Market braces for Nanmadol loss creep

September 23 2022 by Marcus Alcock-

Perils cuts Cyclone Alfred loss estimate to US$1.25bn

- September 12

Ex-Tropical Cyclone Afred struck Australia's Southeast Queensland and northeastern New South Wales in February and March, leaving over 300,000 homes and businesses without power.

-

Vietnam braces for Typhoon Kajiki, but losses set to be less than Yagi

- August 25

PVI Insurance chairman Duong Thanh Danh says the typhoon is forecast to hit areas that are less industrialised than those affected by Typhoon Yagi last year.

-

Vietnamese (re)insurers brace for Typhoon Wipha, Hong Kong facing US$255m bill

- July 21

Heavy rainfall and strong winds are expected across northern Vietnam, posing risks of flooding and damage, particularly in coastal areas.

-

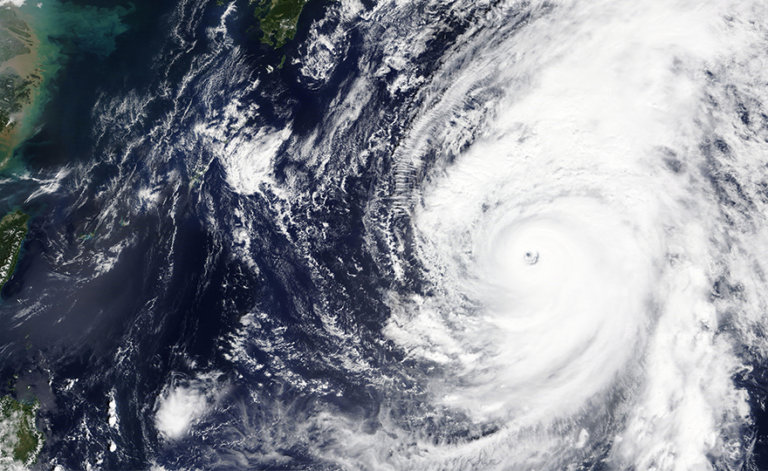

Typhoons predicted to match 30-year average, but more intense hurricane season likely: Munich Re

- May 30

In Northwest Pacific, an initial study estimates 25 named cyclones, 16 typhoons and nine severe typhoons in the highest 3–5 category in 2025.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital

-

BHSI WICare+ | Accelerating Payments, Empowering Recovery

Launched in cooperation with Steadfast’s Singapore network, WICare+ fills the gaps found in traditional coverage and keeps businesses and their workforce secure by covering up to SG$350,000 in medical expenses per claim.