The increasing popularity of high limit/high-deductible medical reimbursement products has attracted a lot of attention, with various carriers developing ‘Million Medical products’ in China. But we believe there are also growing concerns of upward loss ratio trends in medical reimbursement insurance over time. Developments should be closely monitored.

The Million Medical product, which is generally defined as a high-limit and high-deductible reimbursement product, has become the most popular medical product in China since its launch in August 2016. Million Medical products have removed a lot of restrictions from the previous medical reimbursement products, which had seen no major changes in product design before their launch. For instance, medical reimbursement is no longer restricted to the listed items in the social health insurance catalogue, and the annual limit is much higher than before. Instead, Million Medical products reimburse all reasonable medical expenses, with a high limit, while keeping the premium affordable with a higher deductible.

On the one hand, tremendous success has been observed, with over 30 similar products being developed by the industry and more than Rmb10 billion (US$1.49 billion) in gross written premium sold in 2018. On the other hand, there have been some concerns over profitability. There has been a recent upward trend in the loss ratio of this product and certain insurers have started to lose money.

Based on our experience, the rising trend of loss ratios for Million Medical products is entirely expected. In this article, we will discuss this rising trend and its underlying driving force, as well as what potential management measures could be undertaken by insurers to mitigate such risks.

Durational upward loss ratio trend within medical reimbursement products

Currently, the majority of the Million Medical products are offered by non-life insurers. These insurers would usually rely on the most recent loss experience of their products to modify the premium rates or to adjust the underwriting conditions, expecting similar experience to continue in the next year. This would be true for most short-term lines of business, like auto insurance, with a meaningful size of policyholders in the portfolio.

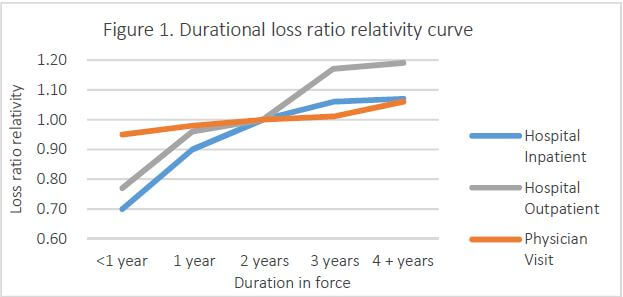

However, this traditional practice of claims management and portfolio monitoring may not work as expected for medical reimbursement products. Quite often, durational effect takes place for newly launched medical insurance products that there is a durational upward trend in loss ratios and it takes much longer for these loss ratios to level off, as seen in Figure 1, which shows a durational loss ratio relativity curve across policy years for the same cohort of insureds. This curve was the result of an analysis using a proprietary medical analytical tool, Milliman’s U.K. Health Cost Guidelines™, based on actual historical data in the U.K. We observed similar patterns with newly launched medical products in Asia repeatedly, such as in Singapore and Hong Kong.

Figure 1 shows how claims costs are expected to grow over the lifetime of a policy for the same cohort of insureds, if there are no premium rate increases other than for member aging and medical inflation factors. The loss ratio when it levels off after year 6 could be 10-60% higher than the first year’s loss ratio varying significantly by benefit type. If we consider new cohorts of insureds joining the portfolio, it will take a much longer time for the portfolio loss ratio to level off.

It has been approximately two and a half years since the launch of this product and new entrants continue to come into this segment over time. For carriers that already have less favourable performances than expected, it could be even more alarming, as we believe the loss ratio will become even higher and the underwriting margin will be further squeezed in the near future. In the following sections, we discuss various factors that could contribute to this durational upward trend. While insurers are closely monitoring some of these factors at the moment, we believe others are not yet on the radars of insurers.

FIGURE 1: DURATIONAL LOSS RATIO RELATIVITY CURVE

Milliman’s U.K. Health Cost Guidelines™

Underwriting wear-off

Applicants need to go through an underwriting process for almost all medical products, whether it is full underwriting (such as disclosing complete medical histories) or simplified underwriting (such as health questionnaires or health declarations). Insurers will use the applicants’ demographics and health information to make underwriting decisions, such as accepting or declining applications, imposing case-based exclusions and offering premium loading or discount. While underwriting approaches usually vary by insurers, people going through effective medical underwriting have selection biases that they are commonly healthier at the point of policy issuance. As time passes, the effectiveness of underwriting usually wears off as the insured’s health status changes, and the medical cost of that insured tends to increase in later policy years.

