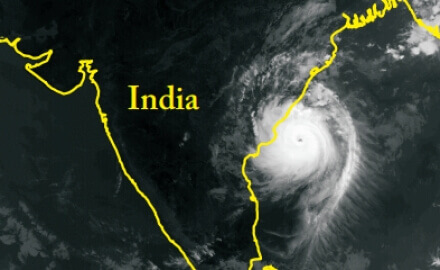

India to revisit nat cat pool following latest cyclone

June 2 2020 by Yvonne Lau-

India mandates Ace Insurance Brokers to study feasibility of local P&I club setup: report

- July 8

The move comes two years after finance ministry flagged the need for establishing a full-fledged, India-owned P&I entity.

-

Lockton appoints Shubhangi Pathak as director for transactional lines in India

- July 4

Delhi-based Pathak is a corporate lawyer, bringing in over 16 years of experience, specialising in M&A.

-

IRDAI chairman race gets new entrant as process drags on: report

- July 1

India’s financial services secretary Maddirala Nagaraju is the new name being considered as the post lies vacant since March 2025, holding up key reforms at a crucial time for the industry

-

GIC Re hands Asta its Lloyd’s syndicate’s managing agency services

- July 1

The agreement with the Davies-backed managing agency relates to the open and prior years of the Indian reinsurer's GIC syndicate 1947.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.