS.

Price hikes?

Without efficient information and models, it is hard for (re)insurers to properly understand and price the risks that they are running.

One solution would be for (re)insurers to err on the side of caution and include an additional premium for those risks that they cannot adequately model.

“I think it's fair to say that process for nat cat risk do need to be regularly reviewed to keep pace with changes in exposure. This often implies prices need to increase,” said Mitchell.

But this carries with it the risk that, if an insurance policy costs too much, people may simply decide not to buy it – and insurance penetration will continue to remain small. Data from Swiss Re suggests that US$60 billion of uninsured nat cat losses are incurred in APAC each year.

“These things work in a cycle because nobody will have the confidence to offer the insurance if it's not well-modelled and the risk is not well-understood,” said Drayton.

Technology may be part of the solution. If technology can be used to reduce costs, this could lead to greater insurance penetration, which could in turn lead to improved data and more efficient models.

“There is the opportunity to improve business model efficiency and reduce the cost of selling insurance,” said Swiss Re’s Mitchell. “This can help close the profitability gap without undermining industry efforts to close the protection gap.”

Digital distribution and claims handling are two examples of where new opportunities for technology lies. “There's also room for simpler and more cost-effective insurance products to help improve affordability,” he added.

There is plenty of scope for improvement in modelling across the region -- which should help with greater insurance coverage and more robust profits.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.