Adverse selection spiral

Property and casualty (P&C) insurers would usually increase premium rates or improve underwriting conditions upon renewal to maintain loss ratios within expectation. However, this may need to be considered more carefully with medical reimbursement products, as policyholders generally have a better idea about their health status than the insurer. In the case of undue rate increases by insurers to offset worsening experience of entire portfolios, healthy insureds tend to lapse and search for other policies with more favourable prices and benefits, while less healthy insureds that have difficulty in finding alternative policies tend to remain in the portfolio. This change of mix of insureds will drive the medical costs even higher and potentially further rate increases as well. This cycle is generally referred to as an adverse selection spiral. The sharper the increase of premium rates, the more significant the adverse selection that will be observed.

Health declarations are not always reliable

As Million Medical products are now mostly sold online on the P&C side, insurers are taking simplified underwriting approaches in the form of health questionnaires and health declarations. No re-underwriting is required at the time of renewal for most of the carriers. However, it is possible that people may not be fully transparent and honest about their preexisting conditions and medical history. Some applicants were detected to intentionally play with the declaration to get the coverage.

Insurers’ practices may also encourage applicants to take the declarations less seriously. For instance, some carriers hesitated to decline claims when sales were booming, as they thought the loss ratio of the Million Medical products could be as low as 30%. In addition, we noticed that some insurers would even pay ex gratia claims in the case of preexisting conditions.

Recently insurers have strengthened the requirement of declarations, and some third-party data may be employed to validate the declarations.

Demographic change and intergenerational subsidy

For medical reimbursement products, quite often the rate of premium increase for a specific age band does not reflect the actual increase in expected insurance cost within that age band. In general, cross-subsidies exist, with younger insureds subsidising older ones.

As they are mainly distributed online, Million Medical products disproportionately capture more young insureds, who are relatively healthier at the moment of purchase. If there are not adequate young insureds flowing into the portfolio continuously, the portfolio will get older, premium adequacy will reduce over time and the loss ratio of the portfolio will increase.

Other potential factors

There might still be some other factors that could contribute to the upward trend in loss ratios.

With more and more insurers starting to offer Million Medical products, a price war could be initiated as the market becomes more competitive. New insurers may even experience a higher ratio of claim fraud as some may be less skilled managing medical portfolios.

Insureds will usually go through a learning curve for new products at the early stages of the policy launch, familiarizing themselves with the claims process and understanding the benefit coverages. The Million Medical product is no exception, even with a faster learning curve. For instance, we understand policyholders have been calling customer service to check whether their medical bills are covered, or they may check around with friends to better understand the coverages. With this, we expect policyholders will better utilise the policies which drive the loss ratio upwards.

Medical inflation trend

Apart from the durational effect of medical reimbursement products with an upward trend in loss ratios, medical inflation trend squeezes the underwriting margin further. With the current high underlying medical inflation trend, a good understanding of such trend can help maintain the loss ratios of the Million Medical products. We discuss the drivers of this medical inflation trend in the following sections.

Technology driven medical inflation

Breakthroughs in drug development, adoptions of high-cost medical equipment and ever-evolving of new medical technologies will result in high medical costs. And with the support of new diagnosis technologies, previously undiagnosed illnesses may be uncovered now and start to be treated. Any of these factors may result in unusually high trends.

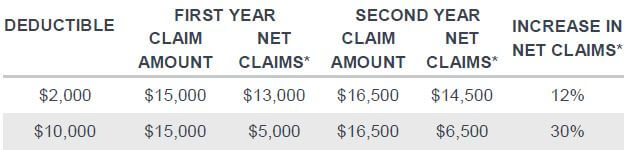

Leveraging effect of deductibles

There is a leveraging effect of deductibles exaggerating the medical inflation trend; that is, the product with higher deductibles will experience higher percentage increases in claims costs than products with lower deductibles or without deductibles. This is illustrated in Figure 2. For simplicity, we assume an underlying medical inflation trend of 10%, which is broadly in line with the medical inflation trends in the Chinese market. Million Medical products usually offer high deductibles of Rmb10,000, which results in a much higher trend net of deductible than the underlying medical inflation trend.

