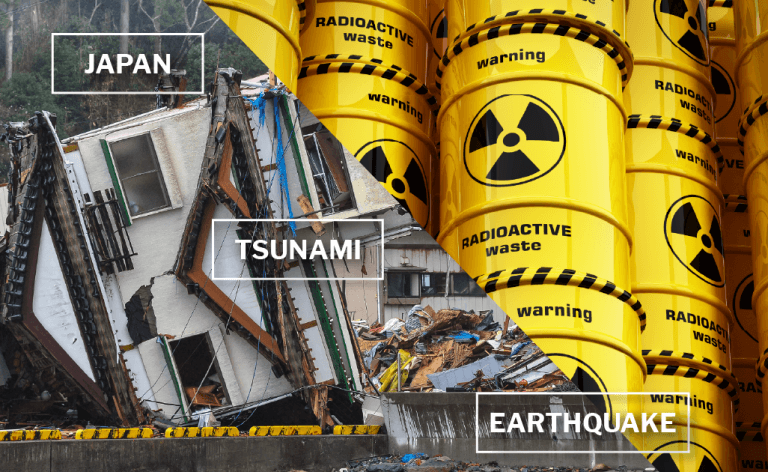

Opinion: After Russia earthquake scare, is Japan’s resurgent nuclear industry really prepared for the ‘Big One’?

August 1 2025 by Marcus Alcock-

Opinion: Australia’s approach to terrorism risk – wilfully perverse?

- February 27

Australian Reinsurance Pool Corporation purchased a reduced retrocession limit of US$1.48bn with an increased deductible of US$356m for its terrorism retrocession program despite the soft market.

-

Opinion: After what feels like forever, India finally responds to the new world of climate change catastrophe

- January 30

With reforms and policy changes, plus the allure of Gift City, India's insurance market is set for a period of robust growth.

-

Opinion: With AI risk growing up fast, be prepared for the losses as insurers get serious

- January 23

Insurance market is waking up to the rise of data centres and the simultaneous surge in demand created by advances in artificial Intelligence, but could it turn into a nightmare?

-

Opinion: Time for Asia’s fac market to hustle as infrastructure boom continues

- January 16

Projects in Vietnam, Malaysia, Thailand, China, Indonesia and Laos offer openings for the facultative (re)insurance market in 2026.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital