Asia to drive global P&C growth in next decade

May 20 2021 by Nick Ferguson

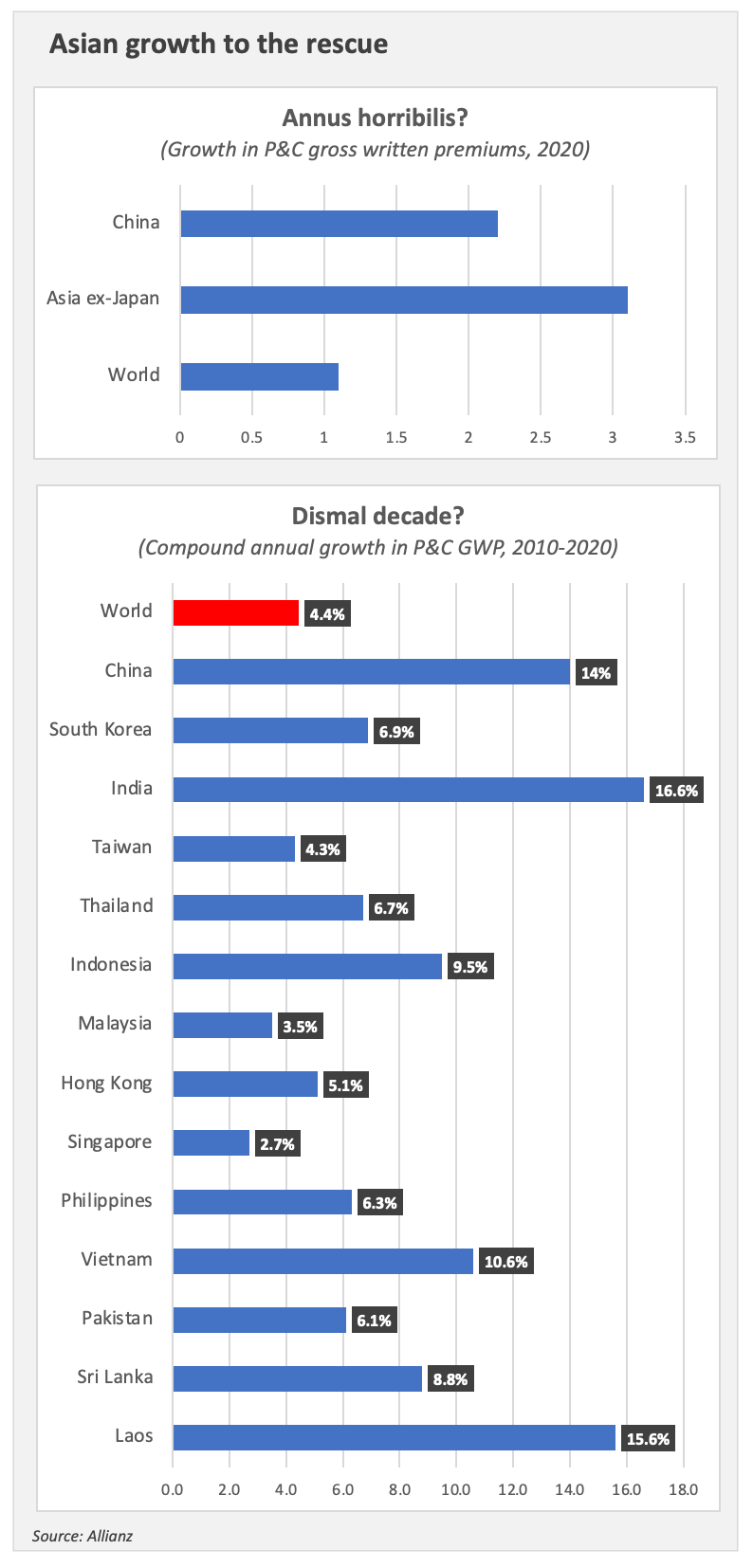

Allianz’s latest report on the state of the global insurance industry describes 2020 as an “annus horribilis” and the 2010s as a “dismal decade”, but the figures also tell a different story — about how important Asia has become as the engine for global premium growth.

During the next decade, Asia (ex-Japan) will contribute 40% of global P&C premium growth — with more than a quarter coming from China, according to analysis of Allianz’s projections by InsuranceAsia News.

That would see the region’s overall share of global P&C premiums rise to 27% as it becomes the second-biggest region in the world after North America. China alone will command 17% of global P&C premiums with a market worth €406 billion a year — still just half the size of the US market but more than four times the size of Germany or the UK.

When Australia, Japan and New Zealand are included, the entire Asia-Pacific region will account for almost a third of global premium by 2031.

The pace of growth is slowing compared to the past decade, but Allianz nevertheless forecasts that the region’s premium pool  will expand by an average of 8.8% a year during 2021 to 2031, with India projected to grow at more than 13%.

will expand by an average of 8.8% a year during 2021 to 2031, with India projected to grow at more than 13%.

In particular, Allianz forecasts that Asia will rebound from Covid-19 quickly, resuming its role as the driving force of global premium growth.

“The region will be setting the pace for the global insurance industry in the 2020s,” the report says. “The numbers are simply breathtaking.”

Annus horribilis

Last year’s figures were also striking, albeit for very different reasons.

While most of the truly horrible numbers were on the life side, global P&C premium growth was nevertheless significantly muted at just 1.1%. But without Asia ex-Japan — where premiums grew by 3.1% — that figure would have been even lower at 0.67%.

This contribution to the global premium pool comes after a decade of strong growth that firmly established Asia’s position as a land of opportunity for insurers with international ambitions.

In 2010, the region’s insurance industry was barely big enough to move the needle at the global level, but the sector in Asia Pacific has now grown to be almost as big as Europe, while P&C premiums in China were more than double Germany or the UK in 2020.

And despite starting the decade with just 10.6% of global premiums, Asia ex-Japan still managed to drive more than a third of the growth in global premiums from 2010 to 2020. By the end of the decade, the region’s share of global premiums almost doubled to 19%.

For international insurers, that growth was easy to predict and difficult to capitalise on as many of the region’s domestic insurance markets remained restricted and difficult to access.

As regulations continue to ease and encourage more foreign investment on the P&C side, international insurers will hope that the coming decade sees more of the opportunity converted into market share and profits.

-

Analytics: Lloyd’s Asia surpasses US$1bn GWP milestone in 2024 amid double-digit growth

- August 27

Offshore fund demonstrates strong performance despite challenges in the Singapore unit and varied underwriting results across business lines.

-

Analytics: Hong Kong’s P&C reinsurance market narrows gap with Singapore

- May 8

Hong Kong benefitted from RBC implementation in 2024, however, Singapore retained top spot in terms of GWP and underwriting results.

-

Analytics: Short-tail performance boost for Australia’s P&C carriers

- March 4

APRA data shows general insurance COR improves in Q4 2024, while profit after tax almost doubles to US$1bn.

-

Analytics: Australian intermediated premiums grow 8.2% in 2023-24

- October 18

While the GWP placed with Lloyd’s in the 12 months grew at a comparable pace, business placed with unauthorised foreign insurers declined marginally.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital