Insurers’ switch to risk-based pricing makes insurance unaffordable: RBNZ

April 30 2024 by Georgina Lee

Property owners in New Zealand are finding insurance increasing unaffordable and those in high-risk properties are vulnerable to a total loss event, as more insurers are switching to a risk-based approach for pricing natural catastrophes risk in order to cope with rising reinsurance costs.

Climate change has increased the underlying risks of flood, storm and other weather events, a trend that may accelerate in the future with global warming, according to an article in the May edition of the financial stability report released by the Reserve Bank of New Zealand (RBNZ) on April 29.

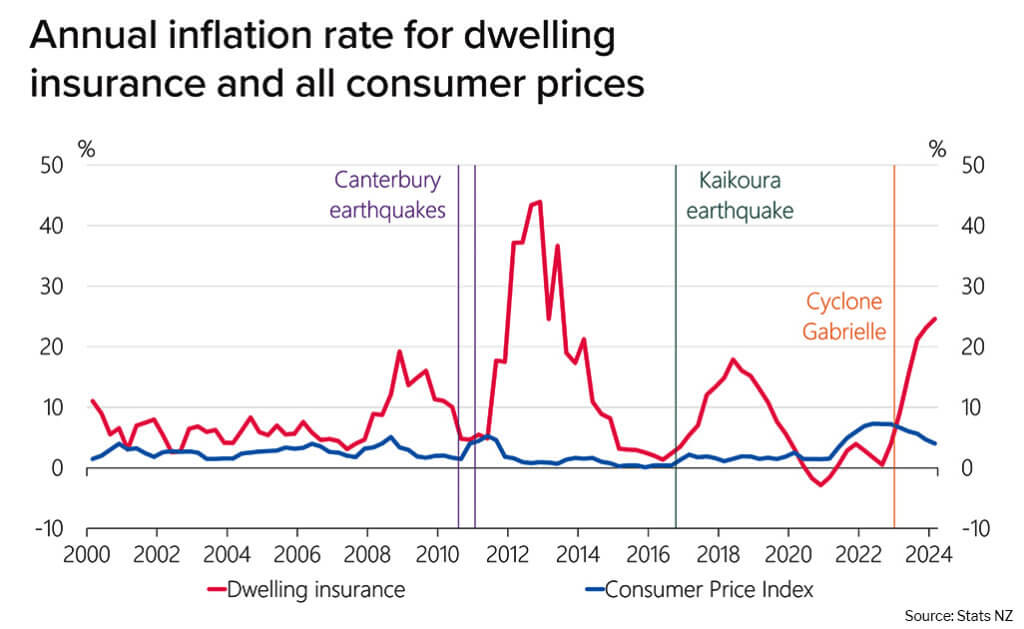

Premiums for residential dwelling insurance have outstripped inflation over the past decade, reflecting higher reinsurance costs as reinsurers adjust their views on New Zealand risks.

Insurers are increasingly switching to risk-based pricing for residential dwelling insurance, which sees the value of insurance premiums becoming more tailored to the specific risks that a property faces. Insurers are able to make that switch as improved data and modelling have enabled them to unbundle different risks, and those with more granular risk data are best placed to obtain more favourable reinsurance terms, the RBNZ said.

Insurance premiums will increase if insured losses from these events also grow. Claims from the 2023 Auckland Anniversary weekend floods and Cyclone Gabrielle have totalled NZ$3.7 billion (US$2.2 billion) so far, contributing to New Zealand insurers bearing a higher reinsurance premiums over the past year, the report said.

“Insurers’ adoption of greater risk-based pricing is a rational response to a changing operating environment,” it said. “However, some (high-risk properties’) owners may find insurance increasingly unaffordable. Insurers may begin to make coverage of some risks optional as risk-based pricing becomes more commonplace.”

The central bank said that to-date, risk-based pricing is most commonly used in seismic risk in Wellington, and more granular pricing for flood risk “is at varying stages of being rolled out” by insurers.

While a risk-based approach can be beneficial for society’s overall risk management because it provides a price signal to encourage the proactive mitigation and reduction of risks, the flip side is that it could also cause insurers to gradually withdraw insurance from high-risk properties, whose owners may also find insurance unaffordable.

Rising premiums may also lead to customers choosing to underinsure, leaving owners of high-risk properties vulnerable in a total loss event.

For example, in Australia some property owners continue to opt out of flood cover given the very high premiums they would need to pay to obtain it. Owners are then reliant on their own savings and potential government assistance, which may not fully compensate for their losses, the RBNZ said.

Risk-based pricings contrast with a community-based approach, whereby an insurer assesses a risk based on broad averages across policyholders and does not differentiate the premiums charged, even if an individual policyholder is materially more or less exposed to an insured risk than others.

The central bank notes that the residential insurance market is important to financial stability, as residential dwellings and land account for about 25% and 36% of New Zealand’s household’s net worth respectively. The availability of insurance also supports financial stability by protecting against risks to property value which is used to secure much of New Zealand banking system’s lending, such as those extended to home and commercial property.

“Insurance retreat presents a long-term challenge for the financial system. It is important for all stakeholders (insurers, central and local governments, buyers and lenders) to take action now to improve their understanding of natural hazards, so that future insurance affordability challenges can be better managed,” it said.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital