Full capacity: Atlantic hurricane casts tempestuous forecast

May 24 2025 by Mithun Varkey

Welcome to Full Capacity, a weekly briefing on all the most important developments of the past week with a personal take on the news from our editor-in-chief, Mithun Varkey, delivered to your inbox every Saturday.

Leadership shake-up. AIG’s Australia has promoted Kathleen Warden as general manager for Australia with CEO Grant Cairns departing.

Cairns is understood to be joining hands with former Steadfast COO Nigel Fitzgerald to launch an underwriting business.

Nat cat brief. In what has been labelled a “one-in-500-year” flood event, Manning river in Australia’s New South Wales broke an almost 100-year record.

Significant claims are anticipated as the region battles flooding that has “smashed through” communities in the region.

IAN Insight. In a blunt warning, incoming Lloyd’s CEO Patrick Tiernan has told syndicates that blunt instruments rather than surgical tools would soon be needed if they fail to trim their expectations as rates soften.

“If we want to ensure a soft landing, then we need to plan from the top. At present, our data gives us cause for concern but not alarm,” he said.

Lloyd’s CUO Rachel Turk said: “The market can best be described as fragile. Talk that rates are down 10-15% is apocryphal.”

“Sentiment has shifted. It is now more negative. There is a view that there is a cause for concern,” she added.

Between The Lines. Make sure you catch the latest episode of our fortnightly podcast. The latest edition features an interview with Helen Ye, CEO and founder of Hong Kong-based MGA Qubit Underwriting, where she discusses the evolving MGA market and trends in the crypto insurance world.

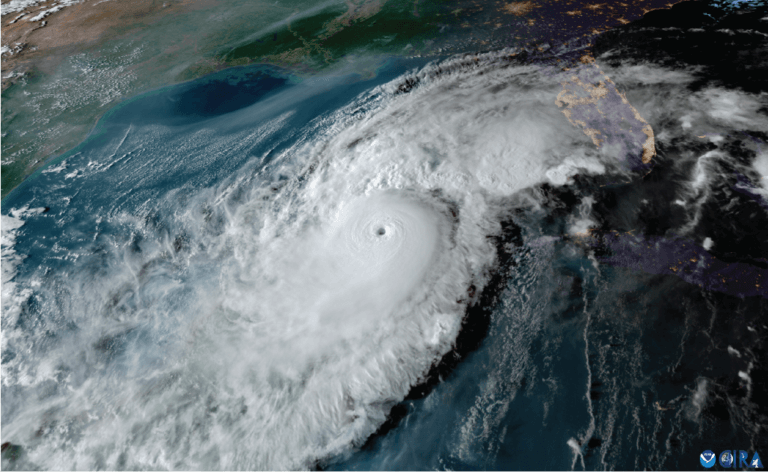

Active hurricane season bears on North Atlantic

As the reinsurance markets race to close the all-important 1.6 Florida renewals, Guy Carpenter is ringing the alarm bells for an active 2025 North Atlantic hurricane season.

The broker has warned property (re)insurers to remain prepared for potentially impactful landfalls, regardless of seasonal expectations.

Meanwhile, the National Oceanic and Atmospheric Administration’s (NOAA) outlook for the 2025 Atlantic hurricane season, which goes from June 1 to November 30, predicts a 60% chance of an above-normal season.

The agency is forecasting a range of 13 to 19 total named storms (winds of 39 mph or higher). Of those, 6-10 are forecast to become hurricanes (winds of 74 mph or higher), including 3-5 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher). NOAA has a 70% confidence in these ranges.

The high activity era continues in the Atlantic Basin, featuring high-heat content in the ocean and reduced trade winds. The higher heat content provides more energy to fuel storm development, while weaker winds allow the storms to develop without disruption, according to NOAA.

Guy Carpenter said total named storms are forecast to be well above average for the 1950-2023 period, and above average compared to the elevated hurricane activity seen between 1995-2023.

What’s fuelling this tempestuous forecast? Above-average sea surface temperatures in the Gulf of Mexico combined with the potential transition to La Niña conditions.

Though sea-surface temperatures are substantially lower than 2024, the North Atlantic is still the third warmest on record.

NOAA is estimating a 30% chance of La Niña making an appearance, which could crank up the activity as the season unfolds. And don’t expect the dampening effects of El Niño this time around.

NOAA’s national weather service director, Ken Graham. “This outlook is a call to action: be prepared. Take proactive steps now to make a plan and gather supplies to ensure you’re ready before a storm threatens.”

People Moves

Axa XL has handed Jamie Chambers an expanded role as CEO for greater China. He will take over from HaoMing Zhou, who is retiring.

The specialty (re)insurer has also appointed Tavpraneet Singh as CUO for international financial lines for APAC and Europe.

AIG has a new CEO in Thailand, with Chubb’s Thanathon Kiratipasuk joining the insurer.

Howden continues its M&A insurance team expansion in India with the appointment of Marsh’s Shreya Iyer as co-head of transactional risk.

Do check out our weekly people move round-up to stay up to speed on the most important appointments in the region.

-

Full Capacity: AI‑led insurtech: revival or recalibration?

- February 14

This week's newsletter discusses a Lloyd's leadership update, M&A updates, Vietnam's odd rate increase, Marsh's insurance rates, Willis’ crisis management annual review and insurtech's AI-led future.

-

Full Capacity: ElementaRe: Approaches to solving the protection gap

- February 7

This week's newsletter discusses an Aviso's Lockton raid, a new MGA in Australia, a Zurich-Beazley update, Marsh's insurance rates, Asia's facultative cover and Australia's approach to a broken insurance market.

-

Full Capacity: Reinsurers rev up with casualty sidecars

- January 31

This week's newsletter discusses an IAN Exclusive, AUB's M&A deal, an Australian nat-cat update, VIG Re's expansion, space debris and the casualty sidecars.

-

Full Capacity: Is Zurich’s pursuit of Beazley a tipping point for specialty consolidation?

- January 24

This week's newsletter discusses two IAN Exclusives, Vietnam's AlphaRe, data centres and the Zurich-Beazley deal.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital