New KPMG Big Data – RegTech Solution transforms the Australian Insurance Industry

March 19 2021

A new KPMG risk analytics tool deployed in the Australia insurance sector has done just that

By James Collier & Briallen Cummings

There is much hype about “big data” and the newly emerging fields of “risk analytics” and “RegTech”, but neither is useful on its own. Information needs to be shared so that a complete industry data set is available. As we see it, such a shared resource needs to be combined with analytical methods that use technology to provide meaningful insights that can help companies maintain profitability while also serving the community more effectively.

A new Risk Analytics RegTech Solution developed by KPMG’s Australian firm to meet the needs of the insurance sector in Australia does just that — and it can be applied to other industries, countries and markets.

Combining forces to combat risk

In our work with companies around the region, we find that businesses are facing the multi-faceted challenges of understanding and responding to profitability pressures, increased customer expectations and a heightened risk environment. At the same time, their customers are asking for more information to inform their decision making as well as assistance in deciphering an increasingly complex product and market environment. As such, companies need to be aware of both long-term changes in their markets, immediate threats and opportunities, and how they benchmark to their competitors. However, such an awareness is challenging to achieve if information is limited to the data that an individual enterprise collects in the course of its business.

Could the solution lie in industry-driven change rather than regulatory-driven change? We at KPMG are convinced that this is the case. Regulators are asking companies to provide more information so they can get a clear picture of what is happening across an industry to detect problems. But companies themselves could benefit significantly from sharing and combining information so they can prevent problems occurring in the first place. KPMG Australia recently developed a risk analytics tool to bring data together for sophisticated analysis and benchmarking. Industry-defining solutions such as these are one of the reasons why KPMG has been recognized by external bodies for its work.

Case study: The Australian experience paves the path to collaborative data-sharing

A major step towards industry-wide data-sharing has taken place in the insurance industry in Australia, where a recent Royal Commission on the financial sector found, among other things, that insurance providers need to be more customer-focused. This was a catalyst for an unprecedented collaboration between the Australian Prudential Regulation Authority (APRA) and the Australian Securities & Investment Commission (ASIC) to look for change. While annual general institution-level statistics were already published, the regulators sought to collect, analyze and publish more detailed information: including granular insurance claims as well as acceptance and decline rates by product. This information enables consumers to make informed comparisons and identify threats to the solvency and profitability of the industry.

The insurance industry — concerned that such information might be only a small subset of available data — decided, with the help of KPMG professionals like ourselves, to collect and share a complete data set on standardized agreed definition bases. This move heralded a more tran sparent and socially responsible approach, with far more information available to independent analysts and the public.

sparent and socially responsible approach, with far more information available to independent analysts and the public.

The regulators reacted positively by agreeing to cooperate with the insurance companies and receive access to the industry report. By taking this approach, the efforts of APRA and the insurance industry are complementary, not competitive.

The basis of the new initiative is industry-wide sharing of information, which is less challenging in the insurance industry than in other sectors, as insurers typically already share much information. What is new is the sharing of far more complete and detailed information.

Collaboration between competitors for the larger good

While information-sharing between competitors has not always been welcome, there are tremendous benefits to be gained for the companies themselves. A key advantage is the ability to use data to strengthen public trust. For example, when a story about an unpaid claim for storm damage hits the media headlines, it may be useful for representatives of the insurance industry to be able to respond instantly by stating precisely how many thousands of other claims were met.

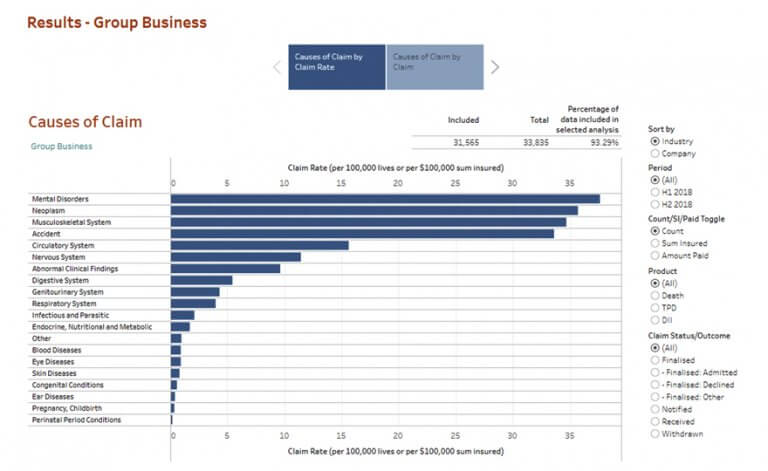

Another major benefit is the ability to be able to understand long-term trends and short-term challenges which can only be reliably deduced from an industry-wide data set, such as the changing number of claims for specific causes of mortality. This can be done more quickly by sharing information within the industry rather than waiting for the government to collect and disseminate statistics.

After discussions with the insurance companies, KPMG created a tool which enables the companies to submit their data regularly, allowing our professionals to draw sophisticated insights and then distill and distribute them quickly. As a result of the insurance industry deciding to make this a top priority, Australia now has some of the most timely insurance data in the world.

The power of data-driven insights

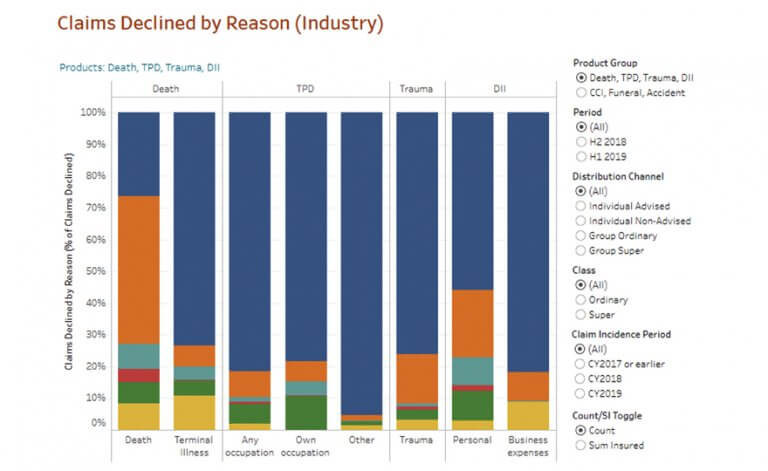

The data set compiled for the tool is highly detailed. Each life insurance company uploads details of every policy and every claim related to mortality and morbidity. The data is then validated using highly specialized automated data validation rules to ensure accuracy. The finalized data from all the companies are combined, allowing analysts to detect changes over time and establish patterns in the evolution of phenomena  such as mental illness or suicides.

such as mental illness or suicides.

The result is an online data visualization report that KPMG presents to the companies that enables them to drill down and focus on specific areas of the data relevant to their needs so they can compare their performance with that of their competitors. Are the company’s claims outcomes consistent with each other and with those of other providers? Is the company providing customers with a better or worse consumer-friendly experience than its competitors?

The result can be greatly improved customer service as well as a more rapid and effective response to changes in consumer preferences. As a consequence, public opinion will be more focused on the good practices of insurance companies and their ability to respond to customer needs, rather than on the failings highlighted in an APRA report.

Collaborating for the collective good

We are keen to stress that the results can be used not just by insurance companies to improve the policies they offer to their customers, but that they are also useful for the wider community. For example, this data can help governments to formulate better policies to deal with social problems and enable better-informed debate in the legislature. Instead of relying on patchy statistical surveys or qualitative information, such as press reports and anecdotal evidence, which may be open to challenge on the grounds of representativeness, discussants can base themselves firmly on demonstrably complete information.

A major advantage of the risk analytics tool is timeliness. Just as in the legal system, where “justice delayed is justice denied,” the same holds true in the business world. The value of information diminishes rapidly over time. The risk analytics tool produces results that previously could take three or four years to emerge, by which time the situation described in the report could have changed. This can be of great use to governments and societies when dealing with problems like the COVID-19 pandemic, where policy responses need to be rapid.

Another important feature is transparency. In the financial sector, there has to be a balance between disclosure and confidentiality. Customer information must be protected as comprehensive and anonymized data is collected, shared and analyzed. Providing as much information as possible to the public enables the industry to maximize the public’s trust in it.

The KPMG risk tool is applicable in other sectors and other countries

Transparency of aggregate data — and the trends discovered from that data — is also needed in areas other than insurance so that companies, their customers, the public and governments can use them. The next field of application might naturally be in the rest of the financial sector, where greater transparency could improve the customer experience and accelerate digital transformation; for example, in providing a more seamless, secure and convenient loan approval procedure based on analysis of past outcomes across the banking industry. The methodology used in the risk analytics tool currently used by the insurance industry is repeatable, and the skills of those involved are transferable.

Applying the tool to banking could help banks solve their problems together, based firmly on the experience of insurance companies. Other industries that could benefit from the tool include the energy and telecommunications sectors, where the systems currently in use for sharing information are cumbersome.

The Australian experience may be unique, but it need not be. The risk analytics tool can be used in other locations where industries have reached a similar level of maturity, including New Zealand, Hong Kong (SAR), China and much of Southeast Asia.

KPMG firms have the brand and breadth of risk domain expertise to spearhead this initiative because they have demonstrated the usefulness of its risk tool and they now have a wealth of industry data and a deep understanding of the industry and its operating environment. In September 2020, KPMG was named Consulting Firm of the Year by Asia Risk, recognizing the quality of its risk expertise, insights and capabilities in multiple jurisdictions across the Asia Pacific region.

The risk analytics tool is in itself unique. It allows companies to upload data and, in return, receive a

sophisticated, high-level value-added analysis that the companies could not obtain if they relied only on their own limited data set. At the same time, KPMG firms’ broad and deep knowledge and expertise allows the risk tool to be modified and deployed a range of other tools as necessary. For example, KPMG professionals have used the Hadoop big data platform to develop a more robust model for credit risk in Taiwan.

The bottom line

KPMG’s risk analytics tool provides a unique methodology for aggregating and analyzing industry-wide data to produce valuable insights for companies, their stakeholders, and the wider society, and does so quickly, so they can act promptly on the information. Extending the tool to other industries and countries where data-sharing is feasible will enable companies to prosper and to benefit the rest of society.

About the authors

James Collier is the Head of Risk Consulting for KPMG Australia and a member of both KPMG’s ASPAC and Global Risk Consulting Executives. He specializes in the use of Risk Analytics and Big Data to drive bespoke regulatory and industry solutions across all sectors.

Briallen Cummings is an Actuary and Senior Insurance Partner in KPMG Australia. She is a specialist in industry-wide data and analytics with skills covering the end-to-end data suite from data specification, ingestion, cleansing and validation through to automated analytics routines, benchmarking and visualization. She has worked across multiple countries in the ASPAC region in over ten years at KPMG.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital