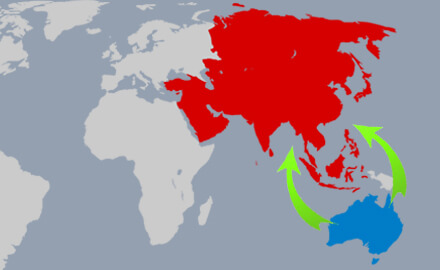

Australia’s brokers target Asia

May 20 2020 by Andrew Tjaardstra-

Howden Australia appoints Eliza Grant as head of M&A insurance

- June 30

Sydney-based Grant previously worked at Marsh for four years, most recently as head of transactional risk for private equity and M&A services for the Pacific.

-

Willis taps Marsh’s Daphne Duan to lead Asia SRC practice

- June 30

Singapore-based Duan previously headed the reserving teams at AXA Partners and Argo Group in London.

-

Australia’s Clearlake Insurance to buy Logan Insurance Brokers

- June 27

Acquisition is due to take effect on Monday, expanding Clearlake’s footprint across New South Wales and the broader Australian market.

-

Bridge Specialty taps Chan Hon Kian as head of trade risk for Singapore’s Acorn International Network

- June 26

Chan brings over 18 years of experience in credit insurance, having worked for Howden Insurance Brokers, Lockton and Aon.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The carrier proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.