-

- March 10 2025

Search begins for new IRDAI chief: report

Debasish Panda’s three-year term as chairperson is due to end on March 13, 2025, although applications are being accepted until April 6.

-

- March 9 2025

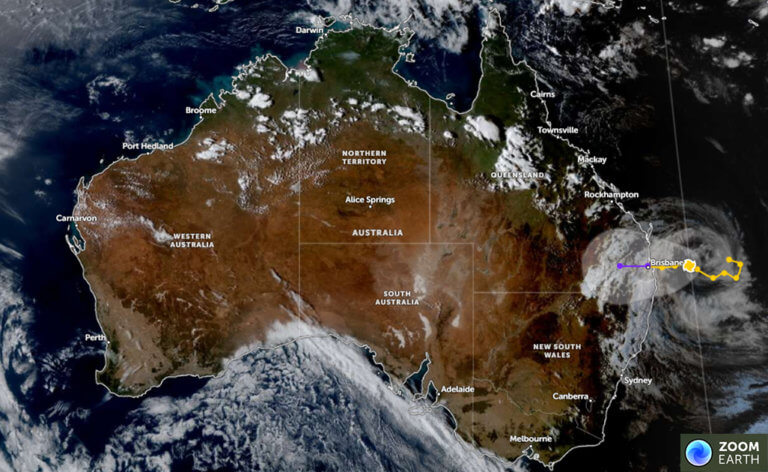

Cyclone Alfred claims top 3,000, thousands more expected in coming days

ICA declares insurance catastrophe as flash flooding, thunderstorm warnings remain with remnants of the ex-cyclone moving inland.

-

- March 7 2025

Huatai P&C underwriting to benefit from Chubb support, FY24 9M COR down to 94.7%: Fitch

The rating agency affirms the insurer financial strength rating of 'A+' (Strong), with a stable outlook.

-

- March 5 2025

Cyclone Alfred could be US$1.25bn hit on Australian insurers: S&P Global

Cyclone could be worse than some of Australia's largest nat cats in the past 10 years.

-

- March 5 2025

M Pallonji Group-led consortium applies for Indian general insurance licence: report

Group appoints Aditya Sharma, chief distribution officer at Bajaj Allianz, as CEO of proposed venture, according to the The Economic Times.

-

- March 4 2025

Allianz APAC P&C business total business volume tops US$2bn

The insurance group's regional total operating profits rose 6% to EUR795 million despite less favourable health claims experience.

-

- March 4 2025

IRDAI extends 4% obligatory cession for FY26 renewals

Cession applies to policies attaching in the FY26, and will be placed with GIC Re.

-

- March 4 2025

Mitsui Sumitomo eyes global cyber expansion with US$30m Coalition investment

Funding builds on the Japanese insurer's strategic partnerships with the cyber specialist MGA in Australia and Japan.

-

- March 3 2025

Portfolio rejig improving underwriting margins for India’s second-largest non-life general insurer: AM Best

Global ratings agency confirms financial strength rating of B++ (Good) and a long-term issuer credit rating of bbb+ (Good) for ICICI Lombard General Insurance Company.

-

- March 3 2025

Allianz Malaysia’s FY24 general insurance GWP rises 13.8% to US$775m

But insurer refrains from issuing profit forecast or guarantee for FY25.

-

- March 3 2025

Aon completes acquisition of Mitsubishi Chemical’s in-house agency business in Japan

Aon will provide corporate and personal lines insurance to MCG companies and its employees in Japan.

-

- March 3 2025

MSI to improve underwriting profitability, driven by steady rate hikes: Fitch

Global rating agency affirms insurer rating of A+ (strong) with a stable outlook.

-

- March 1 2025

Suncorp to settle class action suit over add-on sales

Settlement must be approved by the Supreme Court of Victoria, but no date has been set for the hearing,

-

- February 28 2025

Swiss Re’s 1.1 APAC renewals growth slows down

Reinsurer's 2% increase in regional premium volume this year contrasts the 5% growth reported in last year’s January 1 renewals.

-

- February 24 2025

Nepal’s Himalayan Re to generate ‘positive’ FY24 underwriting margins: AM Best

Rating agency affirms financial strength rating of B+ (Good) and a long-term issuer credit rating of bbb- (Good), with a stable outlook.

-

- February 21 2025

Samsung Fire & Marine’s expects ‘no impact’ on profits, capital after rejig: report

Samsung Life is seeking to make the South Korean non-life insurer its subsidiary and clarified that it has no plans to expand its holdings.

-

- February 20 2025

India’s insurance regulator forms committee to review proposed reforms: reports

Committee, which has already held its first meeting, is being led by former State Bank of India chairman Dinesh Khara.

-

- February 20 2025

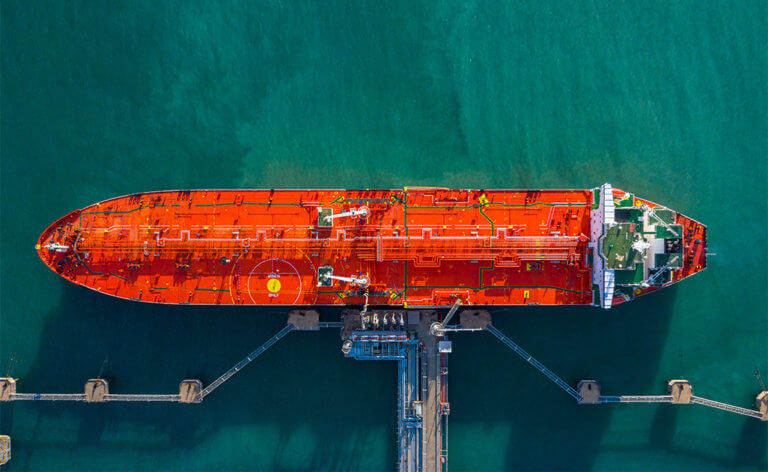

Underwriting performance of P&I clubs likely to fall in FY25: AM Best

P&I clubs are likely to seek further price improvements in the February 2025 renewal, making it the sixth consecutive year of general increases.

-

- February 18 2025

AIG Japan in good stead with robust capitalisation, liquidity: S&P Global

Rating agency upgrades outlook from stable to positive, while affirming A+ rating.

-

- February 17 2025

Seoul Guarantee scales down IPO valuation by 39% to US$1.5bn: reports

Korean surety and credit insurer reduces its expected offer price range to US$18-22 per share from US$27-36.