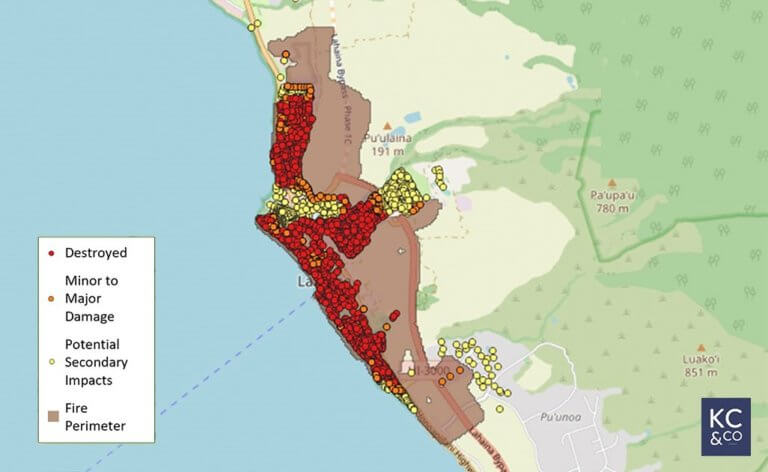

Hawaii wildfire insured property losses to hit US$3.2bn: KCC

August 16 2023 by Andrew Tjaardstra-

Sompo receives regulatory approvals for US$3.5bn Aspen acquisition

- February 19

Transaction is expected to close in the next several days, subject to the satisfaction of customary closing conditions.

-

Does Zurich’s US$11bn Beazley deal signal the end of the Lloyd’s listing experiment? Survivors are now in the spotlight

- February 16

Deal will leave only two Lloyd’s players – Hiscox and Lancashire – listed on the London Stock Exchange, with capital-rich Japanese insurers expected to be amongst those circling.

-

Lloyd’s promotes Emma Loynes to CEO of Asia Pacific, Middle East, Africa

- February 13

Singapore-based Loynes succeeds Chris Mackinnon, will leave for Munich Re Specialty in April.

-

Lloyd’s promotes Emma Loynes to CEO of Asia Pacific, Middle East, Africa

- February 13

Singapore-based Loynes succeeds Chris Mackinnon, will leave for Munich Re Specialty in April.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital