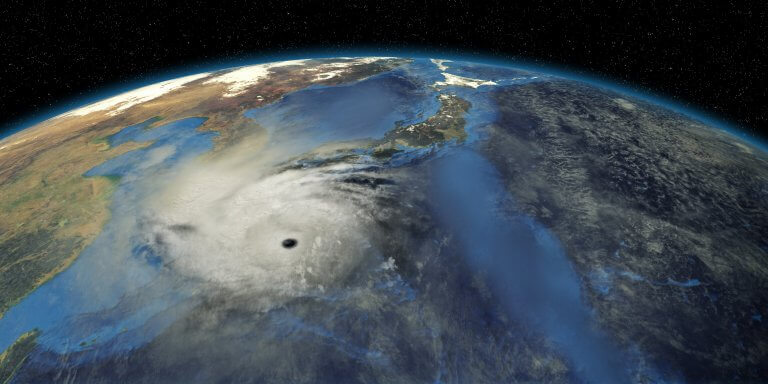

Asia 2020 nat cats brought US$95bn in economic damage

January 27 2021 by Yvonne Lau-

Heavy rain, strong winds brings state of emergency, disruptions to central New Zealand

- February 16

States of emergancy have been declared in five districts and 30,000 properties have reported power outages as a result of the extreme weather on the North Island.

-

Heavy rain, strong winds brings state of emergency, disruptions to central New Zealand

- February 16

States of emergancy have been declared in five districts and 30,000 properties have reported power outages as a result of the extreme weather on the North Island.

-

IAG’s net profit falls 35% in H1 following Queensland hailstorms

- February 12

IAG's underlying underwriting results remained resilient across the first half of FY26, despite losses from the hailstorms in Queensland.

-

ARPC declares end of ex-Tropical Cyclone Mitchell

- February 11

It is the seventh of Australia’s storm season after tropical cyclones Fina, Grant, Hayley, Jenna, Koji and Luana.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital