Guy Carpenter | Dedicated reinsurance capital for Asia life business

May 31 2023

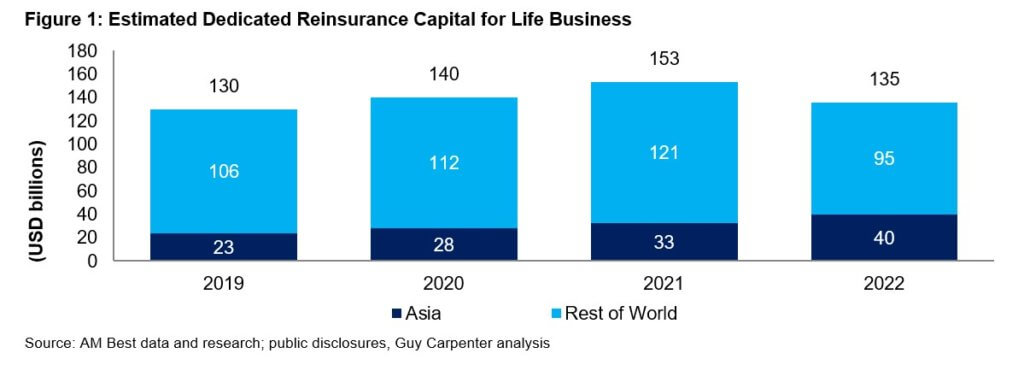

According to the latest estimates by Guy Carpenter and AM Best, there was US$505 billion of dedicated reinsurance capital globally in 2022. We estimate that ~27% of the global reinsurance capital, US$135 billion, was dedicated to life business globally and ~30% of that global life reinsurance capital, US$40 billion, was dedicated to the Asia life market.

Reinsurance capital dedicated to Asia life business grew from US$33 billion in 2021 to US$40 billion in 2022, despite a drop in global dedicated life capital over the same period, highlighting the attractiveness of the region and large opportunity pool, particularly on legacy deals (in-force blocks) in the mature markets such as Hong Kong and Japan.

Most of the new available capital is from “asset intensive reinsurers”, with appetite for legacy products with investment risk. The increase in interest was most notable after the first offshore life reinsurance deal in Hong Kong in 2021 between a multi-national insurer and a US asset intensive reinsurer on a legacy block of whole life policies.

Asset intensive reinsurers are typically backed by asset management companies or private equity firms, and have an extensive track record of deals in the US. They are now entering the Asia market and have been successful on familiar product sets and suitable currencies of the underlying product, such as USD, which ultimately allows them to leverage their in-house investment expertise and write these blocks at attractive prices for insurers in Asia.

Soft Market

The current life reinsurance market for Asia can be considered as a soft market, particularly for asset intensive deals because: (a) more capital is available including recent capital raisings and increasing allocation to Asia, and (b) higher interest rates, which means lower initial premiums for coinsurance structures.

Since 2021, US$9 billion in Japan and US$6 billion in Hong Kong of legacy deals were completed with offshore asset intensive reinsurers.

We expect deals completed with new capital sources to continue increasing at an even quicker pace when asset intensive reinsurers develop more experience in Asia.

Reinsurance Needs

Due to the upcoming regulatory capital reforms and accounting changes in Asia, insurers operating in the region are facing increasing demands to optimise their capital position and improve shareholder returns. A solution used by many insurers is to reinsure legacy portfolios of asset intensive products such as whole of life policies and annuities on a coinsurance structure.

Guy Carpenter is the largest life reinsurance advisor in the Asia-Pacific region and has placed USD 40 billion of present value premiums in total. Guy Carpenter has a successful track record advising and executing large, complex and value accretive asset intensive deals in Asia, including the first in market whole life participating portfolio (Hong Kong 2021). We continue to help insurance companies in Asia enhance capital efficiency and maximize value by advising on capital management, reinsurance strategy and specific reinsurance placements.

|

Matthew Rose

Head of Life & Capital, Asia Pacific Email: [email protected] |

|

Victor Hai

Senior Vice President, Life & Capital, Asia Pacific Email: [email protected] |

|

Marcus Leung

Senior Vice President, Life & Capital, Asia Pacific Email: [email protected] |

|

Hirokuni Amano

Vice President, Life & Capital, Japan Email: [email protected] |

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The insurer proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.