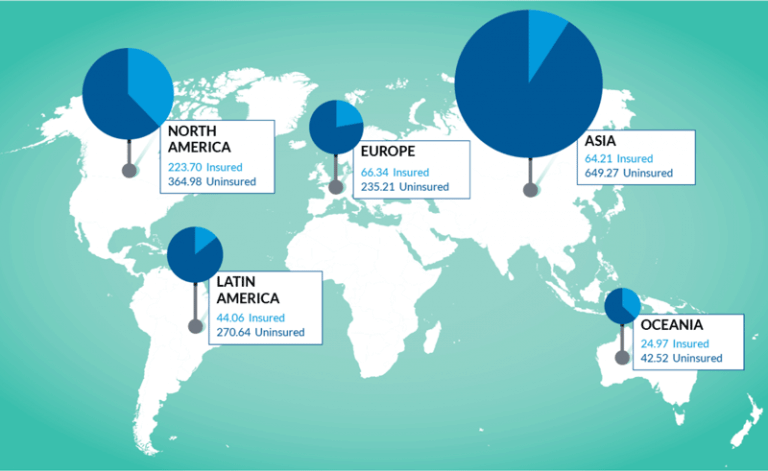

Asian protection gap is world’s biggest

November 30 2018 by Nick Ferguson-

APAC’s block life reinsurance market to thrive amid regulatory changes and capital optimisation, but oversight looms

- June 30

Japan has been home to some of the larger deals, but demand is also seen in the likes of Hong Kong, Singapore, South Korea and Taiwan.

-

Insuring prosperity: APAC’s dynamic fine art and specie market in the frame as risk landscape, extreme weather drive demand

- June 26

As China's influence wanes, markets like Japan, South Korea, and Singapore are gaining traction, with family offices and new private museums in nearby regions driving demand for coverage and competition.

-

In unique Asia, underwriters look to stay dialed amid ‘unprecedented wave’ of cyber attacks

- June 24

A surge in cyberattacks is likely behind a 14% rise in large cyber claims in Asia during the first half of last year, with a new report shining a light on attacks on the financial services sector.

-

Strait of Hormuz tanker collision highlights dark fleet dangers, but not seen as war event

- June 19

Adalynn and Front Eagle collided on Tuesday in the Strait of Hormuz amid the ongoing tensions between Iran and Israel.

-

Allianz General | Allianz General combines innovative protection solutions while powering social good to lead Malaysian market

The carrier proactively addresses emerging risks and evolving customer protection needs while giving back to the community.

-

Sedgwick | Asia’s Energy Transformation – Balancing Growth, Risk and Renewables

Energy market presents unique risks, especially in a region which includes China and Japan as well as developing nations like Vietnam and the Philippines.

-

Beazley | Turbulent Waters: the maritime energy transition challenge

Businesses are facing a complex transition to non-carbon energy sources amid a push to achieve net-zero emissions for the marine sector by 2050.

-

Aon | Navigating shifts in the global and Asia insurance markets

Neelay Patel, Aon head of growth for Asia, says the market in Asia is at an ‘interesting stage of the cycle’.