From speedier claims to managing climate change to developing a pandemic response, digitalisation and data can make a real difference in the region.

By Russell Higginbotham, CEO Reinsurance Asia & Regional President, Swiss Re Asia

The world is still grappling with the Covid-19 pandemic. And while this health crisis takes its toll on individuals, families and economies around the globe, climate change continues to march on in the background, displacing people from their homes and damaging infrastructure.

Is there a way that we, in the insurance industry, can address both issues at the same time?

We know digitalisation will be a driving force for decades to come and the current pandemic has accelerated this trend. With growing demand for insurance comes rising expectations for the seamless delivery of services via digital channels that don’t just facilitate sales of insurance products.

It’s the idea of actually matching or bundling an insurance product to daily lifestyle decisions that will make digital insurance offerings more intuitive– whether it’s suggesting insuring a new home purchase against weather phenomenon anticipated in that area, offering a health insurance product based on purchasing patterns or creating a product that does both at the same time as an intuitive service.

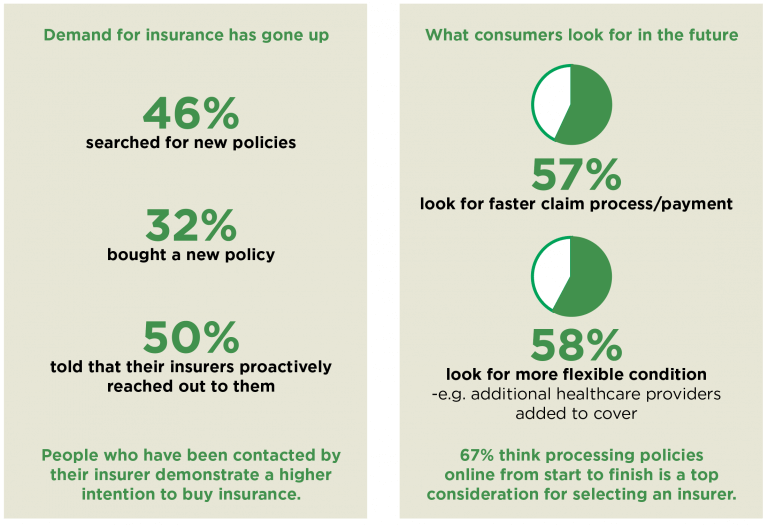

Over half of those polled in our Asia Pacific Covid-19 survey want to see faster claims processes and payments, and 67% named the ability to process policies entirely online as a top consideration in their choice of insurer – this is where digitalisation and automation is a game-changer.

Our survey confirms that the automation of claims and an efficient payout is the first step in this digital journey with the customer. But the journey goes beyond that. Where our industry needs to take this further is in anticipating risks and matching the best solution to protect against these risks, enabling people to live in a safer and more resilient world.

Predictive analytics and more proactive disaster responses could benefit millions in Asia – a region that sits on the ‘Ring of Fire’ and that has been responsible for almost all of the world’s largest earthquakes over the past century.

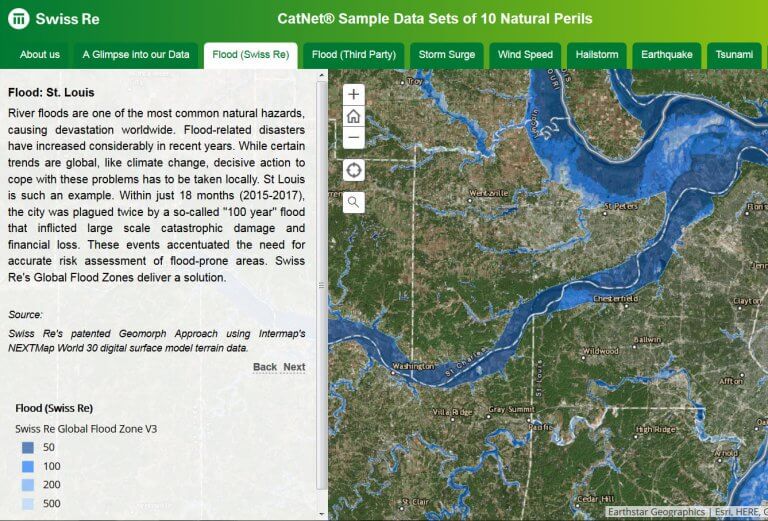

Our CatNet® tool, which provides swift overviews and assessments of natural hazard exposures; and our work with tech start-up One Concern to develop new pandemic-related solutions based on sophisticated epidemiological models are great examples of how data can inform decision-making, and help societies build, and rebuild, for the better.

Defining digitalisation’s real goals

Amid all the excitement about the new capabilities and opportunities technology will bring, it’s easy to lose sight of the people it’s supposed to benefit the most.

A recent global report highlighted research focused on four industries that have invested heavily in digital transformation – including financial services. It found that despite trillions of dollars being poured into digitalisation, just 19% of customers had noticed a significant improvement in their experiences.

In the rush to embrace technology, we can’t lose sight of the ultimate goal – to better serve customers and society as a whole. Every digital step we take should be designed for human impact and measured in terms of social outcomes. After all, insurance is not just about cash payouts when things happen, it’s about helping people get back on their feet quickly.

The first step in keeping digitalisation human-centred is to ensure it connects directly to customer needs. In property and casualty, for example, research indicates the claims process tends to be a flashpoint for customer dissatisfaction. Leveraging technology to make the claims process smoother and more efficient, therefore has the potential to pay significant dividends.

Digital can also help to reach those who were previously unreachable. A farmer in rural India may have had no desire to travel miles just to fill in forms (or do so again)when he has no idea what the actual payout will be. To facilitate that on a smartphone with a guaranteed speedy payout for lost livestock or crop has the ripple effect the market needs. The farmer is insured, and he knows how soon he will receive claims if something happens to his crops. He is able to replant quicker, and the broken food chain can resume much faster than before.

By using data to gain more insights into the customer lifecycle, we can do a better job of ensuring solutions are tailored to real-life circumstances and reach customers at the right moment. Mapping key events such as home purchases or establishing a business and using artificial intelligence to offer corresponding products in near real-time, will demonstrate our awareness of customer needs and ability to support their ambitions.

Greater availability of data also paves the way for dynamic pricing models, in which insurance cost changes based on the customer’s behaviour – an approach we’ve pioneered with partners in markets like Thailand that promises a much more affordable product for the chronically ill.

At the same time, we must always strive for balance. It’s very easy for the collection and use of data to come across as invasive, and AI-delivered personalisation can to some people look a lot like surveillance.

That points to the need to adopt technology sensitively, and to make sure it’s accompanied by a healthy dose of human judgement. Customers want technology to be an enabler rather than a replacement for in-person interaction and advice, which, particularly in high-value moments and for critical life decisions, will remain invaluable and irreplaceable.

The other way we can ensure digitalisation connects to human causes is by harnessing it to create safer, more resilient societies for everyone. This is especially true in our region, where major disaster events are occurring with greater frequency and a massive protection gap remains.

Around a third of over 300 disaster events last year took place in Asia, with typhoons in Japan alone causing at least US$15 billion in insured losses. The human cost of these events – not just lives cut short but infrastructure destroyed, supply chains disrupted, and funds that should be going to causes like education and healthcare swallowed up by reconstruction – is immeasurable. In the wake of the pandemic, disruptive, once-in-a-lifetime events are not just abstract fears for much of the Asia Pacific population.

We can leverage technology to address these issues on multiple fronts. By further developing tools like CatNet®, we can enhance our understanding and assessment of risks, and tailor more transparent, accessible solutions accordingly. Digitalisation will improve the transparency of infrastructure, paving the way for dynamically underwritten policies that help protect the promising smart cities and sustainable projects emerging across the region.

Finally, we must ensure we’re not just selling policies or processing claims, but empowering people and businesses. By harnessing connectivity and working with the right partners, we can extend our capabilities to traditionally underserved customers and locations, ensuring they have access to relevant solutions that deliver quick results.

Ultimately, people don’t want cash payouts – they want financial safety nets, healthcare and infrastructure that enable them to weather shocks and to bounce back stronger. This is how we envision harnessing digitalisation for human impact.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital