Insolvencies slow in Asia as China’s stimulus works

April 15 2019 by Andrew Tjaardstra-

Chaucer’s political violence underwriter Boaz Appiah relocates from London to Singapore

- February 13

Appiah has been with the China Re company for over four and a half years in London, having joined from Markel.

-

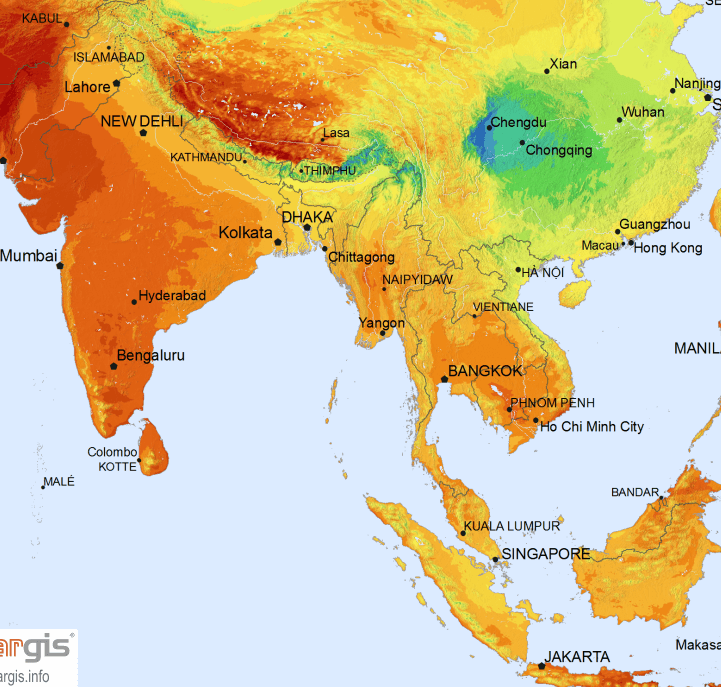

APAC to remain ‘highly exposed’ to political volatility, cross‑border security risks in 2026: Willis

- February 12

Report shows 8% of global client incidents originated in Asia Pacific in 2025, mirroring the previous year but within an increasingly volatile environment.

-

APAC to remain ‘highly exposed’ to political volatility, cross‑border security risks in 2026: Willis

- February 12

Report shows 8% of global client incidents originated in Asia Pacific in 2025, mirroring the previous year but within an increasingly volatile environment.

-

Bondi Beach claims yet to trigger terrorism pool, ARPC says

- January 22

Insurers have received 25 claims following the deadly attack last month.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital