Indian and Malaysian carriers keen to transform claims and underwriting approaches

July 23 2024 by InsuranceAsia News

The insurance industry in Asia is at a pivotal juncture, characterised by both challenges and opportunities. Insurers in the region grapple with slowing growth, market fragmentation, and profitability pressures. Emerging risks such as climate change, cyber threats, and the rise of electric vehicles further complicate the landscape.

However, technological advancements, a growing middle class, and increasing urbanisation present significant opportunities for growth and innovation in the insurance sector in the region.

Asia’s insurance market faces several headwinds. The industry has seen a slowdown in premium growth across life and property and casualty (P&C) lines, compounded by deteriorating profitability and an increase in catastrophe claims. Despite these challenges, Asia is viewed as a growth engine for global insurers due to its large population and rapid economic development. This dual-track approach — engaging with emerging opportunities while optimising core operations for efficiency — is crucial for navigating the evolving market.

Technological integration is another critical factor. Insurers must embrace digitalisation and leverage advanced analytics to stay competitive. The integration of telematics data, AI-driven risk assessments, and parametric insurance products are examples of innovations reshaping the industry. This shift is essential for meeting the rising expectations of a tech-savvy customer base and addressing the complex risk environment.

According to Scott Horwitz, senior principal consultant for insurance at FICO, who noted speaking at a FICO and InsuranceAsia News webinar “Addressing complexities in underwriting and claims: with country spotlight on India and Malaysia”, innovations and technology need to address specific decision areas – for example, an underwriting decision in motor insurance – and break down silos across the organisation.

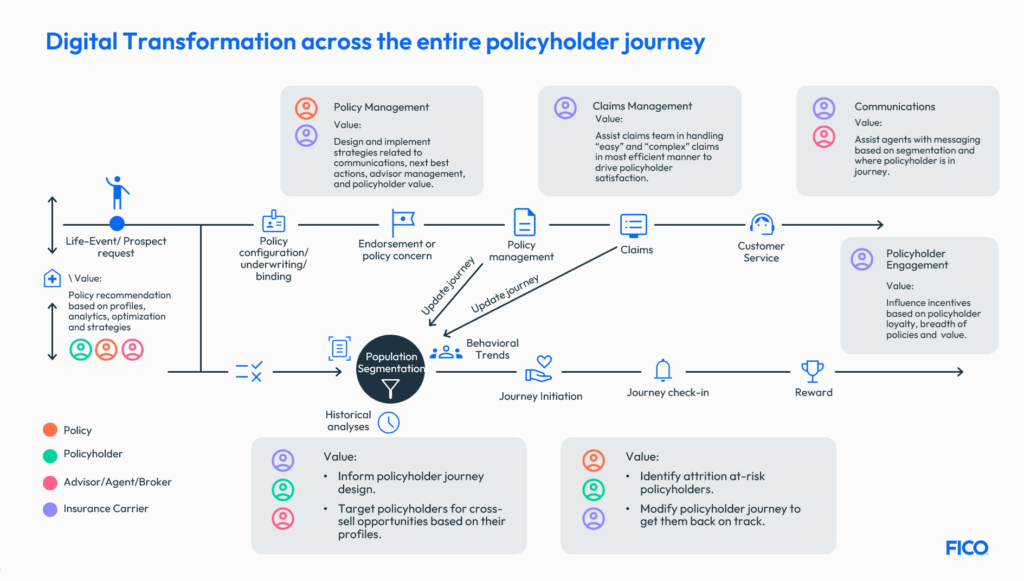

When carriers make one of those individual decisions, they need to be able to draw from data across the organisation, to access analytic models that assess a variety of metrics, and to implement strategies that drive the overall policyholder journey. Carriers should be looking at their technology architecture in relation to a 360-degree view of the policyholder to take full advantage of the benefits of digital transformation.

Market transformation

Given these dynamics, markets like Malaysia and India, which are experiencing significant growth and possess immense potential for further improvement through technological advancements, illustrate how insurers can leverage regulatory changes and innovative approaches to navigate the current challenges and capitalise on opportunities.

Malaysia’s non-life insurance sector has been experiencing substantial growth, with premiums increasing by 46.1% to MYR1.9 billion (US$403.7 million) in the second half of 2023. This growth was driven by the motor segment and a lack of large natural catastrophe claims. Despite this progress, volatile financial markets and rising motor and medical claims inflation, coupled with more frequent severe climate events, continue to exert pressure on the sector.

India’s non-life insurance market remains heavily driven by the health and motor insurance segments. Regulatory changes are reshaping the landscape, with the Insurance Regulatory and Development Authority of India (IRDAI) mandating quicker claim settlements, policy cancellations, and new premium payment options under the “pay as you drive” model. These changes aim to increase flexibility and customer satisfaction, reflecting the market’s ongoing transformation.

India’s insurance market is undergoing significant transformation. Arti Bhushan Mulik, head of underwriting and product development at Universal Sompo General Insurance, noted during the webinar.

“IRDAI has brought in a lot of flexibilities in terms of product filing, getting new venues for analysing and pricing the risk, and the penetration of insurance in India,” Mulik said.

Mulik highlighted the introduction of “pay–as–you–drive” motor policies, which reward drivers who adhere to regulations with lower premiums.

“If you are driving within the control following all the regulations, then you might pay a reduced premium,” she explained.

The underwriting workflow is also evolving to incorporate more personalised data analysis, leveraging advanced algorithms to determine coverage and pricing more accurately.

“The focus is on getting the right information with the help of some focused questions and then putting an algorithm behind those questions and arriving at the proper coverage and pricing. All these things need to be embedded in the system,” Mulik emphasised.

Data challenges and opportunities

Data availability remains a significant challenge. Accurate product pricing and analysis require robust data, which necessitates digitalisation. Mulik emphasised the need for digitalised data to create a scientific basis for underwriters.

“The major challenge comes with the data availability. If you have to price the product you need to have a data basis for which the analysis and the pricing can be done. Everything now needs to be digitalised so that we can package the product and prepare a scientific base for underwriters,” she said.

Horwitz mentioned that new data sources like telematics are opening up different underwriting paths, allowing for more tailored and effective insurance solutions.

“Digitised data makes it easier to access and easier for the underwriters to use and manipulate. And then there are brand new sources of data which maybe we haven’t even thought about,” he noted.

This move away from a one-size-fits-all approach allows for more tailored underwriting processes.

“We’re really beginning to see these within the underwriting process rather than one size fits where everyone gets the same questionnaire or the same process,” Horwitz added

Legacy systems and cloud platforms

Transitioning from outdated claim systems to more agile and analytical platforms is crucial for future growth, said Varsha Gujarathi, chief claims officer at Universal Sompo General Insurance.

“Legacy systems pose a lot of operational challenges, being rigid, inflexible, outdated, unable to keep changing according to the new demands, hinder innovation, agility, hurdle to ever-increasing demands of customers,” she said.

Integrating current communication systems with legacy data can drive more agile and efficient operations.

Horwitz added that cloud platforms centralise information and enhance transparency but also bring challenges related to data security and potential breaches. Automated, multi-channel communication methods can improve efficiency and reduce the time spent on claim processing.

“Much can be done with automated, multi-channel and two-way customer communications. Getting claimants to self-serve by answering SMS or email, using automated voice calls, or even an interactive portal reduces the time operatives spend chasing for answers and managing the process,” Horwitz explained.

Integrating claims and underwriting

A unified digital platform for policy and claim servicing is ideal as centralising underwriting and claims components, including communications, AI-based analytics and data management, provides a comprehensive view of the policyholder. This integration helps prevent disconnects and improves decision-making, making claims processing more efficient and accurate.

“If a claim system is too separate from underwriting, there could be too many disconnects,” Horwitz said.

“If I have access to the underwriting process, that might help me make the claims decision, as perhaps there was a coverage that was added on.”

Mulik emphasised that correct underwriting simplifies claims settlement, and Gujarathi highlighted the importance of collaboration among internal stakeholders to combat fraudulent claims effectively.

“If the underwriters do their job correctly, it’s much easier to settle the claims,” Mulik noted.

Gujarathi highlighted the importance of working with all internal teams, saying, “[Talking to other teams] is something that the claims team has to do, whether they are from underwriting, sales, actuaries or internal audit departments.”

Understanding claims data and being aware of evolving fraud trends are crucial for improving efficiency and profitability. “Creating awareness of types of frauds, or how it is evolving in the market is something which should constantly be given to claim handlers,” Gujarathi said

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital