In 2017, Asia Pacific experienced a relatively benign loss year as total insured losses amounted to less than 5% of global insured losses. This is in stark contrast to 2011 when the Christchurch and Tohuku earthquakes and Thai floods ballooned the region’s losses.

Total global insured losses from natural catastrophes and man-made disasters, however, increased to a record level (US$144 billion) and economic losses (insured plus uninsured) were the second highest on record after 2011. 2017 not only served as a sharp reminder of the devastation that can be caused by severe weather events, but also provided the reinsurance industry with its first real test of resilience since 2011.

The sector has, however, also undergone significant change since then, with the continued inflow of new capital from third-party investors. The low-interest rate environment and the attractions of un-correlated risk of reinsurance have been persuasive arguments for investors who have flocked to an already over-capitalized marketplace.

At the same time, many capital providers have been seeking to expand their footprint in Asia as a way of optimizing their portfolios through increasing exposure to non-peak regions and perils. Consequently, most reinsurers have been employing some form of diversification benefit in their pricing models – the lower the correlation a catastrophe contract can bring is reflected in a lower capital requirement and, as a result, a lower price.

This decrease in pricing has occurred in spite of increasing exposures over the same period. After the global losses of 2017, it is logical to argue that the price of Asia’s diversification benefit should be a contribution to the ‘diversification cost’.

This should not merely be a question of obtaining payback after losses but also a return to a more risk-commensurate level of pricing. Reinsurance remains one of the most effective ways for insurers to manage capital and protect themselves against earnings volatility. Pricing must, nevertheless, be technically adequate for this to remain sustainable.

Exposure and Economic Growth

More importantly, the reinsurance industry has a significant role to play in helping expand growth in Asia. Reinsurers can help address the acute problem of under-insurance by collaborating with primary insurance companies, not just from a capital standpoint, but also by offering customized solutions to provide disaster relief.

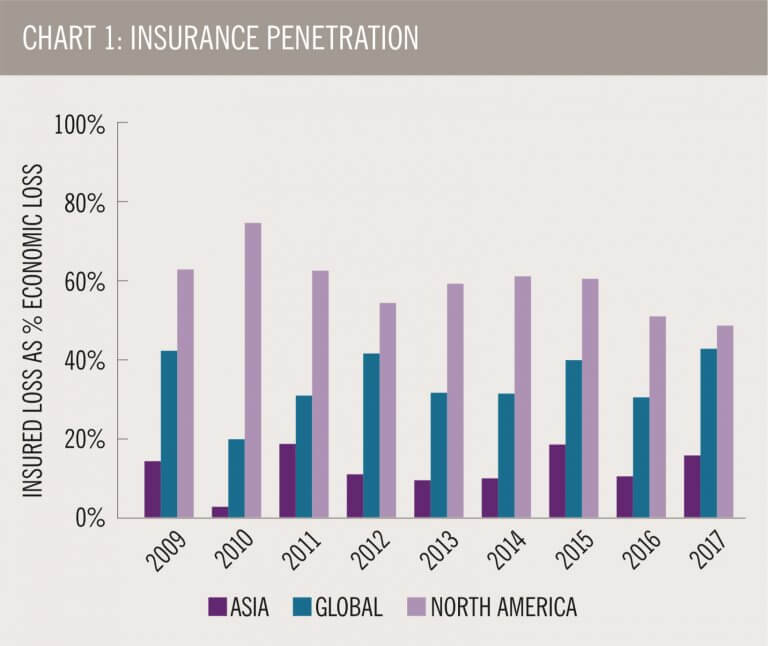

Such action should help increase penetration in the region and close the yawning protection gap. As shown in Chart 1, insured losses relative to the total loss has remained low and in 2017, just 16 percent of the region’s economic losses were insured – significantly below the global total and more developed markets such as North America.

Source: Swiss Re sigma and Aspen Re

Exposure in the region is still rapidly increasing and, as highlighted at the 2017 Institute Catastrophe Risk Symposium, Asia has a ‘serious problem’. Over the last 20 years, Asia has accounted for almost half of the world’s economic losses from natural disasters. The United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) confirmed this trend over a longer timescale. Since 1970, Asia Pacific has become increasingly exposed to natural catastrophes, both in terms of frequency of events and severity of damage, compared with the rest of the world and the gap has been widening.

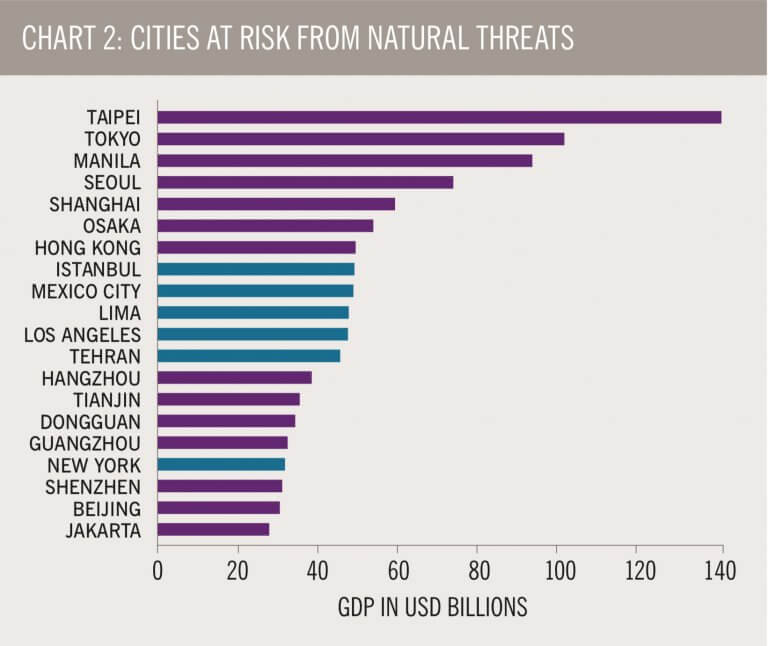

The region’s rapid population growth coupled with socio-economic development and urbanization has increased the exposure of people and assets to natural perils. Cities have expanded with the migration of people from rural areas, resulting in a growing concentration of GDP in coastal areas which carry higher exposures to tropical storms and flooding. Chart 2 shows that 14 of the world’s top 20 cities, as ranked by GDP and which are considered at risk from the threat of natural hazards, are situated in Asia. This includes those ranked one to seven – with a combined US$785 billion GDP – considered at risk in the 10-year period until 2025.

Source: Lloyd’s City Risk Index 2015-2025; Aspen Re

The impact of climate change on these coastal areas is a real concern. Over the past century, Asia-Pacific has experienced warming trends and greater temperature extremes. Climate change could explain the notable rise in the frequency of periodic weather events such as heatwaves, floods, cyclones and droughts. Similarly, the increasing value of earthquake damage is evidence of increased risk concentration as people with more valuable properties are residing in earthquake-prone areas.

Increasing Resilience

The 32nd ASEAN Summit of April 2018 was hosted by Singapore under the themes of “Resilience and Innovation” and included discussion about the region’s disaster resilience capabilities. Singapore’s Natural Catastrophe Data and Analytics Exchange, led by the Institute of Catastrophe Risk Management at Nanyang Technological University in conjunction with the Monetary Authority of Singapore, is one such initiative that has already been launched (April 2016), with the aim to share and improve the region’s catastrophe risk data, especially economic exposure data.

Support and expertise in terms of this big data initiative is needed from all within the industry including (re)insurers, brokers and catastrophe modelling firms. Through greater cooperation from all interested parties, natural catastrophe data, including economic loss and exposure, together with drone and satellite data, can be aggregated and analyzed to create a comprehensive regional database of Asia Pacific natural catastrophe risk.

Rising asset values and increased urbanization, including the mega-cities in coastal regions as well as the impact of climate change, suggest that a major catastrophe is a very real threat. Initiatives such as the South East Asia Disaster Risk Insurance Facility have been formed to provide disaster risk financing and insurance solutions. Micro-insurance and public-private partnerships are also looking to close the protection gap and the reinsurance industry has a part to play.

Initiatives and Innovation

The emergence and future use of insurtech should accelerate insurance penetration and a number of regulators across the region, including Singapore, have been setting up regulatory ‘sandboxes’ to encourage Fintech innovation. This should offer potential for (re)insurers to not only introduce technological enhancements to the traditional value chain, but also to act as distribution ‘conduits’ for insurtech companies. The region’s emphasis on digital connectivity and innovation, as well as the China Belt and Road initiative, will undoubtedly bring new growth opportunities in specialty lines such as cyber, construction, surety, liability and cargo.

The reinsurance industry’s call to arms is based on improved knowledge and understanding of risk with the help of more accurate data, enhanced modelling techniques and continued development of partnerships with insurance clients, as well as regional governments, in order to ensure that (re)insurance growth keeps pace with economic development.

Philip Hough, managing director, Asia Pacific, Aspen Re, believes that the region’s diversification and growth potential calls for responsible pricing and continued improvements in understanding the region’s catastrophe risk. Provision of capital will continue to be a key function of the industry but, increasingly, reinsurers should seek to provide customized solutions for risk management which will rely on enhanced collaboration in areas such as data collation and analysis and product development.

-

AI: Complexity mismatch amid the case for augmenting the investment office

- January 21

With prudent oversight and strong guardrails, an augmented investment office can allow insurers to confidently ride the private credit boom without being undermined by the complexity they have embraced.

-

Marine: Amid backlogs and breakdowns, Covid-19 maintenance delays put vessel safety at risk

- December 9

Asia is at the sharp end of a hidden maritime risk, with post-pandemic machinery-related losses becoming an even more significant issue.

-

W&I: Balancing growth, commerciality and sustainability in Asia Pacific’s W&I market

- November 6

Warranty and indemnity (W&I) insurance is now being utilised with increasing frequency across a far broader range of deal sizes and geographies in the region.

-

Nuclear: Insurance sector’s role in the region’s nuclear renaissance

- October 21

The biggest driver of nuclear expansion in Asia is the massive increase in power demand from data centres, while the real transformation will be driven by small modular reactor technology.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital

Philip Hough, Aspen Re

Asia Reinsurance: Diversification and Growth

Philip Hough, Aspen Re