-

- November 7 2025

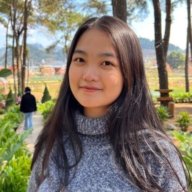

Philippines, Vietnam facing ‘100s of millions’ of losses from Typhoon Kalmaegi: Aon

Officials in the Philippines also warn of Typhoon Fung-wong, which is expected to develop into a super typhoon by Saturday.

-

- November 6 2025

SIRC: Verisk eyes expansion of hail risk solutions to Japan

The data analytics provider will also roll out its flood models for Australia and New Zealand in 2027.

-

- November 6 2025

SIRC: Reinsurers continue to be bottom-line focused: AM Best

Q&A with AM Best’s Christie Lee, senior director, head of analytics and head of North East Asia, and Victoria Ohorodnyk, director and head of analytics for Southeast Asia, Australia and New Zealand.

-

- November 6 2025

SIRC: Motivated market drives appetite for alternative structures: Gallagher Re’s Jones

With both insurers and reinsurers pursuing growth, the broker expressed a strong sense of optimism for clients during the 1.1 renewals.

-

- November 5 2025

SIRC: Not just capital: Hanoi Re in active discussions with strategic investors to grow business in Southeast Asia and beyond

Hanoi Re will also look to strengthen its core non-life treaty portfolio, especially property, engineering and marine, while developing specialty and liability.

-

- November 5 2025

SIRC: Satellite disaster management specialist seeks new heights in APAC after building Japan foundation

Kohei Watanabe, strategic account manager for APAC, says ICEYE has operationalised flood monitoring in Taiwan, Thailand, and India and continues to expand across Asia.

-

- November 4 2025

SIRC : Demand for flood, SCS data increases amid rising economic losses in APAC: Perils

Recent typhoons in the Philippines, Hong Kong and Vietnam, along with Myanmar earthquake, also drive demand for historically peak perils data.

-

- November 4 2025

SIRC: Everest Re doubles down on specialty as APAC demand rises

Demand for bespoke solutions and interest in parametric structures that deliver faster recovery and greater flexibility are growing, according to Kevin Bogardus, chief executive for Everest Re in Singapore.

-

- November 4 2025

SIRC: Reinsurance in APAC set for growth amid rising insurance demand: Malaysian Re

Reinsurers will need to continue navigating a complex risk landscape, including heightened cat volatility, evolving regulatory frameworks, and demographic shifts, says Malaysian Re’s Ahmad Noor Azhari Abdul Manaf.

-

- November 4 2025

SIRC: APAC (re)insurers face execution risks amid evolving regulatory environment: Fitch

From China’s capital charge cuts to South Korea’s revised solvency benchmarks, APAC markets are recalibrating insurance rules to balance resilience with growth.

-

- October 30 2025

Rokstone sets sail for marine growth in Asia amid regional expansion

Two weeks into the operation, the marine specialty MGA in Singapore has already started binding policies, managing director Rama Chandran told InsuranceAsia News' Between the Lines podcast.

-

- October 30 2025

Exclusive: Lockton Australia’s Patrick Moore leaves for Aviso

Sydney-based Moore was most recently general manager for growth and client strategy at Lockton.

-

- October 28 2025

MSIG appoints Aon veteran Eric Schaap to newly created role to strengthen broker partnerships

Singapore-based Schaap has extensive expertise across broker management, risk maturity modelling, claims systems implementation, and governance-aligned analytics strategy.

-

- October 24 2025

UIB Asia Singapore’s CEO given expanded role to oversee Labuan operations

Francis Savari has been formally approved by the Labuan Financial Services Authority as principal officer of UIB Labuan.

-

- October 24 2025

Starr expands India presence with new Gift City branch

The new office will conduct both general and reinsurance business, marking an important step in strengthening Starr's commitment to the Indian market, according to the company.

-

- October 23 2025

Allianz in pole position to buy Nib Holdings’ travel business: report

Besides Allianz, two other bidders are interested in Nib Holdings' travel insurance business, according to an AFR report.

-

- October 23 2025

IAG upgrades FY26 guidance following RACQ’s acquisition

The Australian insurer now expects GWP growth of approximately 10% in FY26, up from the original 'low-to-mid single digit' range.

-

- October 23 2025

Ex-BMS head of international David Battman joins Huntington Advisory as partner

This appointment coincides with the opening of Huntington Advisory’s London office as part of its international expansion.

-

- October 23 2025

London P&I Club opens representative office in Shanghai

The new office in Mainland China is led by Wenjia Gao and reflects the club's long term commitment to Asia, according to chairman John Lyras.

-

- October 22 2025

Exclusive: BHSI faces claim after Hong Kong’s Chinachem Tower fire

Willis is understood to be the broker, while Charles Taylor is the loss adjuster.