Currency mismatch piles pressure on Asia underwriting

November 16 2022 by Karen Lai

The strengthening of the US dollar on the back of the US Federal Reserve’s hawkish policy stance has left Asian insurers with a significant challenge from assets and liabilities, especially due to currency mismatches.

As the (re)insurance industry stares at a capacity crunch, there is more focus on the asset side of the business, and hence asset-liability management (ALM).

“The US dollar has strengthened considerably against other currencies, and that’s another constraint on overall capacity. Most of the reduction of capital in the industry is caused by a reduction in asset values rather than underwriting losses,” said a senior executive of a global reinsurance broker. “And most of that’s on the fixed-income bond side.”

Insurers have been adopting a more defensive investment line. “In Europe and APAC, what we basically see is insurance companies have a much more conservative investment behaviour right now,” said Thomas Gillmann, insurance strategy and advisory of APAC for global asset manager DWS Group.

First of all, the economic outlook is not too positive at the moment. Secondly, insurance companies can also now afford to invest more conservatively, because of the rising interest rates.

If you’re investing in government bonds or investment grade corporate bonds, you also already get a decent yield again, so they really can afford to maybe switch from high yield investments more into investment grade investments again.

While currency mismatch is a problem impacting nearly all non-US (re)insurers, the problem is deeper in Asia because of the lack of a deep local currency bond market.

“In general, the fixed income markets are not very deep and broad in Asia Pacific. Therefore, insurance companies in the region are significantly invested into US fixed income assets such as investment grade US corporate bonds or US treasuries,” Gillmann said.

“It’s just a structural challenge that they don’t have enough assets to match their liabilities. So they need to invest overseas,” he noted. “I would say, this is the key challenge for insurance companies in Asia in general.”

We see more countries and jurisdictions moving towards more advanced risk-based solvency regimes. And under these regimes, they typically try to avoid ALM mismatch risks that are not really rewarded.

Thomas Gillmann, DWS Group

Taiwan focus

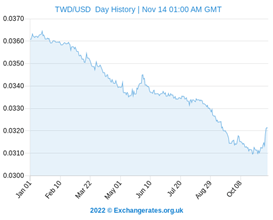

In the region, the problem is more pronounced among Taiwanese insurers because of their exposure to foreign currency-linked assets. Taiwan’s insurance regulator, the Financial Services Commission, had in March last year, relaxed the foreign investment limit for insurers from 35% to 40%.

“Over the years Taiwanese life insurers have increased their foreign currency investments to reduce the duration mismatch, due to inadequate domestic supply of long-term fixed income assets. In the process, the severity of duration mismatch has reduced but that of currency mismatch has increased,” said Anthony Lam, associate director of insurance at Fitch Ratings.

DWS’ Gillmann added: “What we see right now, for example in Taiwan, the yields in the US have increased quite significantly, while the yields in Taiwan dollar have not increased that much, there is an imbalance between assets and liabilities — the value of assets has decreased a lot while the value of liabilities has also decreased, but not that much.”

When insurers, especially life insurers, sell policies that tend to be long-dated for liability-matching assets, they by nature still invest into long-duration assets to match the interest rate sensitivity of longer-dated liabilities.

As insurers issue policies in local currency and invest in foreign currencies, asset currency mismatches are introduced to the book over time. If the currency of the assets depreciates as interest rate increases, the insurance company would not be able to pay its liabilities if it does not hold enough equity to absorb the currency loss.

“Insurance companies often don’t see value in these particular risks,” said Gillmann.

Taking action

In addition, the solvency regime also encourages stricter asset liability management, because under these regimes, in particular, currency risk, as well as interest rate mismatch risks are subjected to a very punitive capital charge.

Gillmann added, “We see more countries and jurisdictions moving towards more advanced risk-based solvency regimes. And under these regimes, they typically try to avoid ALM mismatch risks that are not really rewarded.”

Macroeconomic realities have been reshaping insurers’ approach to products. With high capital charges chipping away at their solvency ratios, insurers are shifting towards more capital-light products.

“They are shifting from traditional guaranteed products to investment-linked products, because for these products, they don’t have to hold significant capital for the investment risks, because the investment risks are basically borne by the policyholders and not by the insurance company,” said Gillmann.

-

Forget the noise, geopolitical tensions demand scenarios not predictions

- February 20

Hoe-Yeong Loke, head of research at UK risk management association Airmic, tells InsuranceAsia News rare earth minerals and tensions around Taiwan are likely to remain pressing issues for Asia and the global supply chain.

-

Does Zurich’s US$11bn Beazley deal signal the end of the Lloyd’s listing experiment? Survivors are now in the spotlight

- February 16

Deal will leave only two Lloyd’s players – Hiscox and Lancashire – listed on the London Stock Exchange, with capital-rich Japanese insurers expected to be amongst those circling.

-

Resilience’s the word: calls for strategic shift, and it’s no longer optional

- February 13

Resilience has shifted from an operational buzzword to a strategic boardroom imperative, risk management organisation Airmic says.

-

‘Positive and progressing well’: P&I renewals slow and steady amid moderate increases, member loyalty

- February 12

Skuld, Shipowners' Club, Steamship Mutual, Britannia P&I Club and West P&I speak to InsuranceAsia News ahead of the 2026 renewals.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital