Insurtech profile: Galileo Platforms

February 17 2021 by Andrew Tjaardstra

The InsuranceAsia News (IAN) insurtech profile series provides readers with exclusive insight into the digital disrupters changing the face of the industry across the region.

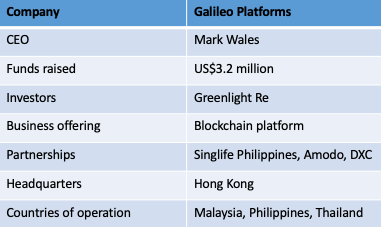

Founded in 2016, Galileo Platforms is a Hong Kong-headquartered insurtech focused on blockchain technology. IAN recently sat down with Galileo Platforms CEO Mark Wales to learn more about the company and its plans for the future.

The platform uses encrypted client and contract data that a distributor, insurer or reinsurer can use with permissioned access. It can also be used as a policy administration tool or as a front end for a legacy system to support digital distribution. The company places a strong emphasis on product innovation, transaction speed and data analytics.

Target customers include insurers looking to embrace the digital realm without a back-office policy admin system replacement, as well as those looking to tap new markets with new products, such as unbanked or underbanked customers in South-East Asia.

Target customers include insurers looking to embrace the digital realm without a back-office policy admin system replacement, as well as those looking to tap new markets with new products, such as unbanked or underbanked customers in South-East Asia.

The company also looks to connect e-commerce sites and “super apps” with (re)insurers with targeted products. It is predominantly focused on South-East Asia and the firm is already operational in Malaysia, the Philippines and Thailand. It has also had discussions with possible partners in Australia, Africa and Europe.

Partnerships and products

Galileo Platforms’ first insurance customer was Singlife Philippines.

GCash, the largest e-wallet in the Philippines, is the first distributor on the platform working with Singlife. Using Galileo’s cloud-based blockchain technology, the new Singlife Philippines service is aiming to reach a large and mostly untapped insurance market. With Singlife, it has launched products ranging from dengue fever and Covid-19 protection to income replacement, while more products are in the pipeline.

The firm recently announced a strategic partnership with Amodo, a provider of insurance telematics technology and advisory services, including behaviour data analysis. The partnership’s new insurance offerings will be available globally with the initial roll-out in Asia. One of the first offerings is personal accident insurance for motorbike riders. It is targeted at people using motorbike taxi services, and it can provide coverage when a customer is a pillion passenger by using Amodo’s telematics app on a customer’s mobile phone.

Galileo also has a partnership with the US firm DXC Technology focused on digital distribution and policy administration systems.

Fundraising and competition

During its early years, Galileo was a member of Hong Kong’s Cyberport incubation program. So far, it has raised US$3.2 million from investors, with the lead investor being Greenlight Re — a reinsurer based in the Cayman Islands. It is also currently in the process of raising an additional US$1.5 million. According to Wales, the firm currently plans to grow organically rather than through M&A.

Potential competitors include platform providers such as eBaoTech, TCS and DXC Assure as well as other insurtechs such as ZA Tech, CoverGo and Ignatica. When it comes to blockchain, the firm is vying for business with firms such as Ledgertech, MediConCen and ChainThat.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.