*Net claims refer to actual claims paid net of deductibles

Becoming proactive and staying one step ahead

Considering the narrowing of underwriting margins over time, it is important for insurers to review value chains systematically to see how they could stay a step ahead of the market, how to be better prepared for the potential increase of medical cost and how to proactively mitigate the risks.

In general, existing carriers should closely monitor the loss experience to make sure premium adequacy levels remain reasonable. Monitoring the performance of the overall portfolio may not work well, but monitoring at a more granular level commonly adds more insights. For example, carriers could consider other factors such as geographic areas and occupations, with different segments having different premium adequacies. In addition, it is important to monitor the following factors which have been discussed before:

The premium adequacy level may vary significantly by age and gender, with cross-subsidies across age bands; the duration of policies; and medical inflation.

To be able to assess premium adequacy on more granular segments, insurers need to estimate the underlying risks for each segment more accurately, with various data sources and more sophisticated predictive modelling techniques involved. If a certain segment is found to be of lower-than-expected premium adequacy, premium rate increases need to be adjusted carefully to avoid any adverse selection spiral. Another option, if rate increases are not tolerable, is that insurers can consider spreading some increases to deductibles too.

Apart from the rate adjustment, insurers can also improve performance with better risk selection and enhanced underwriting processes, leveraging additional sources of data. For example, some insurtech startups could instantly access detailed medical records with authorisation from applicants. This would certainly be a big improvement in assessing the health status of potential insureds over the current approach of questionnaires or health declarations.

Claims management is another control that can help insurers reduce reimbursement of unnecessary medical costs. Collaborating with a third party having access to proprietary medical data can also help insurers in fraud detection. Machine learning and other technologies driven by artificial intelligence (AI) may be employed as well.

In addition, insurers can also play an important role in managing the health status of insureds and maintaining better risks in the pool. Insurers can promote healthy lifestyles by offering discounts based on exercise habits and providing value-added services, such as more proactive preventive care and wellness services. In the long run, insurers can even consider care management programmes by including case management to deliver quality care, and disease management for renewal insureds with chronic diseases.

Conclusion

The Million Medical product has been growing strongly in recent years, with more and more insurers beginning to offer this option. However, the underwriting margin of this product has been quickly narrowing, a trend that will likely continue into the future. It is clear that more effort is needed to better manage this product and make it a more sustainable medical reimbursement product in China.

The article is written by Guanjun Jiang who is a principal and consulting actuary at Milliman and Qiuwen Peng, a consulting actuary at Milliman.

References:

1 Clark, K.L. & Bentley, T.S. (22 February 2016). Should You Consider Offering Medicare Supplement Plans Alongside Your Medicare Advantage Product? Milliman Medicare Issue Brief. Retrieved 28 March 2019 from http://us.milliman.com/insight/2016/Should-you-consider-offering-Medicare-Supplement-plans-alongside-your-Medicare-Advantage-product/.

2 Baveja, L. & Roberts, M. (10 January 2018). Chronic Disease Management: Considerations for International Adoption. Milliman White Paper. Retrieved 28 March 2019 from http://us.milliman.com/insight/2018/Chronic-disease-management-Considerations-for-international-adoption/.

-

Insurtech: 6 AI trends reshaping the industry

- February 25

AI has become the defining technology of our time, entering the hands of everyday consumers and employees faster than any innovation in recent history. The speed of adoption has been remarkable, mirrored by an equally intense wave of hype, but real business impacts are beginning to surface. What was once the domain of specialised data […]

-

AI: Complexity mismatch amid the case for augmenting the investment office

- January 21

With prudent oversight and strong guardrails, an augmented investment office can allow insurers to confidently ride the private credit boom without being undermined by the complexity they have embraced.

-

Marine: Amid backlogs and breakdowns, Covid-19 maintenance delays put vessel safety at risk

- December 9

Asia is at the sharp end of a hidden maritime risk, with post-pandemic machinery-related losses becoming an even more significant issue.

-

W&I: Balancing growth, commerciality and sustainability in Asia Pacific’s W&I market

- November 6

Warranty and indemnity (W&I) insurance is now being utilised with increasing frequency across a far broader range of deal sizes and geographies in the region.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital

Guanjun Jiang, Milliman

Evaluating the performance of medical reimbursement products

Guanjun Jiang, Milliman