Peak Re leverages Hong Kong’s unique position to extend reinsurance cover to emerging societies.

Companies that specialise in reinsurance in Asia are rare, yet after just nine years Peak Re has successfully positioned itself as a professional global reinsurer with roots in Hong Kong.

Founded in 2012 with a vision to serve the needs of communities and the emerging middle class through the provision of risk solutions and services, the company has fast expanded over the years to become the 29th largest global reinsurer in terms of net written premiums.

Founded in 2012 with a vision to serve the needs of communities and the emerging middle class through the provision of risk solutions and services, the company has fast expanded over the years to become the 29th largest global reinsurer in terms of net written premiums.

As this group continues to grow, Peak Re’s portfolio is expanding to cover risks from more business lines and geographic regions.

The experience of Peak Re exemplifies the potential of Hong Kong enterprises that combine a talented team with global expertise, an ambition to deliver on its purpose and a commendable vision to supporting the needs of societies.

Reinsurance for the 21st century

As a global reinsurer, Peak Re has now a diverse portfolio across business lines and geographies, though it retains a strong focus on Asia which contributes around two-thirds of its annual premiums.

“The unique approach of Peak Re reflects our focus on modernising reinsurance while supporting growth in Asia Pacific and beyond,” said Franz Josef Hahn, Chief Executive Officer of Peak Re.

Part of this modernisation has been a focus on operational efficiency, which is highly valued by Peak Re’s clients and one of the company’s biggest competitive advantages. As of the end of 2020, its expense ratio was just 3.7% and the company boasts a six-year track record of settling more than 90% of claims within five days.

“We use relevant technology and information to assess risks and offer innovative solutions,” said Hahn. “This is illustrated in our unmatched claim settlement record.”

Since its inception, Peak Re has evolved and reached numerous milestones. In June 2020, Moody’s assigned the company a first-time A3 rating and it was named Asian Reinsurer of the Year for the fifth time in a row at the Asian Banking and Finance Insurance Awards.

Peak Re also announced the successful issuance of US$250 million of perpetual subordinated guaranteed capital securities at 5.35% in 2020 — the first public capital instrument in perpetual hybrid format issued by a Hong Kong-based global reinsurer.

In May 2020, the company completed the acquisition of 100% of the share capital of Lutece Holdings, a Bermuda-based company specialising in insurance-linked securities, and was renamed as Peak Capital Holdings.

This acquisition follows two successful sidecar placements through Lion Rock Re in 2018 and 2020, providing ILS investors with a unique, high quality and diversified portfolio of reinsurance business. Through Peak Capital, the company will explore new opportunities to innovate in the ILS space.

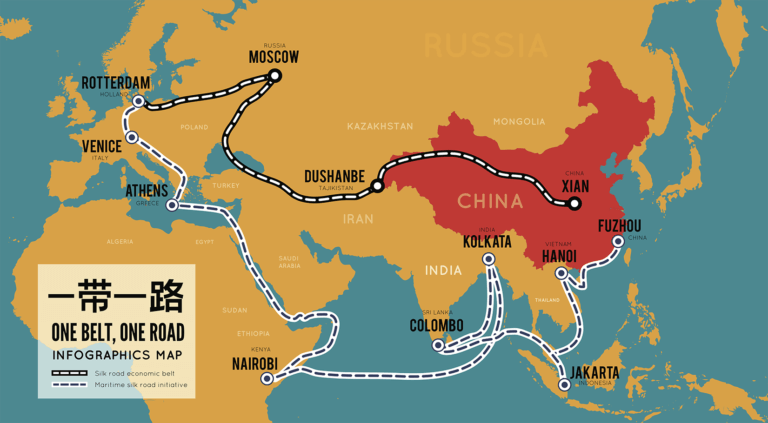

Advantages offered by the Belt and Road Initiative

With Mainland China being a major market for Peak Re, the Belt and Road Initiative (BRI) is particularly relevant. The initiative will underpin investment and infrastructure construction across multiple territories in the years to come.

“We believe Hong Kong is well positioned to help us capture BRI opportunities, and we are working to strengthen our franchise by improving our risk-screening and business portfolio management,” said Hahn.

Further, the Hong Kong government has implemented various initiatives that are beneficial to Peak Re. These include the preferential treatment granted to Hong Kong-based reinsurers regarding capital requirement under the China Risk Oriented Solvency System. This helps to improve the accessibility of mainland Chinese business for Hong Kong-based reinsurers, while the favourable tax rate at 8.25% further affords a strong competitive advantage to Hong Kong-based reinsurers.

Increasing focus on ESG

The events of the past 18 months have brought the importance of environmental, social and governance (ESG) issues into greater focus. Peak Re prides itself on being a purpose-led organisation founded to advance the (re)insurance industry and society, and continues to make ESG a major consideration in its decision making and its approach to risk management.

This was epitomised last year when the company provided risk and underwriting expertise to evaluate, structure and price a tailored insurance solution that enabled the rapid rollout of Covid-19 vaccines in the Asian market. The reinsurance solution provides coverage against severe side effects after vaccination, alleviating public concerns.

Other solutions developed during the past year have helped to mitigate pollution, encourage the adoption of renewable energies and provide critical illness insurance coverage for children with autism, as well as partnering with clients and a fintech company to develop an innovative trade credit insurance ecosystem.

Home advantage

Hong Kong, as an international financial centre at the heart of Asia, offers unique advantages for Peak Re.

“It has a large pool of talented risk-management professionals, top-of-the-class financial infrastructure and supportive government policies,” said Hahn. “Because of the global nature of our business, it is necessary that we operate as a multicultural team with knowledge of different markets. In this regard, we have found that Hong Kong remains highly attractive to overseas talent.”

After years of living in Hong Kong, Hahn admires the city’s work ethic: “People in Hong Kong have a huge capacity to execute well and get things done, and this has been a major part of Peak Re’s growth and success.”

“The unique approach of Peak Re reflects our focus on modernising reinsurance while supporting growth in Asia Pacific and beyond,”

Franz Josef Hahn

Chief Executive Officer of Peak Re

For more information:

[email protected]

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital