Guy Carpenter | Dedicated reinsurance capital for Asia life business

May 31 2023

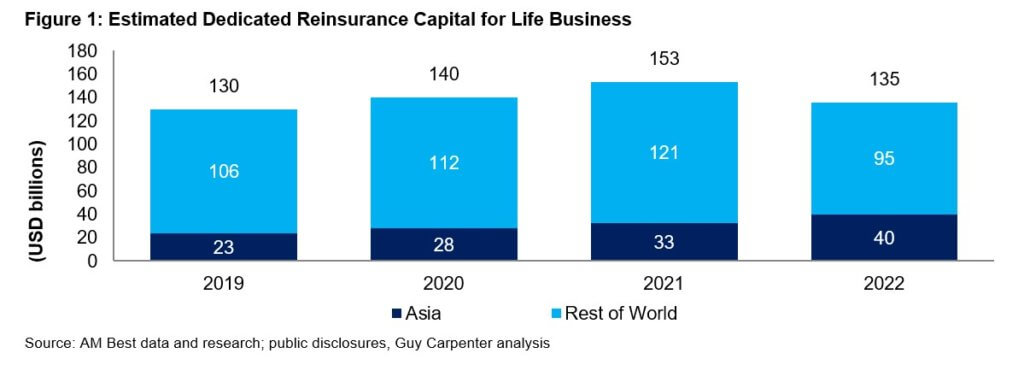

According to the latest estimates by Guy Carpenter and AM Best, there was US$505 billion of dedicated reinsurance capital globally in 2022. We estimate that ~27% of the global reinsurance capital, US$135 billion, was dedicated to life business globally and ~30% of that global life reinsurance capital, US$40 billion, was dedicated to the Asia life market.

Reinsurance capital dedicated to Asia life business grew from US$33 billion in 2021 to US$40 billion in 2022, despite a drop in global dedicated life capital over the same period, highlighting the attractiveness of the region and large opportunity pool, particularly on legacy deals (in-force blocks) in the mature markets such as Hong Kong and Japan.

Most of the new available capital is from “asset intensive reinsurers”, with appetite for legacy products with investment risk. The increase in interest was most notable after the first offshore life reinsurance deal in Hong Kong in 2021 between a multi-national insurer and a US asset intensive reinsurer on a legacy block of whole life policies.

Asset intensive reinsurers are typically backed by asset management companies or private equity firms, and have an extensive track record of deals in the US. They are now entering the Asia market and have been successful on familiar product sets and suitable currencies of the underlying product, such as USD, which ultimately allows them to leverage their in-house investment expertise and write these blocks at attractive prices for insurers in Asia.

Soft Market

The current life reinsurance market for Asia can be considered as a soft market, particularly for asset intensive deals because: (a) more capital is available including recent capital raisings and increasing allocation to Asia, and (b) higher interest rates, which means lower initial premiums for coinsurance structures.

Since 2021, US$9 billion in Japan and US$6 billion in Hong Kong of legacy deals were completed with offshore asset intensive reinsurers.

We expect deals completed with new capital sources to continue increasing at an even quicker pace when asset intensive reinsurers develop more experience in Asia.

Reinsurance Needs

Due to the upcoming regulatory capital reforms and accounting changes in Asia, insurers operating in the region are facing increasing demands to optimise their capital position and improve shareholder returns. A solution used by many insurers is to reinsure legacy portfolios of asset intensive products such as whole of life policies and annuities on a coinsurance structure.

Guy Carpenter is the largest life reinsurance advisor in the Asia-Pacific region and has placed USD 40 billion of present value premiums in total. Guy Carpenter has a successful track record advising and executing large, complex and value accretive asset intensive deals in Asia, including the first in market whole life participating portfolio (Hong Kong 2021). We continue to help insurance companies in Asia enhance capital efficiency and maximize value by advising on capital management, reinsurance strategy and specific reinsurance placements.

|

Matthew Rose

Head of Life & Capital, Asia Pacific Email: [email protected] |

|

Victor Hai

Senior Vice President, Life & Capital, Asia Pacific Email: [email protected] |

|

Marcus Leung

Senior Vice President, Life & Capital, Asia Pacific Email: [email protected] |

|

Hirokuni Amano

Vice President, Life & Capital, Japan Email: [email protected] |

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital