Full capacity: Buffett touts Berkshire’s insurance edge as he calls time

May 10 2025 by Mithun Varkey

Welcome to Full Capacity, a weekly briefing on all the most important developments of the past week with a personal take on the news from our editor-in-chief, Mithun Varkey, delivered to your inbox every Saturday.

Lloyd’s. Nearly four months after John Neal announced his plans to step down as CEO of Lloyd’s and join Aon, the Council of Lloyd’s has announced a replacement in Patrick Tiernan.

Tiernan has been the chief markets officer for Lloyds and, as we had flagged up in November, was seen as the leading internal candidate for the CEO role.

Spotlight. Despite a global leadership shake up and a subsequent organisational restructuring, Markel said Asia remains firmly in its sights as it views the region as a significant opportunity under its new structure.

Former Lloyd’s Asia managing director Simon Wilson, who took over as the CEO of Markel Insurance in March, said the changes were “an initial step to have the divisional structure and leaders to equip and empower local experts”.

Meanwhile, the Lloyd’s underwriter’s search for a successor to Christian Stobbs is still continuing.

IAN insight. Munich Re Specialty – Global Markets, Syndicate in Asia, the Lloyd’s arm of Munich Re, said it was making significant strides in diversifying its offerings to cover complex risks, such as cyber and fine art and specie, in addition to its recent focus on renewable energy.

What was once a traditional marine operation focused on several oil and gas projects has transitioned to a cleaner and greener beast with a leading regional renewable energy book.

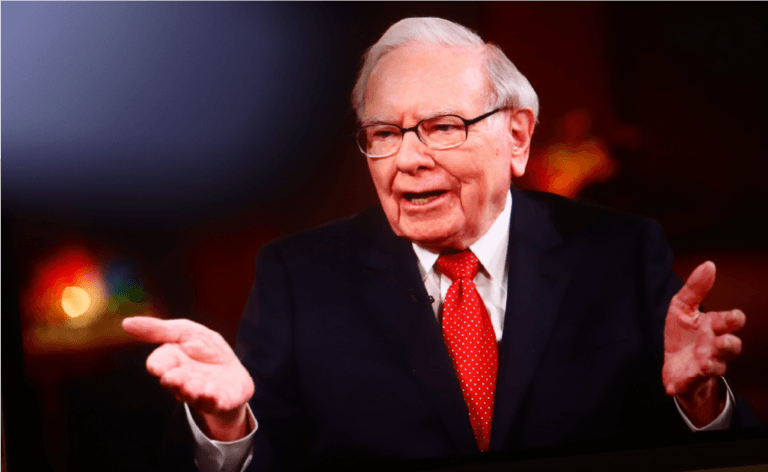

Buffett bows out

Warren Buffett, the “Oracle of Omaha”, whose investment wisdom shaped generations, announced his retirement earlier this week at Berkshire Hathaway’s annual meeting.

At 94, the billionaire declared it was time to step aside, handing the reins to longtime heir apparent Greg Abel.

Though his succession plan had been in place for four years, the timing of Buffett’s departure seemed to catch many off guard, including Abel himself and Wall Street investors. The following day, Berkshire’s shares dipped by 5%, a testament to Buffett’s irreplaceable aura.

Speaking to investors, Buffett underscored the brilliance and importance of Berkshire’s insurance empire.

“Property-casualty insurance is a rare business,” he mused. “You need capital as a guarantee fund that you will keep your promises, but you can use it to buy other low capital-intensive businesses. You can buy Apple and have it support that business.

That can be a pretty good business and it’s one of the reasons we’ve done well over time.”

He was also clear about Berkshire’s edge in the insurance business.

“There is no property and casualty company that can basically replicate Berkshire,” he insisted. “Prices are down this year, and risks are up this year. But we do have unusual advantages in the insurance business that can’t really be replicated by our competition.”

When asked about AI’s looming disruption, Buffett emphasised his unshakeable faith in his vice-chairman and head of insurance business Ajit Jain.

In response to questions about the impact of AI on the insurance industry, Buffett said he “wouldn’t trade everything that’s developed in AI in the next 10 years for Ajit.”

The future now rests in the hands of the newly appointed CEO, Abel, the low-key operator who’s spent years steering Berkshire’s sprawling non-insurance empire. It will be fascinating to see how he stewards the business and the legacy as he steps into the spotlight.

War brewing in South Asia

After Indian missiles struck what was described as Pakistani “terror infrastructure” on Tuesday, long-standing tensions between the two neighboring nations erupted.

As the two nuclear powers exchanged fire, the specter of a full-scale conflict looms, raising alarms about the potential ramifications for war insurance.

This situation compounds the array of geopolitical challenges already heightened by the ongoing Russia-Ukraine conflict and the turmoil in the Middle East.

For now, the India-Pakistan dispute seems to be confined to the Himalayan region of Kashmir, with minimal immediate impact on the Indian mainland.

However, the closure of airspace between the two countries has disrupted commercial aviation, potentially driving up insurance costs as aircraft and shipping routes are forced to reroute.

Additionally, the suspension of the Indian Premier League – a two-month cricket extravaganza showcasing some of the world’s top talent – could significantly affect underwriters involved in this multi-billion-dollar event.

As the situation unfolds, underwriters may face upward pricing pressures and could see some capacity pulled from one of the fastest-growing insurance markets in the world.

People Moves

Allianz Trade, this week, announced that its incumbent Asia Pacific CEO Paul Flanagan is retiring and that he will be succeeded by Rodrigo Jimenez. Jimenez, who is currently based in London, will begin a three-month transition period from July 1 and officially take over the helm on October 1.

Chubb has handed Titus Samuel an expanded role as head of power and construction for Asia, having been the head of power generation and utilities at the insurer since 2017.

Paul Schappacher has returned to AIG as a senior underwriter for commercial property in Australia.

Check out our wrap up of the most important people moves from the insurance industry in Asia this week.

-

Full Capacity: APAC insurance M&A gains momentum

- February 21

This week's newsletter discusses Swiss Re's acquisition of QBE's trade credit and surety arm, Sompo's clearance to acquire Aspen, two M&A deals, HDI's Southeast Asia focus, ARPC's terrorism retrocession program and APAC’s M&A growth.

-

Full Capacity: AI‑led insurtech: revival or recalibration?

- February 14

This week's newsletter discusses a Lloyd's leadership update, M&A updates, Vietnam's odd rate increase, Marsh's insurance rates, Willis’ crisis management annual review and insurtech's AI-led future.

-

Full Capacity: ElementaRe: Approaches to solving the protection gap

- February 7

This week's newsletter discusses an Aviso's Lockton raid, a new MGA in Australia, a Zurich-Beazley update, Marsh's insurance rates, Asia's facultative cover and Australia's approach to a broken insurance market.

-

Full Capacity: Reinsurers rev up with casualty sidecars

- January 31

This week's newsletter discusses an IAN Exclusive, AUB's M&A deal, an Australian nat-cat update, VIG Re's expansion, space debris and the casualty sidecars.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital