There’s no question that in a tough global environment, Asia Pacific remains a region of growth and opportunity. The kind of slowdowns anticipated in Europe and the US look less likely here. Perhaps as a result, there’s also a sense that inflation will remain relatively contained thanks to factors like the region’s more restrained stimulus in response to Covid-19, generally less tight labour markets and key position in global supply chains.

But Asia is not immune to economic challenges and there is a strong argument for more caution around the inflation outlook. Only a clear-eyed and realistic assessment of its impacts will ensure we can continue to mitigate risk and address the region’s protection gap challenges, while safeguarding a sustainable (re)insurance industry.

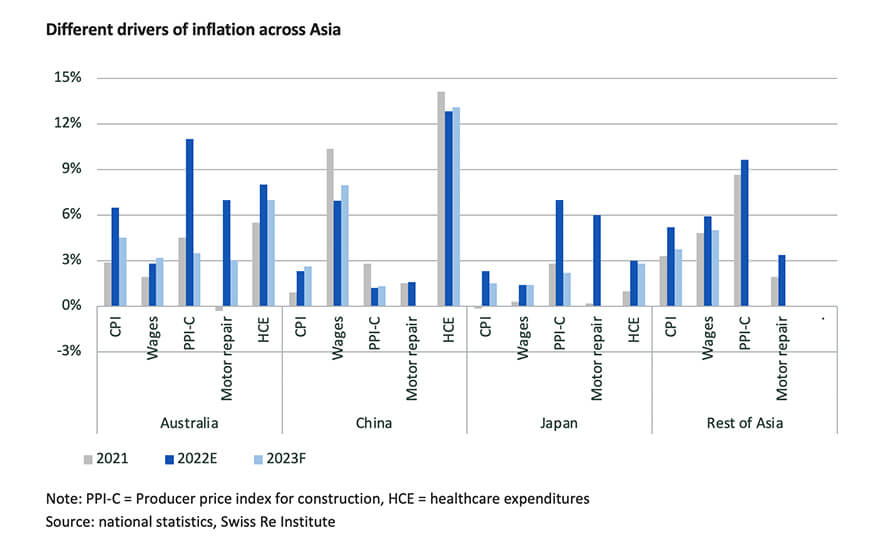

We see headline rates of inflation remaining relatively lower in APAC compared to other advanced markets, but rising costs are here to stay. Following the US Federal Reserve, some markets like New Zealand and Korea have just experienced the fastest interest rate hikes in more than a decade in their effort to fight inflation and rein in the interest rate differential with the US. Some underlying drivers of inflation, however, are more structural and harder to abate in nature; and policymakers must also take into consideration imported inflation and the lagged impact of a strong US dollar.

There are troubling spikes in some individual components of inflation emerging across the region. In Australia, for example, construction costs continue to rise at record rates, which will have a direct impact on the construction sector.

(Re)insurers should brace for impact

We need to be cognisant of, and prepare for, the knock-on effects on the (re)insurance sector. If we don’t take swift action to reprice for inflation, we’ll struggle to catch up, and to manage risks and provide coverage for businesses and consumers over the long term.

We are seeing demand surge turbo charge claims inflation. This is particularly prevalent as catastrophe events across the region continue to rise, increasing the cost of repair or replacement of damaged property, when many individuals and organisations vie for a limited supply of labour and materials.

As an industry, we must enter a period of adjustment across the entire value chain to ensure we fully account for volatility, and don’t simply absorb higher risks that could haunt us later.

When it comes to the impact of inflation. this applies across all structures. For non-proportional contracts, inflation increases the indexed value of historical losses. When retention is held constant, this increases the frequency and size of losses that are ceded into reinsurance treaties, and hence impact non-proportional treaty pricing. For proportional contracts, fixed-commission treaties become less economical if insurers are not able to adequately adjust the primary rate for claims cost inflation.

The confluence of increasing claims inflation and material mismatch in the demand-supply of reinsurance capacity means that reinsurance pricing needs to rise to reflect this. This particularly applies in an inflationary environment with a higher probability of market or disaster-driven shocks. Historical loss models should be updated to consider both changing assumptions about primary and secondary perils and the impact on insurance claims. Excess of loss costing will change, and margins will need to improve to reflect additional downside risk or volatility – and so the capacity to pay claims is maintained.

Retaining capacity

This recalibration will be a delicate, at times difficult, process. But given the current situation, the pain of inaction could be even greater. (Re)insurers must also remain financially sound to ensure the capital that underpins our ability to help our clients manage risks remains sustainable.

Instead of indifference, or inaction, I call on the industry to confront inflation and the new risks that arise in its wake with level-headed evaluation. APAC is not alone in this struggle: whether the effects of climate change, the Ukraine conflict or supply chain disruption, the challenges exacerbating risks and costs are global. Similarly, reinsurance capital is a global commodity, and we should view our efforts as part of a concerted global response.

Amid this volatility, insurers should be thinking about how they are going to compensate themselves for the risks they take. In our discussions, our message to insurers is primary pricing must respond; anticipate change in reinsurance programmes by increasing retentions and engaging early to avoid missing out or paying a heavy price.

This article was written by Mark Senkevics, Swiss Re’s Head of Property & Casualty Underwriting for Asia, Australia & New Zealand.

-

AI: Complexity mismatch amid the case for augmenting the investment office

- January 21

With prudent oversight and strong guardrails, an augmented investment office can allow insurers to confidently ride the private credit boom without being undermined by the complexity they have embraced.

-

Marine: Amid backlogs and breakdowns, Covid-19 maintenance delays put vessel safety at risk

- December 9

Asia is at the sharp end of a hidden maritime risk, with post-pandemic machinery-related losses becoming an even more significant issue.

-

W&I: Balancing growth, commerciality and sustainability in Asia Pacific’s W&I market

- November 6

Warranty and indemnity (W&I) insurance is now being utilised with increasing frequency across a far broader range of deal sizes and geographies in the region.

-

Nuclear: Insurance sector’s role in the region’s nuclear renaissance

- October 21

The biggest driver of nuclear expansion in Asia is the massive increase in power demand from data centres, while the real transformation will be driven by small modular reactor technology.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital

Mark Senkevics, Swiss Re

Confronting inflation to avoid playing catch up at renewals

Mark Senkevics, Swiss Re