HSBC Asset Management | Is it time to relook at Asian currency bonds?

October 14 2024

Asia’s resilient macroeconomic backdrop and robust growth outlook bodes well for the region’s fixed income market. With diversification and performance high on investors’ agendas, it seems a good time for global portfolios to revive allocations in Asian local currency bonds – including Hong Kong dollar (HKD) bonds for the right type of institutions.

Time for fixed income to shine

Bond investors continue to benefit from a rebound in the fortunes of the asset class. Macro dynamics are supportive of fixed income in general. Yields are attractive, particularly compared with levels following the global financial crisis, and even earlier. If yields continue to fall as inflation ebbs and flows, and amid the possibility of more coordinated central bank rate-cutting, bonds will remain appealing given the extra spread from investing in any credit risk resulting in an attractive all-in yield.

In line with this, the desire among many institutional investors for a defensive stance creates a bias to quality credits, and Asia’s strong and stable growth outlook creates a compelling case for increasing exposure to the region.

Asian local currency bonds – worth another look

A combination of the strong US dollar and misperceptions such as Asian local debt being difficult to access, have meant this asset class has been out of favor in most global portfolios. Yet there are three key reasons why asset owners should rethink their allocations.

Firstly, the fundamentals are healthier in Asia than in many advanced Western economies. Reasonable growth forecasts for most of the region are supported by a stable macro backdrop, in turn creating less need for monetary stimulus.

Inflation is a case in point. Across most of Asia, it has been lower than in other parts of the world, resulting in shallower rate-hiking cycles following the pandemic.

Further, Asian central banks don’t want to see their currencies weaken relative to global peers, particularly at a point when it might be disruptive to their economic prospects.

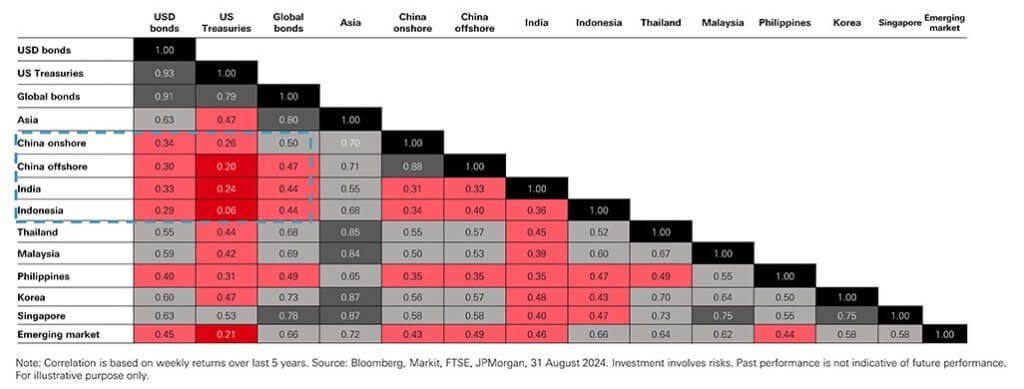

Secondly, Asian local currency bonds offer an attractive diversifier within global asset allocation. For example, the Chinese, Indian and Indonesian markets are lowly correlated since they tend to follow domestic rate cycles, and local supply and demand conditions. Put simply, this should be beneficial to long-term, risk-adjusted returns.

At the same time, valuations in bond markets in China, India and Indonesia indicate relatively attractive long-term yields. With inflation under control – and broadly within central bank targets – investors can enjoy good levels of real carry.

Figure 1. Correlation in last 5-yr period of Asian local currency bonds (unhedged in USD) versus US and global & emerging market bonds (hedged in USD)

Another potential opportunity in Asia’s local markets that certain institutions shouldn’t overlook is in HKD bonds.

These are particularly suitable assets for investors such as insurance companies, endowments, pension funds and foundations which have liabilities in HKD and are looking for an effective, high quality hedge in investment-grade HKD-denominated assets. Notably also, these institutions benefit from solid credit ratings and fundamentals – a key part of the allure of HKD bonds. Plus, the HKD’s peg to the US dollar minimizes currency risk.

HKD bonds, despite being a relatively low-yielding asset, also offer some potential protection for investors from the risk scenario of a resurgence in inflation in the US, given these assets have a lower level of sensitivity to US economic conditions. That feature therefore potentially makes HKD bonds less volatile than US treasuries.

At the same time, sustainable bonds account for an increasing proportion of the market, issued by the government as well as by quasi-government entities and corporates. This provides investors with a wider variety of issues to choose from than used to be the case.

Renewed demand in Asian currency bonds

Ultimately, local Asian fixed income is in a sweet spot. The global outlook favors bonds in general, and the excess capacity for Asia’s economies to grow strongly over the coming years is supportive of credit markets, especially in the local currency space.

For investors, projections of a weakening US dollar play to the strengths of this asset class. There is also much less of a perception now than in the past that the region’s local markets are difficult to access. As a result, there’s no reason for global portfolios to avoid exposure to Asian currency bonds. And for the right type of buyer with certain requirements, HKD bonds continue to serve as a ballast within the overall allocation.

Find out more about HK dollar bonds

https://www.assetmanagement.hsbc.com.hk/en/institutional-investor/abf-hongkong-dollar-bond

Important information

For professional investors and intermediaries only. This document should not be distributed to or relied upon by retail clients/investors.

This document is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management (Hong Kong) Limited (“AMHK”) accepts no liability for any failure to meet such forecast, projection or target. AMHK has based this document on information obtained from sources it reasonably believes to be reliable. However, AMHK does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document and the website have not been reviewed by the Securities and Futures Commission. Copyright © HSBC Global Asset Management (Hong Kong) Limited 2024. All rights reserved. This document is issued by HSBC Global Asset Management (Hong Kong) Limited.

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital